- The Blueprint

- Posts

- It’s the strongest buyer’s market in over a decade

It’s the strongest buyer’s market in over a decade

Plus, ranking the best markets for luxury buyers

It’s a buyer’s market

For a while now, many people have been reluctant to say it out loud, but we can say it confidently now: this is a buyer’s market. And we’re not just going on vibes. The data backs it up.

According to Redfin, we’re now in the strongest buyer’s market in over a decade. What makes this moment unusual is why it’s happening. This isn’t the result of a classic housing glut. Instead, buyers are pulling back faster than sellers, and that shift is quietly reshaping leverage across the market.

It sounds counterintuitive, but it matters, and in today’s Blueprint, we break down exactly what’s driving it and what it means for you and your clients.

Let’s get into it!

- James

The strongest buyer’s market on record

Source: Unsplash

There were 47.1% more U.S. home sellers than buyers in December, the largest gap since Redfin began tracking this data in 2013. That’s up 7.1 percentage points from November, the biggest monthly jump since September 2022, and up 22.2 points from a year earlier. Here are the key takeaways from Redfin’s latest update:

How Redfin defines a buyer’s market: A market is considered buyer-friendly when there are more than 10% more sellers than buyers. When there are more than 10% fewer sellers than buyers, it’s a seller’s market.

Falling buyer demand is driving the shift: The number of active buyers fell 5.9% month over month to 1.34 million, the lowest level on record. Sellers pulled back too, but much less—down just 1.1% to 1.97 million. Year over year, buyers were down 11.8%, while sellers were up 3.9%.

The Sun Belt is home to the strongest buyer’s market The biggest imbalances were concentrated in the Sun Belt, led by Austin (+128%), Fort Lauderdale (+125%), Nashville (+111%), Miami (+103%), and San Antonio (+103%), reflecting years of heavy construction and growing affordability constraints.

Price trends reflect the imbalance: Home prices rose just 0.6% year over year in buyer’s markets, compared with 3% in balanced markets and 4.9% in seller’s markets. Dallas stood out, with 86.8% more sellers than buyers and a 7.6% year-over-year price decline, the largest drop among major metros.

My take

The current market we’re facing isn’t a classic housing glut; it’s a demand pullback. Buyers are stepping away faster than sellers, and that imbalance is giving the remaining buyers real leverage, especially in the Sun Belt, where years of aggressive construction are now colliding with affordability limits. Markets like Austin, Dallas, and parts of Florida are feeling it most, with rising inventory and softening prices, while tighter Midwest and Northeast markets remain more resilient. For sellers, pricing realistically matters more than ever. For buyers who can afford to move, this is the most favorable negotiating environment we’ve seen in years.

The top metros for luxury homebuyers

Source: Unsplash

Each quarter, Realtor.com and The Wall Street Journal team up to rank the luxury housing markets that are performing the best and are most appealing to luxury buyers. The rankings evaluate 60 luxury markets nationwide, scoring them on factors like supply and demand, economic health, and overall quality of life.

Here are the top-performing luxury metros this quarter:

My take

What stands out in this ranking isn’t how expensive these markets are – it’s how balanced they are. Detroit and St. Louis lead because luxury there remains attainable and supported by steady demand and solid fundamentals, while even high-cost markets like San Diego and Santa Barbara are benefiting from price recalibration. This is a luxury-buyer story, not an ultra-luxe one: buyers in the $1M–$3M range are more price-sensitive and selective, while ultra-luxury buyers remain far less constrained. The takeaway is clear: today’s strongest luxury markets are those that offer premium living without forcing buyers to overextend.

Portugal’s Foundations for Long-Term Living

For buyers evaluating relocation or long-term ownership, lifestyle appeal is only part of the equation. Practical living metrics like healthcare access, infrastructure, and holding costs often determine whether a market works in reality, not just on paper.

One of Portugal’s most overlooked strengths is its healthcare system. The country consistently ranks among Europe’s best for accessibility and outcomes, offering both public and private care at a fraction of U.S. or UK costs. Health expenditure per capita remains below the EU average, yet life expectancy and treatment quality remain high.

For residents in southern destinations like Vilamoura and Palmares, this matters in practical terms. These communities are supported by modern infrastructure, proximity to private hospitals, and services designed for full-time living, not just short stays. That combination makes them viable for families, remote professionals, and retirees evaluating long-term relocation.

Portugal also benefits from structurally lower holding costs. Property taxes are modest, insurance rates remain low, and everyday expenses sit well below Western European norms. As The Economist noted in its 2025 assessment, strong infrastructure and efficient reforms continue to reinforce Portugal’s livability advantage. For buyers looking beyond purchase price to long-term cost of ownership, the math remains compelling.

Metros where home prices have fallen the most

Source: Unsplash

U.S. home prices are essentially flat, up just +0.1% year over year between December 2024 and December 2025. Beneath the national average, however, price declines are becoming more widespread. According to ResiClub’s analysis of the Zillow Home Value Index, 106 of the nation’s 300 largest housing markets – about 35% – posted year-over-year price declines during the Dec. 2024 to Dec. 2025 period.

