- The Blueprint

- Posts

- Where mega investors are buying the most

Where mega investors are buying the most

Plus, why mortgage demand is cooling

The main issue

You’ll likely spot a recurring theme in this issue. It’s a recurring theme for our whole industry.

Affordability.

We take a look at all the latest market data, and show how this important issue is impacting buyers across the country, specifically in the South and West.

On the flipside, we also take a look at mega investors. Their activity tells us a lot about what’s going on in some major metros, and what agents (and their clients) can learn from them.

We also recap our terrific conversation with the incredible real estate coach Ricky Carruth. If you haven’t had a chance to watch it, definitely check it out. It’s packed with great advice, and we think it’s a must-watch for all agents.

Now, let’s get into today’s Blueprint!

- James and David

Mortgage rate drop doesn’t raise demand

Source: Unsplash

While mortgage rates just hit their lowest level since April, the drop wasn’t enough to revive demand. Total mortgage application volume fell 1.2% from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index via CNBC. Refinance activity edged higher, but purchase applications pulled back, underscoring the ongoing affordability challenges facing buyers. Here are the other key data points:

The average 30-year fixed rate for conforming loans fell from 6.69% to 6.64%, with points dropping slightly from 0.60 to 0.59.

Refinance applications rose 1% week-over-week and were up 20% YoY, despite slightly higher rates than last year.

Purchase applications declined 3% week-over-week, but were up 17% YoY.

Our take

Buyers may have more options than a year ago, but higher prices are still making affordability an issue. Until that improves, demand is likely to remain choppy. All eyes now turn to this week’s economic releases, especially Friday’s jobs report, which could shift mortgage rates in either direction. Keep an eye on that.

Housing risk climbs, especially in the South and West

Source: Unsplash

In Q2, homeowners across the country faced mounting financial pressures as affordability weakened and foreclosure risks climbed, according to ATTOM’s latest Housing Risk Report. While mortgage rates, wages, and unemployment stayed mostly steady, record-high home prices pushed costs well beyond typical income levels in many markets.

The riskiest areas were concentrated in the South and West, where high foreclosure rates, underwater mortgages, and elevated unemployment weighed heavily on local housing stability.

Here are the key takeaways:

High-risk regions: Of the 50 riskiest counties, 14 were in California, 7 in Florida, 5 in New Jersey, and 4 in Louisiana.

Affordability strain: In 19% of counties (111 total), owning a home required at least half of annualized wages. In 63% of counties, it required at least one-third.

Underwater mortgages: Nationally, 2.7% of homes were seriously underwater. In Louisiana, some parishes exceeded 17%.

Foreclosures: National foreclosure activity hit 1 in every 1,413 homes, with the highest rates in South Carolina, Florida, New York, Texas, and Indiana.

Unemployment stress: About 35% of counties had unemployment above the 4.4% national rate. California’s Imperial County led with 19%.

Regional contrasts: The South had heavy representation on both ends of the spectrum, with 18 counties among the least risky and 21 among the most risky.

Our take

The report shows us that as national rates and wages hold steady, local housing markets are feeling the squeeze. Affordability remains the biggest hurdle, with rising foreclosure activity and underwater mortgages in certain regions adding to the pressure, especially in parts of the South and West. The big takeaway here: market strength will hinge less on national price records and more on whether local economies can support current housing costs without falling into distress.

Markets where mega investors are buying the most

Source: Cotality

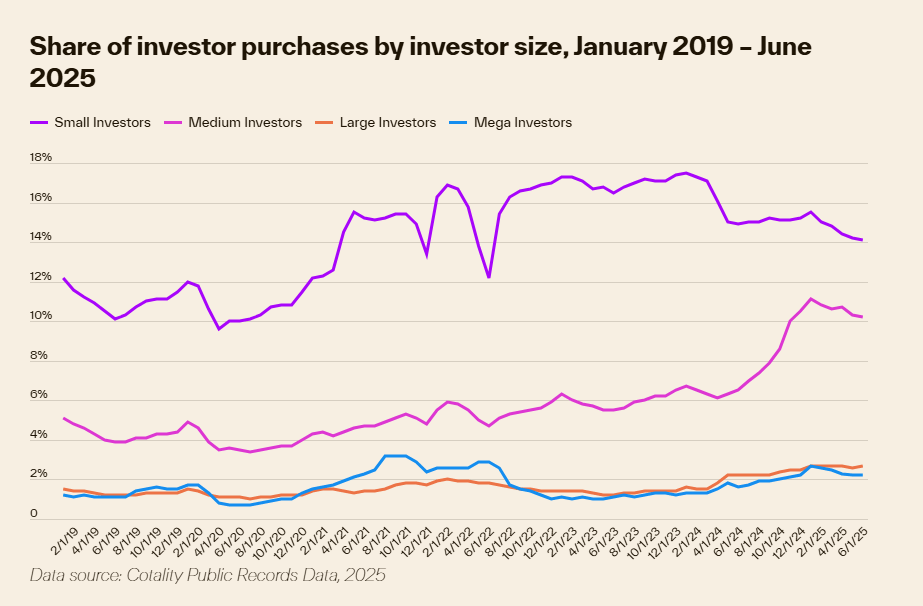

Between January and June, investors had a sizable impact on the market, according to a new report from real estate analytics firm Cotality. Investors accounted for 32% of single-family home purchases in January, and while that number dropped to 29% by June, it was still much higher than the same time in 2024, when it was only 25%.

