- The Blueprint

- Posts

- Our reaction to the big mortgage rate drop

Our reaction to the big mortgage rate drop

Plus, housing market breaks all-time record

The big rate drop

Last week truly ended on a high note or a low note, depending on how you want to look at it.

We saw the biggest single-day mortgage rate drop since last August.

We’re going to give you a brief rundown of all the latest numbers, and what they could mean for the housing market and your business in the weeks and months to come.

Obviously, the big question is whether this will revive housing demand.

While the answer remains to be seen, we want to remind all our agent readers about an active group of buyers they might not be targeting — investors. In today’s Foundation Plans, we have some quick tips on how to market to this group, and why it’s something to consider.

With that, let’s get into today’s Blueprint.

- James and David

Mortgage rates see biggest one-day drop in over a year

Source: Realtor.com

On Friday, the average rate on the 30-year fixed mortgage fell 16 basis points to 6.29%, the sharpest single-day decline since August 2024, hitting its lowest number since October, according to Mortgage News Daily via CNBC. The move came on the heels of a weaker-than-expected August jobs report. Here are the highlights:

Jobs report: Just 22,000 jobs added in August, compared to a 12-month average of 128,000; unemployment rose to 4.3%; earnings growth slowed to 3.7%.

Employment sector shifts: Health care and social assistance gained jobs, while federal government employment shrank.

Mortgage rate context: There has been a considerable drop in the 30-year mortgage rate since it peaked at 7.08% in May.

Market reaction: Homebuilder stocks Lennar, DR Horton, and Pulte rallied; the homebuilding ETF (ITB) is up ~13% over the past month.

Demand trends: Mortgage purchase applications remain 6.6% below levels from four weeks earlier, with fresh data due Friday.

Our take

This is exactly the kind of market reaction we anticipated. The Fed now is all but certain to cut rates by at least 25 basis points at its September 16th–17th meeting. The bigger question: will this meaningfully revive housing demand? Broadly, higher mortgage rates have eroded buying power nationwide, and one rate cut won’t reverse that. But in a handful of metro areas where incomes are growing faster than the national average, households are regaining some buying power. Expect local upticks in sales there, even if the national market remains sluggish.

U.S. housing market value hits record high

Source: Zillow

The total value of the U.S. housing market reached a record $55.1 trillion in June, according to Zillow, up $20 trillion (57%) since early 2020. But growth has slowed sharply, with wealth increasing by just $862 billion (+1.6%) over the past year. Here’s what else the listing service reports:

Pandemic boomtowns in the South and Mountain West are cooling, while the Northeast and Midwest are now leading gains. Since 2020, we’ve seen the biggest increases in California (+$3.4T), Florida (+$1.6T), New York (+$1.5T), and Texas (+$1.2T). In the past year, however, we’ve seen drops in Florida (-$109B), California (-$106B), and Texas (-$32B).

Nine metros now each top $1 trillion in housing value, holding nearly one-third of the nation’s total. Those markets include New York ($4.6T), Los Angeles ($3.9T), San Francisco ($1.9T), Boston ($1.3T), Washington, D.C. ($1.3T), Miami ($1.2T), Chicago ($1.2T), Seattle ($1.1T), and San Diego ($1.0T).

New construction has added $2.5T in value nationwide since 2020, accounting for 12.5% of the total increase. It’s been especially impactful in Utah (23%), Texas (22%), Idaho (22%), and Florida (20%), where pandemic demand fueled building booms.

Our take

That $55.1 trillion is impressive, but the real story is the shift in housing wealth. Pandemic boom markets like Florida, California, and Texas are slipping, while the Northeast and Midwest are picking up steam. New York alone drove a quarter of national gains last year, signaling a shift back to legacy markets and other markets overlooked during the boom years. However, states that built aggressively during the pandemic—Utah, Texas, Idaho, Florida—are now better positioned with more balanced supply. Keep a close eye on where builders have been most active. That could show which markets have staying power, and which are poised for further correction.

Top 10 most vulnerable housing markets in Q2 2025

Source: Unsplash

ATTOM has released its Q2 2025 U.S. Housing Risk Report, which ranks county-level markets most susceptible to housing downturns, based on factors such as affordability, equity, foreclosure activity, and unemployment.

Many of the most at-risk markets were concentrated in the South and in California, where affordability pressures and elevated foreclosure rates remain key areas of stress.

Here are the top 10 counties ATTOM deems the most vulnerable housing markets:

Our take

For agents and investors, this is a reminder that market health isn’t uniform. Some counties are highly exposed to affordability gaps and foreclosure spikes, while others remain relatively stable. Tracking these risk factors can help you identify where opportunities may be cooling, and where distressed assets or motivated sellers could emerge.

