- The Blueprint

- Posts

- Existing home sales blow past expectations

Existing home sales blow past expectations

Plus, why many buyers are putting off home purchases

Uncertainty in the market

Just like everyone else, we love to see good news, and today we’ve got a little: existing-home sales defied expectations in July, rising when many experts predicted a decline.

However, when we pull back and look at the whole market, we still see a lot of uncertainty and challenges. We’ll break them all down below.

But, as usual, we want to give you our best advice on how to approach this market.

In today’s Foundation Plans below, we pinpoint one of the biggest questions agents must ask themselves: Who are you targeting?

Sometimes, agents have such a broad message that it waters down their approach. If you’re struggling with that question, we’re going to help you zero in. Finding that answer is nearly guaranteed to improve every area of your business.

With that, let’s zero in on today’s Blueprint!

- James and David

Sales of existing homes surge past expectations

Source: Unsplash

In July, sales of existing homes rose 2% month over month, defying the predictions of many experts who expected a decline, reaching a seasonally adjusted annual rate of 4.01 million units, 0.8% higher than in July 2024. That’s according to the latest update from NAR. Here are the other key data points from July:

Inventory climbed 15.7% YoY to 1.55 million homes, the highest level since May 2020.

The median home price hit $422,400, up just 0.2% year over year, but still a July record

Homes averaged 28 days on market, up from 24 days a year ago.

High-end sales are driving activity:

Sales of homes over $1 million rose 7.1%

Sales between $100K–$250K dipped 0.1%

Sales under $100K fell 8%

Investors made up 20% of sales, up from 13% in July 2024.

All-cash buyers accounted for 31% of transactions, up from 27% a year ago.

First-time buyers fell to 28%, down from 30% in June and 29% last year.

The market now has a 4.6-month supply of homes, short of the 6-month threshold for a balanced market, but still an improvement.

Our take

While the rise in sales is definitely encouraging news, the broader story is that there’s still uneven demand and affordability strain in the market. Price growth is barely above zero percent, homes are sitting longer, and lower-priced segments continue to lag. The high-end segment – driven by investors and cash buyers – is carrying the market while many entry-level buyers remain on the sidelines. Overall, while we’re happy to see those sales numbers, we are tempering our expectations.

44% of U.S. workers are delaying or canceling home purchases

Source: Unsplash

44% of employed American workers are putting major purchases – such as buying a home or car – on hold or canceling them outright due to concerns about job security, according to a Redfin-commissioned survey conducted by Ipsos this month. 35% said they are delaying purchases, while 9% are canceling them altogether. Here are other key findings:

30% say they are accelerating purchases, making or planning major purchases earlier than expected, based on how secure they feel about their jobs

66% say they feel confident about their job security, while 31% say they are concerned

37% report feeling more concerned about job security than they did six months ago

36% say they do not have an emergency fund to cover housing payments in the event of a financial crisis

Our take

Despite low unemployment, job security fears are holding back demand. That anxiety is bleeding into the housing market. Buyers are cautious, especially at the lower end, and sellers should take note. Pricing and flexibility will matter more than ever this fall. It’s little wonder that, overall, sales have been sluggish this year.

Zillow changes course on home prices

Source: Unsplash

After months of cutting its forecast, Zillow is now predicting a slight rise in home values, according to a recent ResiClub report. The firm’s latest 12-month outlook projects that home prices will rise 0.4% between July 2025 and July 2026. That’s in contrast to earlier this year when Zillow slashed its forecast to -1.7% amid faster-than-expected market softening. This week’s revision is the first upward adjustment in months.

So where does Zillow expect the biggest moves? These are the top 10 markets (among the 300 largest U.S. metro) projected to see the largest price gains and declines over the next year:

Gains | Declines |

Our take

Zillow’s revised forecast suggests the housing market may be stabilizing, but not rebounding. The pace of home price appreciation remains sluggish. We’ve seen marginal improvement in affordability, thanks to slightly lower mortgage rates and flatter price growth, but buyers are still contending with monthly payments that remain nearly $1,000 higher than before the pandemic. The biggest gains are showing up in smaller Northeast and Midwest markets, while the sharpest declines – particularly across Louisiana and Southwest Florida – underscore how inventory spikes and weakened demand are weighing heavily on Sun Belt metros.

Schematics

The news that just missed the cut

Source: Unsplash

80% of agents still ignore the easiest form of marketing

From Seattle to Boston, cities are remaking their shorelines

New construction is booming in these metros

Buyer agent commissions rise to 2.43% one year after the NAR settlement

Inside Bridgehampton, the most expensive place to buy a home in New York

Foundation Plans

Advice from James and David to win the day

Normally, we jump straight to the tips in our Foundation Plans, but today we want to lay the groundwork for some terrific upcoming editions we have in store for you.

As you may know, we’ve begun a deep dive into the art of lead generation. (You can find Part 1 and Part 2 on our site.) In our experience, most new agents rush into business development activities – calls, emails, postcards, social media, etc. – without a clear plan. But before you start dialing, mailing, or posting, you need to answer a simple question:

Who are you targeting?

