- The Blueprint

- Posts

- Buyers canceling sales at highest rate on record

Buyers canceling sales at highest rate on record

Plus, the wealthiest retiree markets in the country

Cancellations rising

The market right now is causing buyers to get skittish, and we’re seeing that in the data.

As we note in our first story below, Redfin just reported that home sale cancellations in June hit the highest monthly rate on record. We explain what this means for agents, and how they can prepare.

On that note, as times get tough, we are seeing more and more buyers turn to their parents for help. In our second story, we break down the various ways parents are getting deals done.

And, if you want to know where the wealthiest parents are living, that info is our third story. We report on the hotspots for the wealthiest retirees in America… and you won’t be surprised which state has the most cities on the list.

With that, let’s get into today’s Blueprint!

- James and David

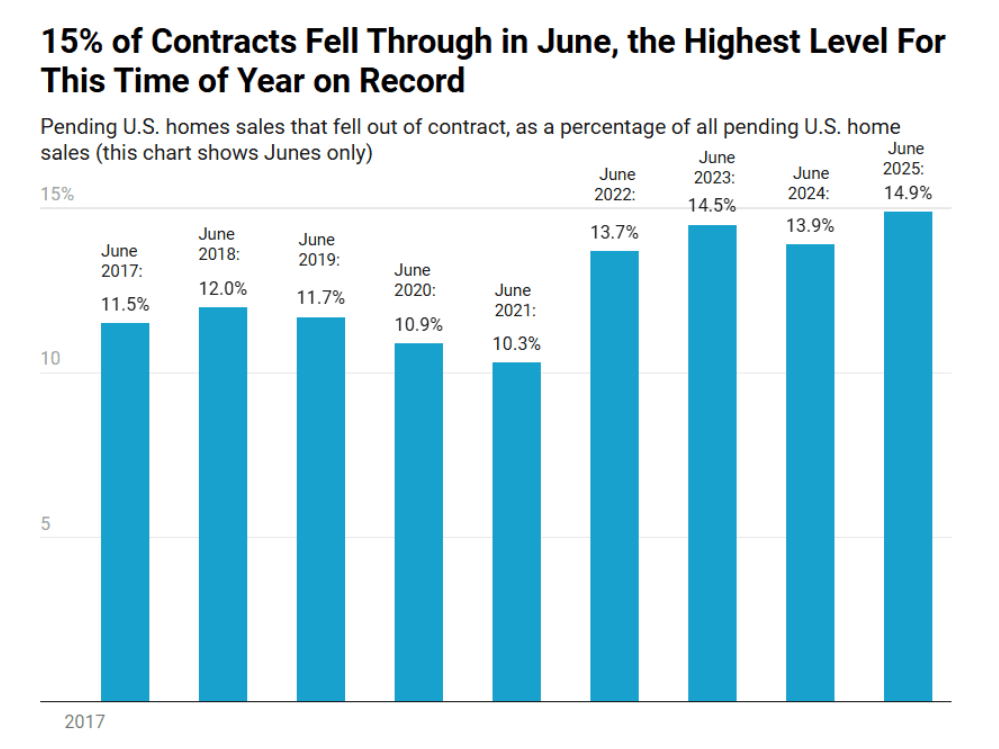

15% of pending sales were cancelled in June

Source: Redfin

In June, more than 57,000 home-sale agreements were canceled, representing 14.9% of all homes under contract, according to Redfin. That’s up from 13.9% a year earlier, and it marks the highest June cancellation rate since Redfin began tracking the data in 2017.

The main reasons why buyers are walking away– economic uncertainty, record-breaking home prices, elevated mortgage rates, and finding a better option during the inspection period.

Here are the other data points:

Sun Belt metros had the highest cancellation rates:

Jacksonville, FL: 21.4%

Las Vegas, NV: 19.7%

Atlanta, GA: 19.6%

California markets lead in year-over-year increases:

Anaheim: 15.2% (up from 12.6%)

Los Angeles: 17.1% (up from 14.7%)

Our take

Agents need to prep for this. It isn’t just a “Florida thing.” Contract cancellations are on the rise in almost every major metro. Expect more volatility in escrow. Stay close to your buyers after the contract is signed, because many of them are still second-guessing. Reaffirm their goals, prep them for inspection surprises, and have backup options ready when deals fall apart. In a market this uncertain, your post-contract guidance matters as much as the offer.

