- The Blueprint

- Posts

- Housing demand is off to a good start in 2026

Housing demand is off to a good start in 2026

Plus, why 40% of the largest U.S. metros will be affordable in 2026

Positive news

As you know, our goal with this newsletter is to give you clear, accurate information and practical advice so you can thrive as an agent. We’ve promised to always be honest and direct – no sugarcoating – even when the news isn’t easy to hear. And last year, that often meant delivering some tough updates.

Today, though, we can genuinely be messengers of some great positive news.

Early indicators suggest that housing demand is off to a good start this year, and Zillow’s latest forecast suggests that affordability pressures are easing in nearly all of the major markets in the country.

We break down what’s driving those trends, what they mean for your business, and kick off a new lead-generation series in today’s Blueprint.

Let’s get into it!

- David

The housing market is opening 2026 with stronger demand

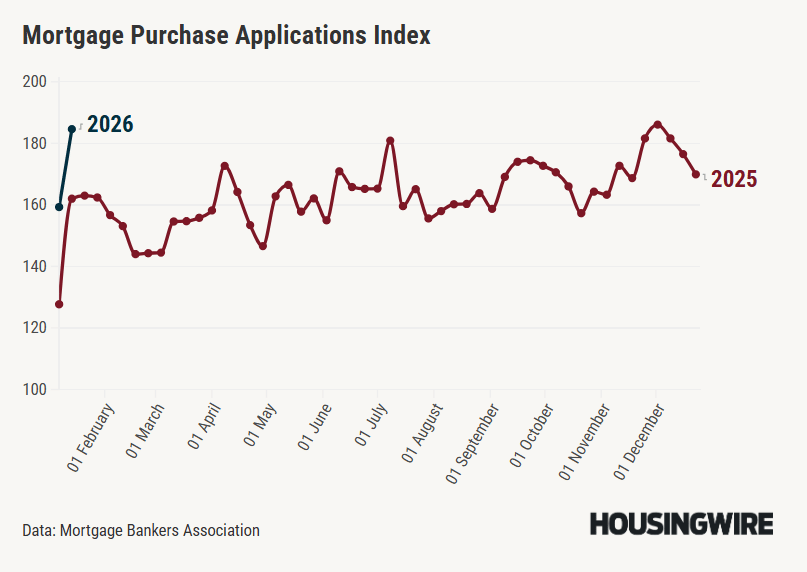

Source: HousingWire

Early indicators suggest housing demand is gaining momentum at the start of 2026. According to HousingWire and its lead analyst, Logan Mohtashami, 2026 is looking like the first year where existing home sales could actually grow. Here’s the evidence and early indicators backing that up.

Mortgage demand is rebounding: Purchase mortgage applications rose 16% week over week and 13% year over year in the first clean data week of 2026, an early signal of improving buyer activity.

Pending sales are accelerating: Weekly pending home sales hit 50,096, the highest level in many years and well above the same period in 2025, suggesting stronger closings 30–60 days out.

Favorable mortgage rates and spreads: Mortgage rates hovered near 6.0%–6.1%, aided by near-normal mortgage spreads, which are helping prevent rates from moving back above 7% even as bond yields fluctuate.

Supply is improving and easing pressure: Single-family inventory rose more than 10% year over year, while price-cut activity increased to roughly 35%, contributing to a healthier balance between buyers and sellers.

My take

2026 is shaping up to be a turning point for housing demand, with early indications suggesting it’s quietly rebuilding rather than roaring back. Stable mortgage rates near 6%, improving inventory, and a healthier buyer-seller balance are giving would-be buyers the confidence to step back in. And the strength in applications and pending sales suggests that interest is turning into real transactions. If rates hold near current levels, 2026 could mark the first year in a while where demand grows steadily instead of stalling or retreating.

40% of the largest U.S. metros will be affordable in 2026

Source: Unsplash

49 of the 50 largest markets in the U.S. will see easing housing costs, and 20 metros will be “affordable” by December 2026, up from just 7 at the October 2023 low when mortgage payments consumed more than 38% of income. That’s the eye-catching claim Zillow makes in its latest market forecast and update. Here are the key takeaways to know:

Zillow defines “affordability” as a mortgage payment that doesn’t exceed 30% of the median household income.

