- The Blueprint

- Posts

- How sellers are thriving in a buyer’s market

How sellers are thriving in a buyer’s market

Plus, foreign buyers with the most purchasing power

The very big picture

Today’s newsletter is packed with a lot of good insight into the current situation for buyers and sellers in the market.

However, we encourage you to pay close attention to our third story on international buyers.

Over our careers, we’ve learned that there are many, many different dynamics when dealing with foreign buyers versus domestic buyers. Our third story highlights one of those key differences: currency.

The fluctuations in their country’s currency can have a substantial effect on their buying power. It’s vital to consider those numbers when consulting them. The report below lays out which currencies are seeing the biggest impact right now.

With that, let’s get into today’s Blueprint!

- James and David

Asking prices see smallest annual increase in two years

Source: Unsplash

Nationwide, it’s continuing to look like sellers are adjusting to this buyer’s market. The median asking price is $403,000, up just 2.2% year-over-year, the smallest increase in nearly two years. That’s according to Redfin’s latest market update. Here’s what else they report:

Sale-price growth up just 1.6% YoY, compared to 5–6% growth earlier in 2024

Inventory up 11% YoY

New listings up just 0.6% YoY this week

Pending sales down 1.7%

Median mortgage payment is $2,679—the lowest in nearly 5 months

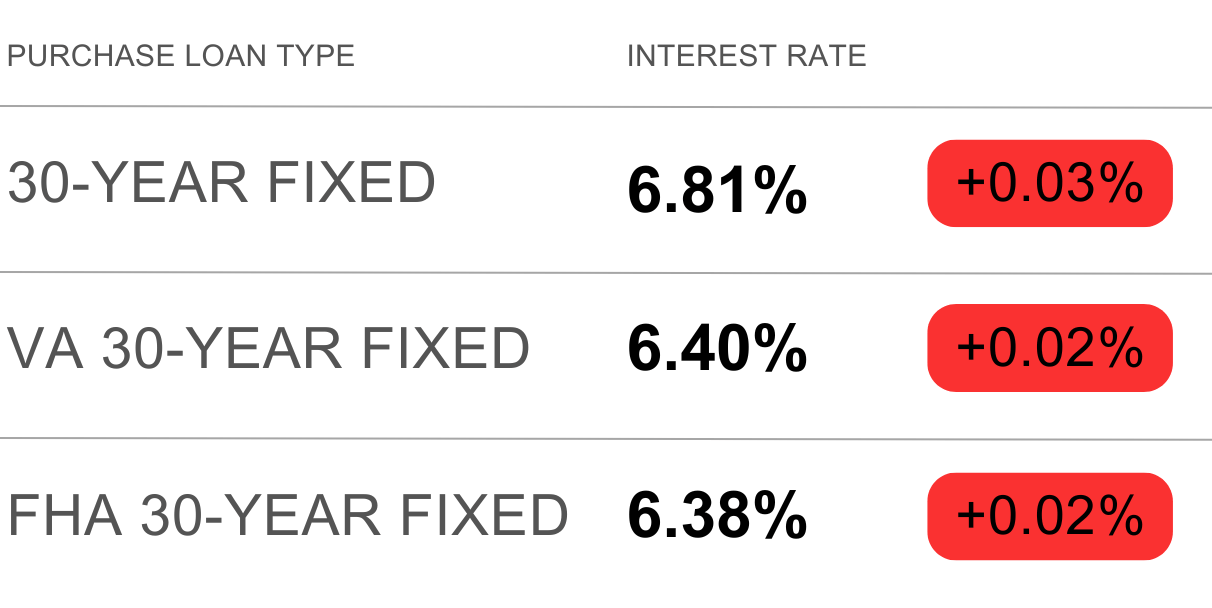

Mortgage rates remain near their lowest level of 2025, despite a slight recent uptick from two weeks ago

Our take

This is a great window of opportunity for buyers. Mortgage payments are easing, prices are stabilizing, and inventory is up. While home prices may tick down slightly by year’s end, buyers shouldn’t wait too long. As listings begin to drop off, negotiating power may shift back to sellers. Markets don’t adjust overnight, but they always adjust. Our advice: encourage serious buyers to strike while the iron is hot!

Profit margins rise for sellers in Q2

Source: Unsplash

In Q2 2025, homeowners earned a 50% profit on average when selling single-family homes and condos. That’s a 1.1 percentage point increase from Q1, but down 5.6 points from a year ago, per ATTOM.

The typical seller made $123,000 in raw profit this quarter, down from $127,990 in Q2 2024. Profit margins varied widely by metro. Of the 156 markets analyzed (each with at least 200,000 people and 1,000+ sales), 77 markets saw profit margins rise from the previous quarter.

Here are the top 5 markets with the biggest profit margin increases and decreases in Q2 2025:

Biggest annual increases | Biggest annual decreases |

Our take

Even though many sellers are lowering their asking prices, they’re still walking away with strong profits. The average raw profit of $123,000 is notable, especially with market conditions cooling. If your sellers are hesitating, show them these numbers. While this isn’t the frenzy of 2021–2022, it’s still a highly profitable market for sellers. In many cases, a realistic asking price today can mean a reasonably fast sale and a six-figure gain. In this market, hesitation can cost more than a price cut. Give your sellers the data – and the push! – they need to act.