Buyers are financing their homes… through their parents

With high mortgage rates, student debt, and persistently steep home prices, many younger buyers are leaning on their parents to help them break into the market. According to Freddie Mac, the share of young buyers using an older-generation co-signer more than doubled from 1.6% in 1994 to 3.7% in 2022. In fact, 38% of Gen Z buyers received help from their parents to purchase their first home.

Here’s how parents are helping:

Gifting a Down Payment: This is the most common form of support. In 2025, individuals can gift up to $19,000 per recipient without triggering the federal gift tax. Larger gifts may need to be reported, though most won’t owe tax unless they exceed the lifetime exemption of $13.99 million.

Co-Signing a Mortgage: For buyers with limited credit or high debt-to-income ratios, a parent’s signature can make all the difference in qualifying for a loan.

Co-Ownership or Buying Outright: Some families purchase homes jointly, with all parties listed on the deed. Ownership is typically structured two ways:

Joint Tenancy with Right of Survivorship (JTWROS): Equal ownership, automatically transferred upon death.

Tenants in Common (TIC): Allows unequal shares and separate inheritance designations.

Shared Equity Agreements: In cases where parents contribute substantially but not as a pure gift, families are increasingly turning to shared equity agreements–formal arrangements that define each party’s financial stake and future return.

Our take

We’ve gone into some detail about this because today’s first-time buyers often aren’t buying alone. Agents need to be prepared to explain these different payment and co-ownership structures. It will truly help you stand out if you can guide them through all the options, especially the rules on gifting. It’s not just about simply buying a home, it’s about handling a multigenerational investment.

The wealthiest retiree markets in America

Source: Unsplash

Baby boomers – those born between 1946 and 1964 – now control nearly half of the nation’s housing wealth, with an estimated $18 to $19 trillion in real estate holdings. That concentration of wealth is the result of decades of homeownership, long-term appreciation, and generational shifts that are reshaping the housing market.

But where is that wealth most heavily concentrated? A new analysis from Realtor.com highlights the metros with the highest levels of retiree real estate wealth.

Here are the wealthiest retiree markets in America:

Count | Markets | Share of homeowners 65+ | Value of real estate held by homeowners 65+ |

1 | North Port, FL | 55.8% | $97 Billion |

2 | Naples, FL | 57.3% | $70 Billion |

3 | Cape Coral, FL | 51.9% | $62 Billion |

4 | Santa Rosa, CA | 46.6% | $54 Billion |

5 | Barnstable Town, M | 53.1% | $34 Billion |

6 | Deltona, FL | 47.8% | $43 Billion |

7 | Port St. Lucie, FL | 49.1% | $38 Billion |

8 | Prescott Valley, AZ | 57.6% | $27 Billion |

9 | Urban Honolulu, HI | 43.4% | $88 Billion |

10 | San Luis Obispo, CA | 49.8% | $31 Billion |

Our take

Retiree wealth isn’t just growing, it’s concentrated. As you can see, Florida claims 5 of the top 10 markets where homeowners 65+ hold the most real estate value. Agents in these areas should recognize the long-term equity held by Boomers, and tailor their outreach accordingly. Whether it’s downsizing, estate planning, or helping adult children buy, these clients have options. Be ready to guide them. And don’t overlook the next wave: many of these owners will pass on property in the coming decade, making relationships with heirs and family decision-makers just as critical as the current homeowner. This is generational wealth in motion, and agents who think long-term will win.

Schematics

The news that just missed the cut

How to boost your online reputation and win search

Which is better for a mortgage — FICO or VantageScore?

How to turn Zestimate confusion into new leads

Homebuilders are slashing prices at the highest rate in 3 years

Vitamin Shoppe founder wants $89 million for his Hamptons home

Foundation Plans

Advice from James and David to win the day

As we continue in our mid-year review and prep for 2026 series, today we’d like to talk to you about listings. We believe the opportunities to get new listings will continue to be plentiful throughout this year and the first half of next year as well. So, we would like to offer you some tips on how to get creative with listing presentations.