On a national level, Zillow expects affordability to improve from 32.6% today to 31.8% by the end of 2026.

Monthly mortgage costs are projected to ease from the October 2023 peak and remain near $2,350 as mortgage rates drift toward 6%

Zillow’s forecast is built on what it calls a trifecta of slow-growing home prices, falling mortgage rates, and rising household incomes.

Zillow’s projection assumes buyers put 20% down, which equals $71,800 on today’s $359,078 typical home and over $73,000 by the end of 2026.

My take

Zillow’s latest update isn’t claiming that we’re about to have a housing boom, but it does suggest the affordability pressure that defined the last few years is starting to ease. Instead of betting on prices falling, it’s pointing to a slow reset where modest price growth, slightly lower rates, and rising incomes finally start working in buyers’ favor. For us agents, that matters because improving affordability tends to bring sidelined buyers back into the conversation. The opportunity in 2026 is likely less about chasing discounts and more about helping buyers make the numbers work through smart financing, realistic expectations, and good timing.

States with the highest foreclosure rates

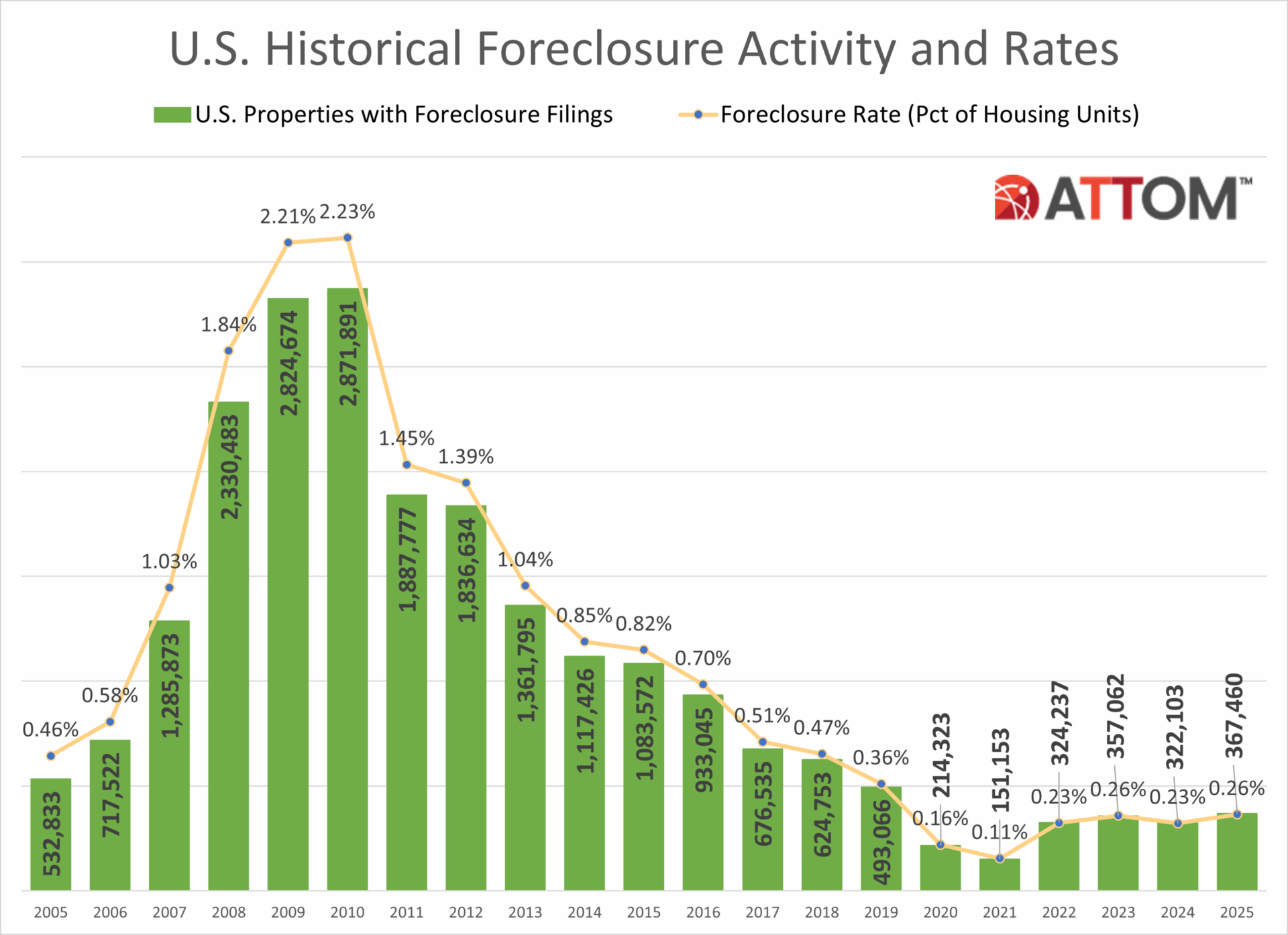

Source: ATTOM

Foreclosure activity accelerated nationally in December 2025, with nearly 45,000 U.S. properties entering some stage of foreclosure – up 26% from the prior month and 57% from a year earlier.

While the national foreclosure rate stood at one filing for every 3,163 housing units, foreclosure activity was far more concentrated in a handful of states. Markets such as New Jersey, South Carolina, and Maryland posted rates well above the national average.

Below are the top 10 states with the highest foreclosure rates as of December 2025:

My take

December’s foreclosure data offers a useful signal about where opportunities may start to show up in 2026. States like New Jersey, South Carolina, Maryland, and Florida are seeing higher levels of distress, which often translates into more motivated sellers, REO activity, and off-market conversations. Importantly, this isn’t a sign of a housing breakdown: most homeowners still have meaningful equity, so many of these situations will likely resolve through standard sales rather than foreclosures. For agents in these markets, this is a good time to sharpen outreach, reconnect with lender and servicer contacts, and get positioned ahead of a slow but steady pickup in distressed-asset flow.