Before you prospect, it’s vital to answer all these questions: Are you targeting your sphere of influence? Expired listings? FSBOs? Investors? Each group requires a different message, script, and approach. Without this clarity, your outreach will be vague, and vague and unfocused outreach rarely produces results.

Today, we’re offering you a framework: a list classifying the kinds of prospects you might want to target throughout your career. It’s not exhaustive, but it is comprehensive enough to get you thinking clearly and strategically.

As you review each category, ask yourself: How would I approach this type of client? Most agents never take the time to do this exercise. But if you want to master lead generation, this is where it begins.

Over the coming months, we’ll give you specific tips on how to prospect each of these groups. For now, here’s your starting point:

1. Sellers

Homeowners looking to sell

FSBOs (For Sale By Owner)

Expired Listings

Withdrawn or cancelled listings

Distressed homeowners (pre-foreclosure, short sale)

Seniors downsizing or transitioning to assisted living

Divorce or estate-related sales

Relocation sellers

Homebuilders offloading spec homes or completed inventory

2. Buyers

First-time buyers

Move-up buyers

Downsizing buyers

Relocation buyers

Investors seeking single-family or multifamily homes

Veterans using VA loans

FHA or low-down-payment buyers

Renters ready to purchase

3. Investors

Buy-and-hold rental investors

Fix-and-flip investors

Short-term rental investors (Airbnb, Vrbo)

Out-of-state or international investors

1031 exchange buyers

BRRRR strategy investors

Real estate syndication groups

4. Developers & Builders

Residential land developers

Infill and urban redevelopment builders

Custom home builders

Multifamily or mixed-use developers

Build-to-rent operators

5. Landowners

Raw land owners looking to sell

Farmers or heirs of agricultural land

Owners of subdividable parcels

Owners near new infrastructure or zoning changes

6. Special Circumstance Prospects

Probate/estate executors

Divorce attorneys (referral source)

Bankruptcy trustees or clients

Code violation property owners

Tax default/tax lien property owners

7. Referral Sources

Past clients and sphere of influence

Lenders/mortgage brokers

CPAs and financial planners

Divorce and estate attorneys

Contractors and service providers

Other agents (e.g., out-of-area referrals)

Did we miss someone? If there’s a prospect type you think belongs on this list, message us. We’d love to hear from you.

In the meantime, review each category carefully and ask yourself: How would I market to this group? Your answers will help you get even more out of the prospecting strategies we’ll share starting next week.

Just in Case

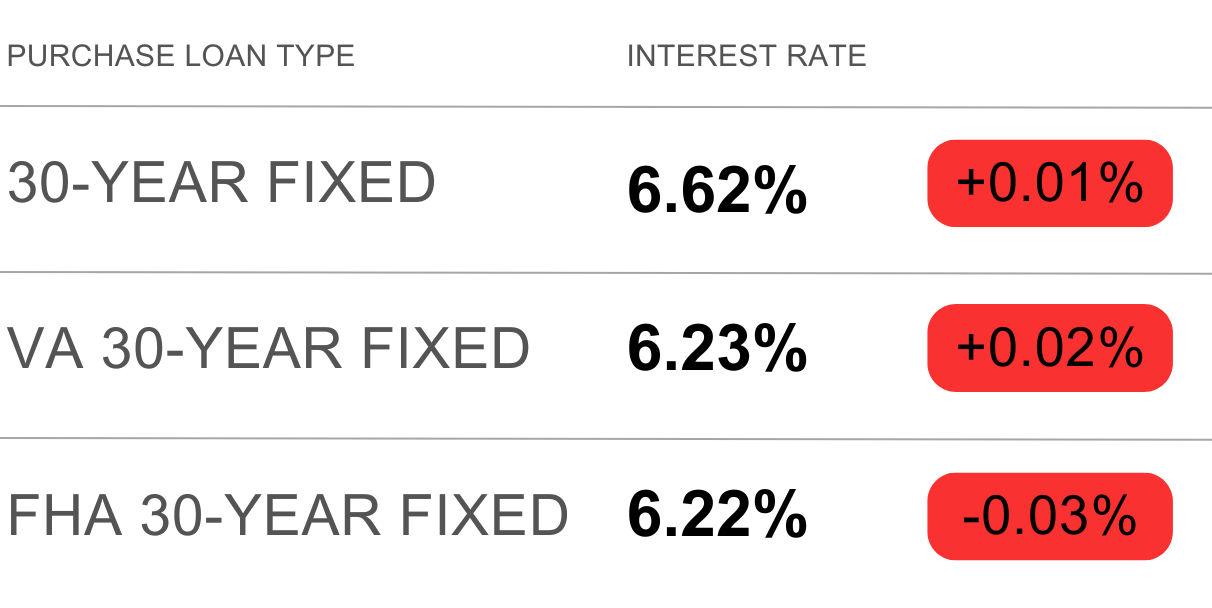

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“The only person you are destined to become is the person you decide to be.” – Ralph Waldo Emerson

We can’t emphasize Emerson’s advice enough. Take ownership of your life, friends. What you’re not changing, you’re choosing. Whatever your goal, the path is the same: make the move. Decide to become the person you want to be, and then act. Don’t just dream about it.

Have a great weekend, and we’ll see you back here on Tuesday!

- James and David