- The Blueprint

- Posts

- Why a busier spring season is taking shape

Why a busier spring season is taking shape

Plus, more homeowners are carrying high mortgage rates than most realize

Hello Breezy!

Our goal with The Blueprint has always been simple: help agents make sense of a business that keeps getting more complex. We want to be your resource: not just to understand where the market is headed, but how to actually operate and thrive as a great agent.

After 25 years in real estate – and rebuilding my business more than once – I’ve learned that being a great agent isn’t just about selling homes. It’s about managing the chaos behind the scenes: the notes, follow-ups, pipelines, comps, the systems that never quite talk to each other, and all the admin stuff that steals your time and focus.

So, for nearly two years, I've been quietly building something that comes straight out of my own experience and frustration as an agent. Today, I can finally share it with you.

Say hello to Breezy!

I’ll walk through it in more detail in today’s Foundation Plans, but at its core, Breezy is a tool that gives you back time to focus on deals and clients.

We’ve officially opened the waitlist, and I can’t wait for you to see what we’ve built.

Let’s jump into today’s Blueprint.

- James

Early signs point to a more active spring market

Source: Unsplash

New listings are up 1.1% YoY, marking the third straight weekly increase after months of declines, and supply is nearing balanced-market territory with months of supply now at 5.4, according to Redfin. Here are the other takeaways from the listing service’s most recent market update.

Buyers have negotiating leverage, with sellers outnumbering buyers by a record 47.1%

Mortgage rates have eased to ~6.1%–6.2%, near a three-year low but still well above pandemic levels

Homes are selling at their slowest pace in six years, with 64 median days on market and pending sales down 3.3% YoY

Affordability is improving at the margin, as the median monthly mortgage payment fell nearly 5% YoY to $2,559 while wages rose about 4%

More sellers are giving up low-rate mortgages, while buyers are returning cautiously, negotiating aggressively, and prioritizing inspections

Demand signals are mixed: mortgage purchase applications are down in the short term, but Google searches for “homes for sale” are at their highest level since August

My take

As we’ve said since the start of the year, 2026 is shaping up to be a year of modest, gradual improvement, not a snapback. Rising incomes, accumulated life events, and slightly lower mortgage rates heading into spring will slowly bring more buyers and sellers back, and the early signs suggest that the process is underway. Inventory is rebuilding, sellers are adjusting to a more negotiated market, and buyers are cautiously re-engaging as affordability improves at the margins. The takeaway is simple: activity is picking up, but progress will be incremental, rewarding agents who price realistically, manage expectations, and execute cleanly rather than wait for a sudden rebound.

The number of homeowners with high mortgage rates is higher than you think

Source: Unsplash

In 2022, about 10% of homeowners had 30-year fixed mortgages with rates above 5%; now, in 2026, that share has jumped to over 30%. That fact is one of the key findings in CNBC’s latest report. Here’s how today’s mortgage market breaks down:

51.5% of U.S. mortgage holders still have rates below 4%

29.6% hold rates between 3% and 4%

27.3% of borrowers sit between 4% and 6%

21.9% have rates below 3%

19.9% of borrowers carry mortgage rates above 6%

If the average 30-year fixed rate falls to 6%, about 5.5 million homeowners could benefit from refinancing

A drop to 5.88% would expand that group to 6.5 million homeowners

Refinance applications are up 120% YoY, underscoring how responsive activity is to even small rate moves

My take

Mortgage rate lock-in is real, but it’s often overstated. Many homeowners with ultra-low rates are staying put, which helps explain why inventory remains tight. At the same time, plenty of sellers are still moving, giving up cheap mortgages because they have equity, income, and balance-sheet flexibility. The market isn’t frozen; it’s just slower. Small rate drops will continue to drive refinancing more than home sales. For agents, expect turnover to stay below historical norms, but not disappear. The deals that get done will come from sellers with real motivation and equity, and from buyers who need help navigating affordability constraints that extend well beyond the mortgage rate.

Nearly 45% of U.S. homeowners are equity-rich

Source: Unsplash

As of Q4 last year, 44.6% of U.S. homeowners with a mortgage were considered equity-rich, meaning they owed no more than half of what their homes were worth.

That share has slipped a bit. According to ATTOM, the equity-rich population fell 1.5 percentage points from Q3 2025 and is down 4.5 points from its recent peak of 49.2% in Q2 2024.

On the other end of the spectrum, there was a small rise in seriously underwater homes. In Q4 2025, 3.0% of mortgaged properties fell into that category, up from 2.8% the prior quarter. These are homes where loan balances exceed market value by at least 25%.

Here are the top 5 states with the highest and lowest share of equity-rich homeowners:

Highest | Lowest |

My take

Even though the percentage of equity-rich homes slipped a bit, it isn’t a sign of trouble. Instead, it’s a sign that the market is normalizing. Homeowner equity is cooling from extreme highs, not falling off a cliff, and the small uptick in underwater homes is still well within historically healthy territory. Most owners remain well-positioned, but the days of automatic appreciation and unchecked pricing power are behind us. What matters now is market-by-market reality. Sellers who price with today’s conditions in mind will still do well, while buyers are finally getting a little breathing room. In short, the housing market is stabilizing, not breaking. Share this widely – especially with those feeling uneasy about the economy or housing outlook.