Schematics

The news that just missed the cut

Source: Unsplash

The Close ranks the best places to buy real estate leads in 2026

How to use monthly data to win more listings

Metros with the most active listings in the country

Commercial builders are losing their appetite to build anything but data centers

How to choose the right brokerage – no matter where you are in your career

Foundation Plans

Advice from David to win the day

For us agents, lead generation is the lifeblood of the business, especially at the start of a new year. The mistake we see most often is agents rushing into calls, emails, mailers, and social posts without a plan. Before you do any outreach, you need to answer one question: Who are you targeting?

Different prospects require different messaging, scripts, and offers. If your target is unclear, your outreach will be vague and unfocused – and that kind of prospecting and outreach rarely produces results.

Over the next few months, we’re doing a deep dive on lead generation. To kick off the series, we’re starting with a simple framework: a list of prospect categories you can target throughout your career. It’s not exhaustive, but it’s comprehensive enough to help you think strategically.

As you review each category, ask yourself: How would I approach this type of client? Most agents never take the time to do this exercise. But if you want to master lead generation, this is where it begins.

Over the coming months, we’ll give you specific tips on how to prospect each of these groups. For now, here’s your starting point:

1. Sellers

Homeowners looking to sell

FSBOs (For Sale By Owner)

Expired Listings

Withdrawn or cancelled listings

Distressed homeowners (pre-foreclosure, short sale)

Seniors downsizing or transitioning to assisted living

Divorce or estate-related sales

Relocation sellers

Homebuilders offloading spec homes or completed inventory

2. Buyers

First-time buyers

Move-up buyers

Downsizing buyers

Relocation buyers

Investors seeking single-family or multifamily homes

Veterans using VA loans

FHA or low-down-payment buyers

Renters ready to purchase

3. Investors

Buy-and-hold rental investors

Fix-and-flip investors

Short-term rental investors (Airbnb, Vrbo)