One of the methods we like using in our pitches is the case study method. It uses your past listings to demonstrate your process and to showcase your expertise, thoughtfulness, and ability as an agent. Here's how to use it:

Outline and detail your listing process – You probably already have a process for getting a home ready to list. Outline this process. Be detailed and thorough, but don’t overwhelm your clients. The point is to explain to the clients what they’re getting when they hire you by demonstrating the thoughtfulness, care, and intentionality you bring to everything you do as an agent.

Collect data and document the process – This is how you'll show prospective clients why they should choose you as their agent. Collect before-and-after photos of previous listings, client testimonials, and the list and sale prices of homes you've sold. Show them your results and the difference you made.

Put it all together – After you've clearly outlined your listing process and compiled data, it's time to take all of this information and package it beautifully. This can be a simple flyer or brochure, or you can create a video to send to potential clients. The most important thing is to show potential clients evidence of your success as an agent and how you can do the same for them.

For more tips and strategies on listing presentations, use these resources.

You don’t need another “motivational moment.” You need a framework that works.

The Estate Elite 90-Day Multi-Million Dollar Listing Challenge gives you a structure to upgrade your business and land your first/next $1M+ listing.

Join now for free and get:

A polished luxury brand and online presence

Weekly post prompts, reels scripts & video walkthroughs

Outreach scripts for agents, buyers & referral partners

Ad templates to attract high-end leads

Live feedback and accountability from our coaching team

You’ll learn directly from us, along with Josh Flagg, Tracy Tutor, Glenda Baker, and Dawn McKenna—the best in the business.

Start with a 30-day free trial. But don’t wait too long—slots are going quickly.

Just in Case

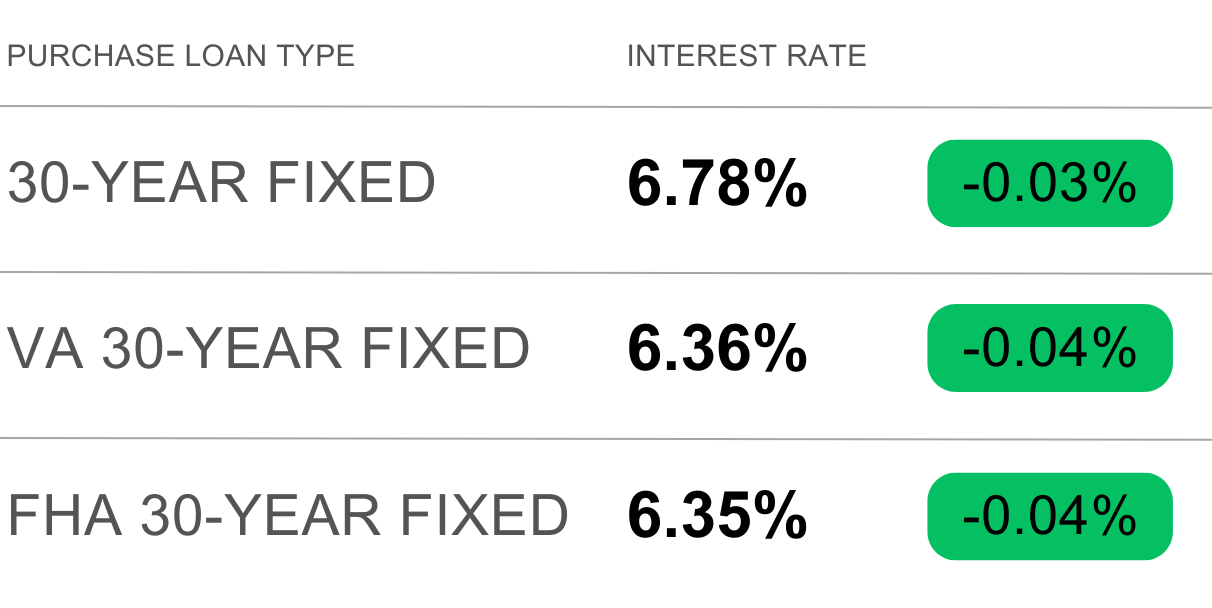

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“Just because you are doing a lot more doesn't mean you are getting a lot done. Don't confuse movement with progress!” – Denzel Washington

Progress isn’t about doing more, it’s about doing what matters most. Be intentional and focused in what you choose to do, friends. That’s how you build the business and life you want.

- James and David