Schematics

The news that just missed the cut

Source: Unsplash

Texas bans property sales to certain international buyers

Best comparative market analysis (CMA) software for realtors

Want to sell your home? Start early: what today’s market means for longtime owners

Here’s how to get a better mortgage rate as the 30-year fixed nears a 1-year low

Clifftop Malibu estate above iconic pier with amazing views lists for $38 million

Foundation Plans

Advice from James and David to win the day

Many agents hear “lead generation” and think about buyers and sellers, but investors represent one of the most consistent, scalable sources of business. They buy multiple properties, move faster than traditional buyers, and often come back for repeat transactions.

As we mentioned in our last edition, 29% of all single-family home purchases in the country were made by investors as of June. Today, in our ongoing series on lead generation, we’ll give you some tips on how to target investors.

Tap into investor networks – Investors gather in predictable places: local real estate meetups, BiggerPockets forums, and even casual landlord associations. Show up where they are and bring value, whether it’s market data, deal comps, or insights into zoning changes. By being a trusted resource in their circles, you’ll naturally position yourself as their go-to agent when opportunities arise. Investors want to see how you can add value, so make that clear from the get-go

Market yourself with investor-specific content – Investors care less about granite countertops and more about cash flow, cap rates, and long-term appreciation. Create newsletters, short videos, or social posts that translate market trends into investment opportunities. When you consistently speak their language, you’ll stand out from agents who only market to traditional buyers.

Offer deal analysis as a service – Many investors—especially those just starting out—struggle to evaluate whether a property will actually perform. If you can break down rent rolls, operating expenses, and financing options in a clear way, you’ll become invaluable. Even experienced investors appreciate an agent who can run quick pro formas and validate whether a deal pencils out.

Leverage repeat business and referrals – The real upside with investors is volume. One investor could represent ten transactions over the next few years—and they often refer their colleagues once you prove your value. Focus on building systems for follow-up, portfolio check-ins, and deal sourcing so you stay at the center of their investment journey.

To help you get going, here are some top forums real estate investors and landlords use. Drop us a line if you have specific questions on how to market to real estate investors.

Just in Case

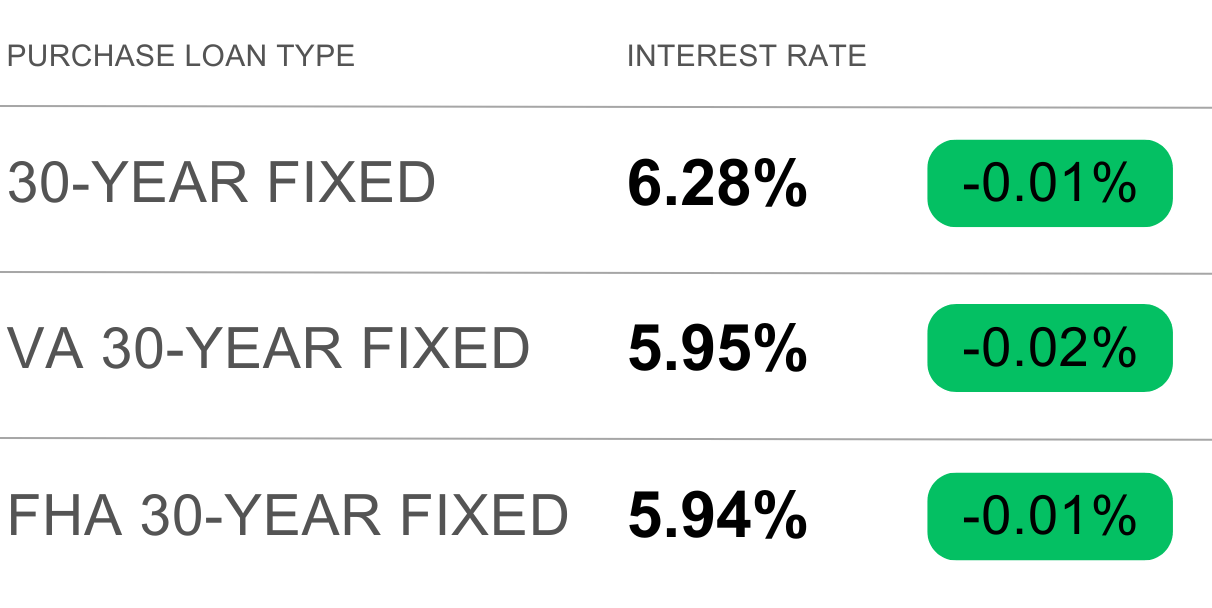

Keep the latest industry data in your back pocket with today’s mortgage rates:

“Whatever you are not changing, you are choosing.” – Laurie Buchanan

Every day is a fresh chance to build the life you want. Perfection isn’t required — choosing to improve is.

- James and David