This was the June breakdown of the share of purchases by investor size:

Small investors: 14.1%

Medium investors: 10.2%

Large investors: 2.7%

Mega investors: 2.2%

For reference, Cotality defines an investor as a buyer owning three or more properties, with these ranges to define the type of investor:

Small: fewer than 10 properties

Medium: 10–99 properties

Large: 100–999 properties

Mega: 1,000+ properties

Here are the top 10 metros where mega investors own the highest share of homes:

Our take

We’ve heard for years that mega investors are buying up all the homes. This data shows they aren’t. But while they may only hold a small share of the market, we can learn a lot from their activity. Cities like Atlanta, Memphis, and Riverside are attracting capital because they pair relative affordability with steady rent appreciation. For agents, the real opportunity lies in tracking where institutional money is flowing, since those metros often signal resilient demand and investment upside for clients. Positioning clients in those markets—whether you’re working with buyers, sellers, or smaller investors—means aligning with the same fundamentals that are drawing in large-scale capital.

Schematics

The news that just missed the cut

Source: Unsplash

Close more deals with these proven closing strategies

Miami Beach mansion sold for $105M in July, now asking $169M

US homeowner count drops for the first time since 2016

How to turn lowball offers into deals that close

Giorgio Armani leaves behind a spectacular international property portfolio

Foundation Plans

Advice from James and David to win the day

If you missed our terrific conversation with Ricky Carruth, our partners at Estate Media have just posted it on their YouTube channel. Ricky is not just one of the most influential real estate coaches out there; he’s also a best-selling author and an agent who knows how to produce $1M+ in commissions on a regular basis.

In our wide-ranging discussion, he opens up about his rollercoaster career in our industry. He also shares his simple-but-powerful philosophy: relationships over transactions. He explains why rejection and objections aren’t barriers, but opportunities that guide you forward.

We believe this episode is a must-listen for agents at every stage of their career. Here’s just a taste of some of the things we cover:

Play the long game when prospecting – Ricky makes an excellent point that the goal of prospecting isn’t to engage in any high-pressure sales tactics, but to get your prospect to open up to you. What do they want? What are their real estate goals? When you know that, you can help them achieve those goals, whether it’s a few months or a few years down the line. Don’t have a one-and-done attitude. Play the long game.

Create conversations – We loved what Ricky had to say here. Real estate is based on talking to people directly. With all the lead-gen tools out there, most agents are trying to avoid that essential step. But that’s a mistake. As Ricky says, the only thing between agents and their goals is thousands of one-on-one real estate conversations with people in their market. When evaluating any lead-gen tool or activity, ask yourself this one key question: how many conversations is it creating?

Again, this is just a small taste of our wide-ranging chat.

Watch it here and let us know what you think!

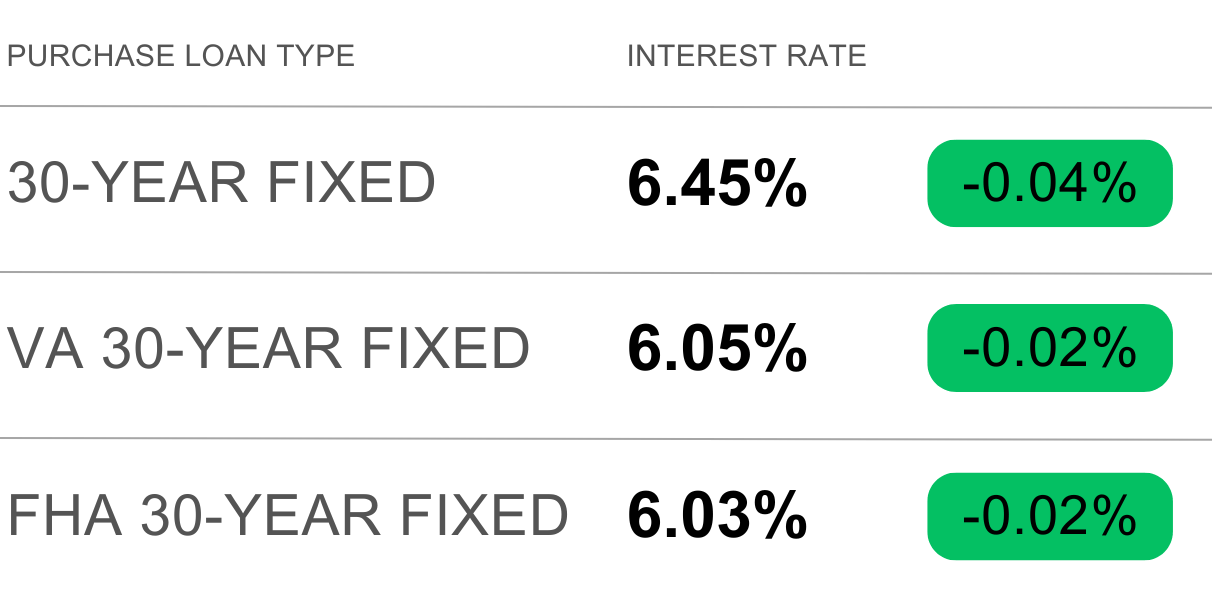

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Unsplash

That’s it for this edition of the Blueprint!

Never forget: each day is a gift and a new opportunity to lead the life you want and to become the person you want to be. The mistakes and missteps you’ve made in the past don’t define you. Live as intentionally as you can and be ruthlessly focused on the goals you’ve set out to achieve. You can do it!

Have a wonderful weekend, and we’ll see you back here on Tuesday!

- James and David