Currencies that give buyers the most leverage

Source: Redfin

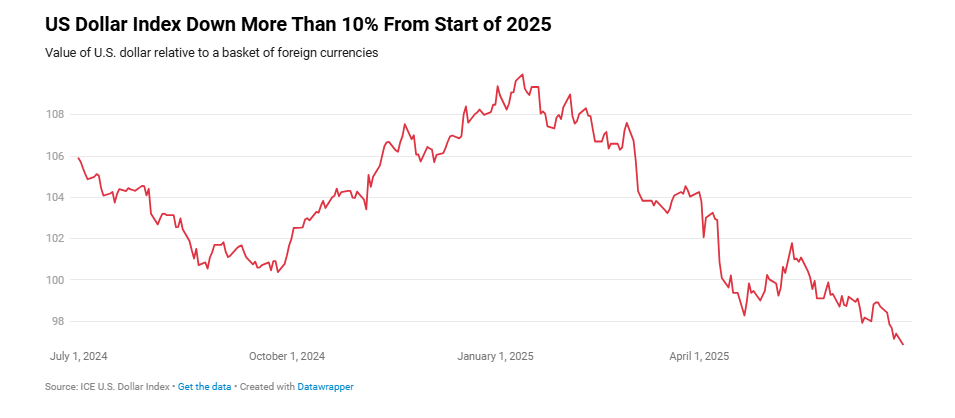

While the median home price rose 1% year over year in June to a record $447,035, the picture looks very different for international buyers. Due to the weakening U.S. dollar, home prices effectively fell between 5% and 10% when measured using the average monthly exchange rate of foreign currencies, according to a new Redfin analysis. The result? In some countries, U.S. homes are significantly cheaper today than they were a year ago.

The Russian ruble saw the biggest gain in buying power, as the equivalent cost in rubles fell 9.6%. Other currencies, such as the Swiss franc, Swedish krona, and Japanese yen, also saw stronger leverage against the dollar.

But not every foreign buyer is getting a discount. For those using currencies like the Mexican peso or Indian rupee, U.S. home prices have become more expensive over the past year.

Here are the top 5 currencies that give buyers the most and least purchasing power right now.

Most buying power

| Least buying power

|

Our take

We loved this report! It gave us a fresh way to think about international buyers. We’ve always valued our relationships with foreign clients—but until now, we hadn’t considered segmenting our outreach by currency strength. Knowing who has the most buying power today can meaningfully sharpen your marketing strategy. If you work with international investors or second-home buyers, focus on those with the strongest currency advantage. This isn’t just about exchange rates—it’s about uncovering hidden leverage. That’s smart business.

Schematics

The news that just missed the cut

Source: Unsplash

Trend to watch: Sellers would rather rent than drop their asking price

Use this letter template and strategy to land million-dollar listings

Christie’s debuts crypto real estate division

Ways you can stand out as an agent

This city has become a haven for luxury second-home buyers

Foundation Plans

Advice from James and David to win the day

Today, we wrap up our mid-year review series. Over the past few weeks, we’ve covered ways to improve your business, but today, we are going to focus on ways to improve yourself. Even the best business strategies won’t work without the right internal foundation. These three mindset shifts aren’t just for the rest of the year, they’re habits we hope you’ll cultivate throughout your entire career:

1. Define the vision for your career – Most agents don’t have a clear sense of direction. They’re unsure if they’re in the business for the long haul, and it shows. Without a defined vision, they struggle to identify their core values, or articulate what sets them apart. Don’t let that be you! Take the time to clarify what you want from your career, what matters most to you, and what makes your approach different. Make your vision specific, personal, and non-negotiable. Then let that vision guide every decision you make!

2. Play the long game when prospecting – The goal of prospecting isn’t to close a deal tomorrow, it’s to build trust and understand what your prospect truly wants. When you focus on their goals, not your timeline, you position yourself as a long-term advisor, not a short-term salesperson. Keep in touch, stay helpful, and follow up with purpose. The agent who stays in the game longest often wins the business… and earns the repeat referrals.

3. Create conversations – Real estate is based on talking to people directly. With all the lead-gen tools out there, most agents are trying to avoid that essential step. But that’s a mistake. The only thing keeping between agents and their goals is thousands of one-on-one real estate conversations with people in their market. So when evaluating any lead-gen tool or activity, ask yourself this one key question: how many conversations is it creating? To be successful in this business, you need to have as many real estate-related conversations as you can. It’s only a matter of time before they convert into sales.

We hope you’ve found our series valuable. You can catch up and read every one of the parts on our site. Tell us what you think. If you have questions, pushback, or just want to share your thoughts, let us know. Drop us a line because we love hearing from you.

You don’t need another “motivational moment.” You need a framework that works.

The Estate Elite 90-Day Multi-Million Dollar Listing Challenge gives you a structure to upgrade your business and land your first/next $1M+ listing.

Join now for free and get:

A polished luxury brand and online presence

Weekly post prompts, reels scripts & video walkthroughs

Outreach scripts for agents, buyers & referral partners

Ad templates to attract high-end leads

Live feedback and accountability from our coaching team

You’ll learn directly from us, along with Josh Flagg, Tracy Tutor, Glenda Baker, and Dawn McKenna—the best in the business.

Start with a 30-day free trial. But don’t wait too long—slots are going quickly.

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

Next week we’re in the middle of Q3. We’re officially in the home stretch for the year now. Let’s make each day count.

Remember: each day is a gift and a new opportunity to lead the life you want and to become the person you want to be. The mistakes and missteps you’ve made in the past don’t define you. Live as intentionally as you can and be ruthlessly focused on the goals you’ve set out to achieve. You can do it!

Thanks for reading, and we’ll see you back here on Tuesday!

- James and David