- The Blueprint

- Posts

- Luxury home prices surge 3x faster than the broader market

Luxury home prices surge 3x faster than the broader market

Plus, the most expensive home sales in the country

Framing is key

In real estate, it’s not just the data, but how we interpret the data that matters most. It all depends on how you look at it.

For example, many sellers are understandably upset about the slow price growth this year.

But that’s not the whole story.

Many of those same sellers are sitting on the kind of equity gains that would’ve been unimaginable just five years ago.

In today's edition, we dig into the numbers and show why reframing the conversation is so important. Zoom in and 2025 looks flat. Zoom out and most sellers are still walking away with some meaningful wins.

The facts haven’t changed — but the way we present them can completely change how clients feel about their options.

- James and David

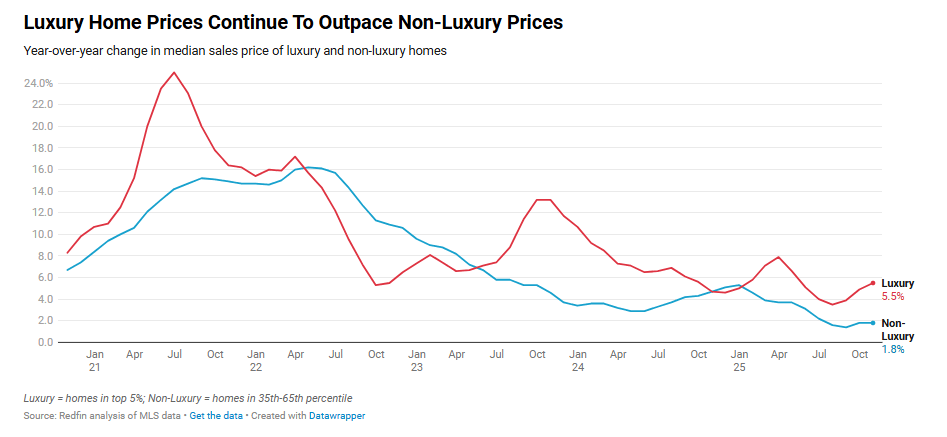

Luxury home prices surged to record in October

Source: Redfin

In October, luxury prices rose 5.5% to $1.28 million, a record high for the month, nearly triple the 1.8% gain for non-luxury homes. According to Redfin, cash-rich buyers and strong equity markets are keeping demand firm at the top end, driving outsized price growth in metros like Milwaukee, San Jose, and, topping the list, Warren, Michigan, a suburb outside Detroit. Here are the key trends to know:

Sales Tick Up but Remain Historically Low — Luxury sales increased 2.9%, compared with a 0.7% rise in non-luxury transactions, but both sit near decade-low October levels. High rates still suppress overall activity, yet the luxury tier benefits from buyers who can move independently of financing conditions.

Inventory Is Rising Across Price Tiers — Luxury inventory climbed 6.4%, while non-luxury supply jumped 9.5%, pushing both to their highest October levels in at least five years. More high-end owners are listing their homes, but overall stock remains below pre-pandemic norms, helping keep prices supported.

Homes Are Taking Longer to Sell — The median luxury home spent 58 days on the market (+6 days YoY), while non-luxury homes reached 45 days (+6 days). Fewer listings are going under contract quickly, reflecting a slower, more cautious market across all price segments.

Our take

The luxury sector is keeping this market afloat, as affluent buyers remain largely unfazed by today’s mortgage rates. While sales are still hovering near decade lows, demand from cash-rich buyers at the top end is strong enough to push prices higher. With inventory climbing and days on market stretching out, the data points to a luxury sector that’s cooling from the 2021–2022 frenzy, but still far outpacing the middle of the market. As we move into 2026, we don’t see this trend abating anytime soon.

Metros with the biggest home value boom since 2019

Source: Unsplash

Home price growth has slowed to a crawl due to issues regarding affordability, mortgage rates, and more homes hitting the market. However, according to Realtor.com, ever since the pre-pandemic era, homes across the top 100 U.S. metros have seen double-digit increases in home values.