Out-of-state or international investors

1031 exchange buyers

BRRRR strategy investors

Real estate syndication groups

4. Developers & Builders

Residential land developers

Infill and urban redevelopment builders

Custom home builders

Multifamily or mixed-use developers

Build-to-rent operators

5. Landowners

Raw land owners looking to sell

Farmers or heirs of agricultural land

Owners of subdividable parcels

Owners near new infrastructure or zoning changes

6. Special Circumstance Prospects

Probate/estate executors

Divorce attorneys (referral source)

Bankruptcy trustees or clients

Code violation property owners

Tax default/tax lien property owners

7. Referral Sources

Past clients and sphere of influence

Lenders/mortgage brokers

CPAs and financial planners

Divorce and estate attorneys

Contractors and service providers

Other agents (e.g., out-of-area referrals)

Did we miss someone? If there’s a prospect type you think belongs on this list, message us. We’d love to hear from you.

In the meantime, review each category carefully and ask yourself: How would I market to this group? Your answers will help you get even more out of the prospecting strategies we’ll share starting next week..

Just in Case

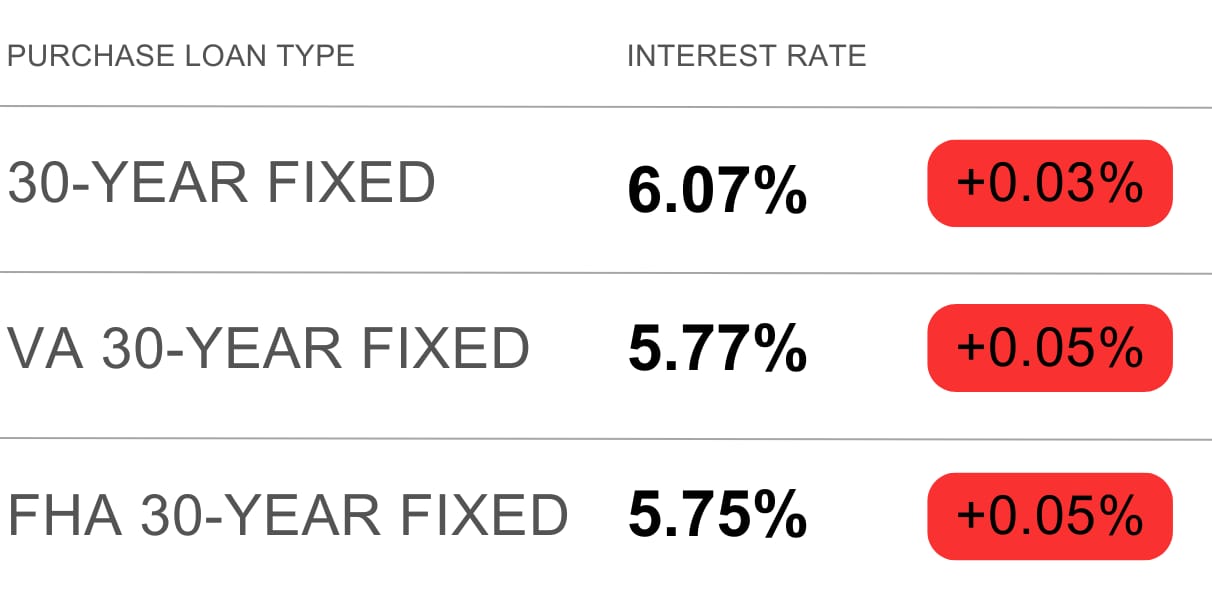

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“A lot of people say they want to be great, but they’re not willing to make the sacrifices necessary to achieve greatness. They have other concerns, whether important or not, and they spread themselves out.” – Kobe Bryant

Ruthlessly stay focused on your goals, friends. To be great at anything, you must choose. You can’t spread yourself too thin. Eliminate all distractions, focus on what’s important, and delegate the rest.

- David