Schematics

The news that just missed the cuts

Source: Unsplash

Here’s how much you need to earn to buy a home in the most affordable cities

Things that actually win listing appointments

The latest news on “pocket-listing bills” across the country

Foundation Plans

Advice from James to win the day

Source: Breezy

As I mentioned up top, today is a really exciting day, and I honestly cannot believe I can finally talk about this. But for nearly two years, I've been quietly building something that comes straight out of my own experience as a real estate agent.

If there’s one thing I’ve learned over my years in real estate, it’s that success isn’t just about knowing the market; it’s about managing the work that comes with it. The calls, the notes, the follow-ups, the comps, the pipeline, the constant switching between tools. That’s where deals get done or lost.

Most agents don’t struggle because they lack hustle or intelligence. They struggle because their day is split all over the place, and their attention is pulled in every direction. Because of this, details slip through the cracks, and opportunities get missed. Not because the agent didn’t care, but because the systems weren’t built for how agents actually work.

That’s the problem Breezy was built to solve.

Instead of juggling spreadsheets, note apps, CRM updates, and presentation tools, Breezy brings those workflows together in one place.

At a high level, Breezy does five things:

Generates branded comps and reports on the fly, ready for clients

Reveals hidden build potential for properties, complete with design guidance, slope analysis, buildable area, and more through our proprietary tool, Underbuilt

Acts as an AI assistant, actually trained for real estate, to help manage tasks and information in real time

Captures and organizes conversations so no follow-up or detail gets lost

Keeps your pipeline current automatically, without manual updating, so you always know where each deal stands

Honestly, when you see what Breezy does with Underbuilt, it will blow your mind. Just watch this!

We will be fully live in the spring, but we have officially opened Breezy’s waitlist today. We’ll be sharing more over the coming weeks, but if you're an agent, you should check out Breezy's website.

This has been a long time coming and means everything to me. I cannot wait for you to see what we built.

Let's go!

Just in Case

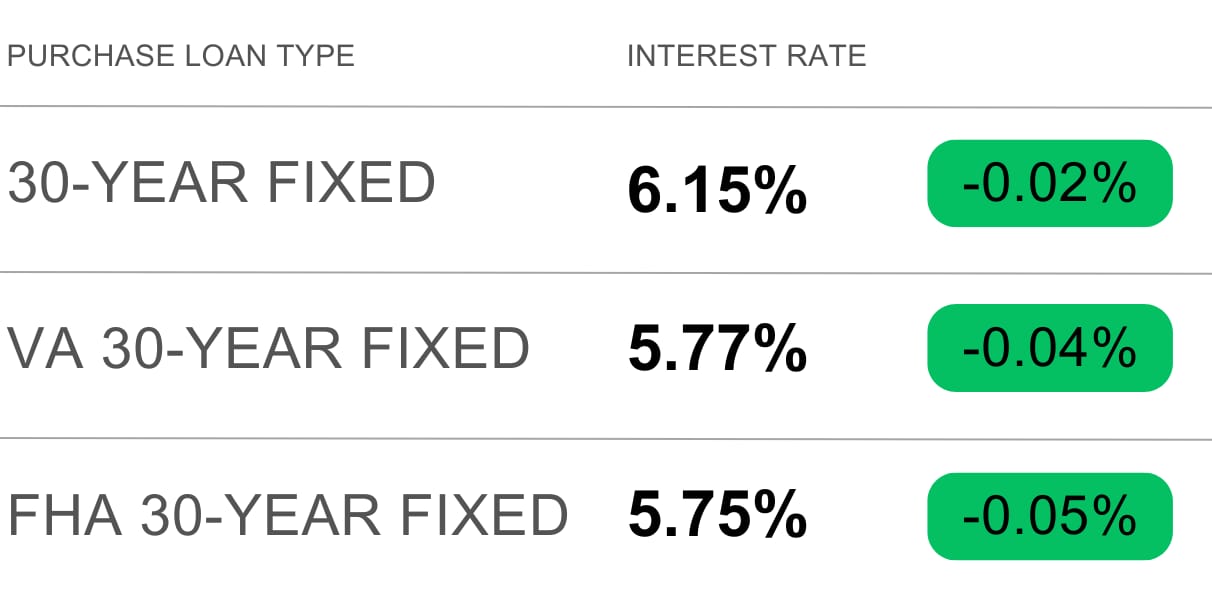

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“It is not necessary to do extraordinary things to get extraordinary results.” – Warren Buffett

The secret of getting ahead is getting started, friends. Don’t wait to be perfect — you’ll be waiting forever. Planning has its place, but progress only happens when you take action. Post the video. Make the call. Host the open house. Whatever it is, do it now. Momentum doesn’t come from thinking — it comes from doing. Start messy, and improve as you go. The perfect time? It’s today.

- James