Here are the top 10 metros where home values increased the most since 2019:

Our take

As we said up top, a lot of sellers are stressed about how slowly prices are growing right now — and that’s understandable. But this is where zooming out really helps. If you bought in 2019 or 2020, you’re likely sitting on a massive equity cushion. In many top metros, home values have jumped 70% to almost 90% since then. So yes, this year’s gains are modest, but the bigger story hasn’t changed–most sellers are still walking away with far more than they put in. It’s all about framing!

The biggest home sales in October

Source: Unsplash

California and Florida dominated October’s ultra-luxury market, with a string of oceanfront estates and celebrity properties trading for more than $30 million.

The month’s top sale was a $59 million Delray Beach estate, followed closely by sales involving two musical artists: Adam Levine’s former Montecito compound, a $53 million San Diego County ranch, and a $50 million Miami-area property purchased by The Weeknd.

In total, five of the top sales cleared $50 million, nine came from California and Florida, and the lone New York entry was a historic Upper East Side mansion.

These are the most expensive U.S. home sales of October:

701 S. Ocean Blvd., Delray Beach, FL 33483: Sold for $59 million

700 Picacho Lane, Montecito, CA 93108: Sold for $57.3 million

41 Arvida Pkwy., Coral Cables, FL 33156: Sold for $50 million

2920 Camino Del Mar, Del Mar, CA 92014: Sold for $50 million

18 Swimmers Pt., Newport Coast, CA 92657: Sold for $38 million

9200 Rockybrook Way, Delray Beach, FL 33446: Sold for $37 million

10 E. 67th St., New York City, NY 10065: Sold for $36 million

901 Oxford Way, Beverly Hills, CA 90210: Sold for $34 million

1821 W. 27th St., Miami Beach, FL 33140: Sold for $34 million

Our take

October’s biggest deals show just how concentrated America’s ultra-luxury market has become. Even in a high-rate environment, deep-pocketed buyers are still competing for oceanfront estates, historic mansions, and celebrity properties, pushing five sales past the $50 million mark. The pattern underscores a simple reality heading into 2026: while the broader market cools, true trophy homes in coastal blue-chip enclaves remain in a world of their own.

Schematics

The news that just missed the cut

Source: Unsplash

Why $200M is the new $100M in luxury real estate

The Fed might not cut interest rates in December, given the latest job report

How to make local content in seconds

States expected to see a surge in population in the coming years

The #1 problem killing real estate deals right now

Foundation Plans

Advice from James and David to win the day

As mentioned in our last edition, we’re diving into the 8 most common reasons why agents fail in the real estate industry. We covered the first four reasons here. In today’s edition, we conclude the series by covering the final four reasons. Let’s get into it.

5. Lack of lead generation and marketing – One of the primary reasons real estate agents struggle is their failure to prioritize consistent lead generation and effective marketing strategies. Generating leads is the lifeblood of any real estate business, and agents who neglect this aspect find themselves without clients to serve. Many agents fail to create a comprehensive marketing plan, relying too heavily on outdated methods or word-of-mouth referrals. Honestly, we don’t rely only on one method of generating leads. As you know, we’re totally open to using old-school methods like door-knocking. But we don’t limit ourselves to those methods. Use any method in line with your values and how you want to present yourself. As always, we remind you: never let your pipeline go dry!

6. Having a 9-to 5 mentality – The real estate industry demands flexibility and a willingness to go beyond a traditional 9-to-5 schedule. Many new agents enter the field expecting to work standard hours, only to discover that clients often need assistance during evenings, weekends, or at other unconventional times. Successful agents understand that they need to be available whenever their clients need them for showings, negotiations, or just to get on the phone and answer a question. Those who stick to a rigid schedule miss opportunities, lose clients, and fail to meet the demands of a fast-paced market. Real estate requires an entrepreneurial mindset, not an employee’s clock-in, clock-out approach.