Here are the top ten metros where home prices are falling the most, YOY:

My take

The headline number says the housing market is “flat,” but that masks a clear shift in leverage. In many Sun Belt metros that led the pandemic boom, buyers are now back in control as rising inventory and abundant new construction force sellers to compete on price. For agents in these markets, success now depends on realistic pricing and market-savvy positioning, not hopeful expectations.

Schematics

The news that just missed the cuts

Agents, don’t do this when prospecting

Blackstone real-estate fund stages comeback with best return in three years

Billionaire Ron Burkle lists his Malibu beach ‘cottage’ for $20 Million

Foundation Plans

Advice from James to win the day

Agents who consistently generate and nurture leads will outperform those who wait for business to come to them, especially in a slow market. That’s why, over the course of this quarter, we’re diving deep into lead generation, sharing our best strategies to help you attract, convert, and sustain a steady flow of clients. In our last edition, we laid out a framework for thinking about who you should be prospecting. Today, we offer some practical tips on how to do it effectively.

1. Protect your lead-gen time – Lead generation is the lifeblood of a thriving real estate business, yet many agents either approach it inconsistently or let distractions take over. Protecting this time is non-negotiable. Treat it with the same importance as a client meeting. By balancing outreach to new prospects with nurturing existing ones, you’ll ensure no lead slips through the cracks while steadily growing your pipeline.

2. Time-block for both new and follow-up leads – Set a daily lead-gen block and split it evenly between calling new leads and following up with existing ones. This ensures you’re both growing your audience and moving warm prospects toward conversion. Treat this time as sacred — silence notifications, close your email, and let colleagues know you’re unavailable so your focus stays sharp.

3. Prioritize speed with new prospects – When new leads come in, act fast! The first agent to connect often wins the business. Go beyond fresh inquiries by targeting expired listings, FSBOs, and older leads that have gone cold. Keep a daily contact goal to maintain high outreach volume and increase your number of quality conversations..

4. Systematize your follow-up process – Your database, warm prospects, and pending deliverables are goldmines… but only if you work them consistently. Use a CRM to track every interaction, set reminders for follow-ups, and deliver on promises like market analyses or property lists quickly. Consistent follow-up builds trust, keeps you top of mind, and turns “maybe later” into “let’s meet now!”

5. Add a personal touch to stand out – In a crowded market, personalized communication can tip the scales. For leads who haven’t set an appointment, send a short video reintroducing yourself, highlighting your expertise, and showing genuine interest in their needs. This extra step makes you memorable and increases the likelihood they’ll take your next call.

Just in Case

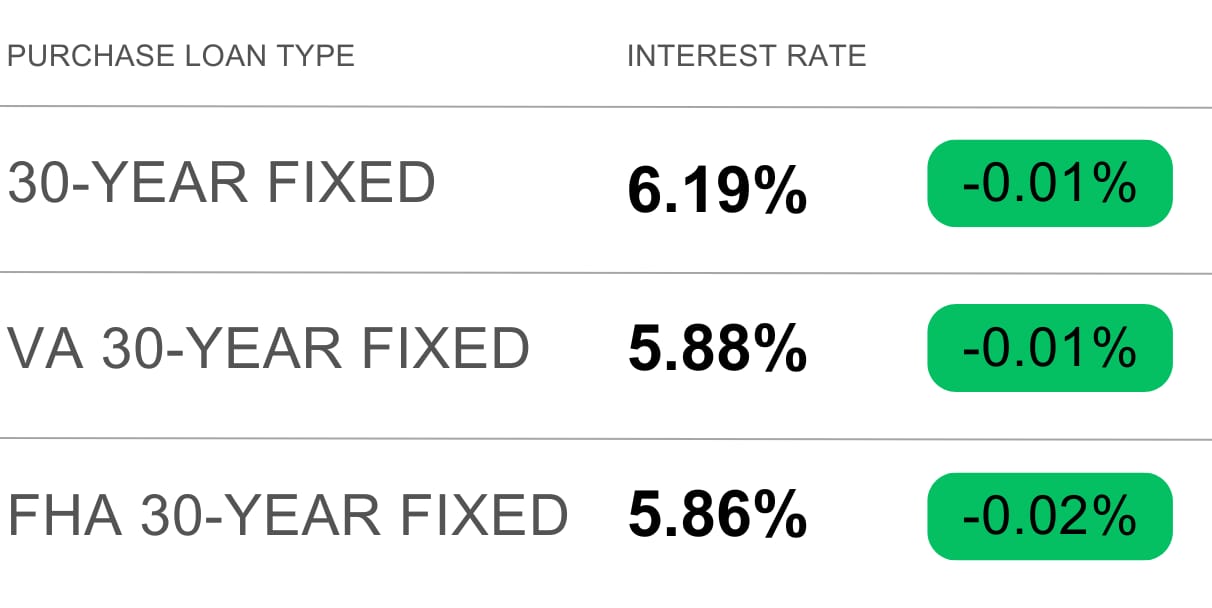

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

"Excellence is never an accident. It is always the result of high intention, sincere effort, and intelligent execution." – Attributed to Aristotle

Thanks for reading, friends. Excellence and success don’t happen by chance — they’re built through intention, focus, and consistent effort.

Have a wonderful weekend, and I’ll see you back here next week!

- James