7. Lack of measurable goals – Without measurable goals, real estate agents often find themselves unsure of how to prioritize their time and efforts. Goal-setting provides direction and focus, enabling agents to track progress and make necessary adjustments. Many agents fail because they don’t set realistic, actionable objectives, such as a specific number of new leads to generate per week or a target number of transactions per month. Instead, they operate reactively, hoping for success rather than planning for it. This lack of strategic vision undermines their ability to grow and achieve long-term stability. Don’t just have goals; make sure you have goals that you can track with concrete numbers and stats.

8. Poor financial management – Real estate income is often irregular, with months of high earnings followed by periods of little or no income. Many agents fail to budget accordingly, spending lavishly during good months and struggling to cover expenses during lean times. Additionally, they often overlook the need to reinvest in their business, whether it’s for marketing, continuing education, or professional tools. Poor financial management not only creates unnecessary stress but also limits an agent’s ability to scale their business. Those who fail to manage their finances wisely often find themselves unable to sustain their careers. We can’t tell you how many agents we know who get behind on their taxes and don’t plan for retirement. Don’t just be a big-game hunter. Make sure you set yourself up for financial success.

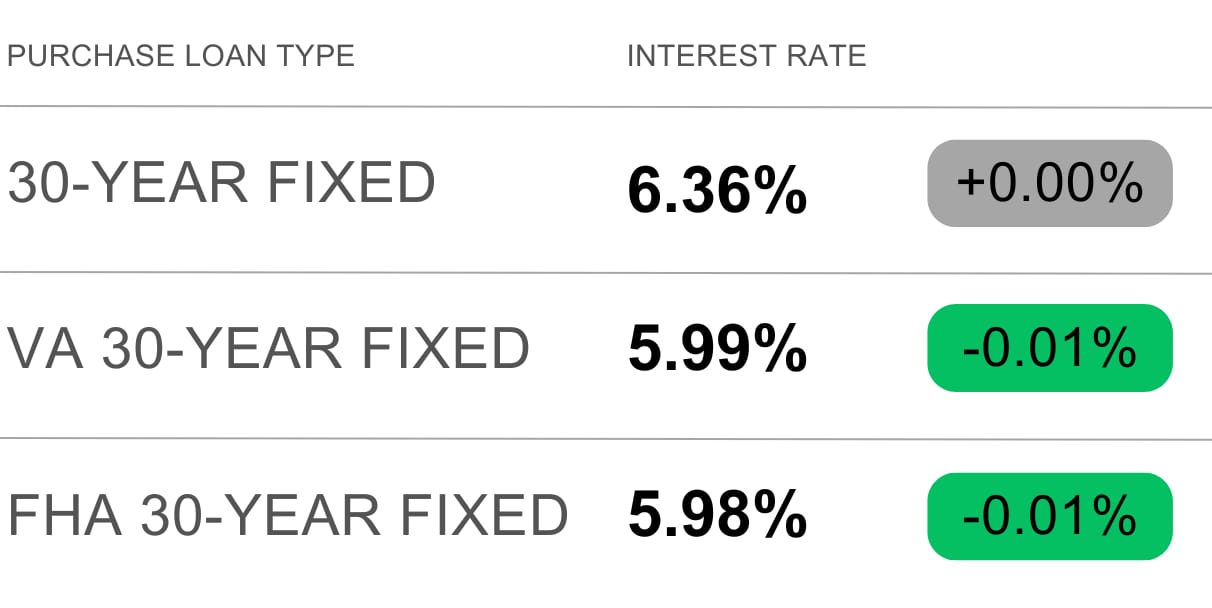

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Unsplash

Each day is a gift, friends — a fresh chance to move closer to the life you want. You don’t have to be perfect; just stay ruthlessly focused on your goals and get a little better each day.

Have a wonderful weekend, and thank you for reading! We’ll see you back here on Tuesday!

- James and David