- The Blueprint

- Posts

- Why buyers are canceling at a record rate

Why buyers are canceling at a record rate

Plus, investors surge into the market

Control what you can

In our ever-changing business, that’s one of our go-to pieces of advice: control what you can control.

In today’s newsletter, we not only discuss shifts happening right now in the market, but also how you can move with those changes.

We discuss the surge in investor activity and explain why it’s important to see investors as potential clients. We also report on the record rate of buyer cancellations, and what you can do to stack the odds in your favor.

Then, in today’s Foundation Plans, we have some great advice on how you can truly take control of your business: understanding the key metrics that allow you to measure exactly how your business is going.

With that, let’s all get going… into today’s Blueprint!

- James and David

Source: Unsplash

Investor activity surged in Q2, with investors buying one-third of all single-family homes sold, marking their largest share in five years, and up from 27% in Q1. That’s according to the latest CNBC update sourcing info from CJ Patrick Co. and BatchData. The gain reflects fewer total home sales, which amplifies the presence of investors in the market, even as raw purchase numbers fell year over year.

Here are other key takeaways from the report:

The size of investor influence – Investors now own about 20% of the nation’s 86 million single-family homes, giving them outsize influence over local inventory and pricing trends.

Small investors drive the market – Individuals with 10 or fewer homes make up over 90% of investor ownership, while institutional players control just 2%, despite dominating media narratives.

Focus remains on affordable markets – Investors paid an average of $455K per home — below the $513K national average — with institutional buyers targeting even cheaper Midwest and Southern markets.

Big landlords shift to build-to-rent – Firms like Invitation Homes and American Homes 4 Rent have sold more properties than they’ve bought for six consecutive quarters, redirecting capital into new rental developments.

Our take

The growing investor share says less about a buying frenzy and more about how weak traditional home sales have become. With institutional players shifting toward build-to-rent projects, small investors are quietly filling the gap and shaping local markets. Their focus on affordable regions highlights where capital still sees opportunity, and where everyday buyers face the toughest competition. The data confirms that investors, not homebuyers, are keeping the housing market afloat for now. As an agent, make sure your client base includes investors, not just the traditional class of buyers and sellers.

Why homebuyers are canceling deals at a record rate

Source: Redfin

In August, 56,000 home purchase agreements were canceled across the country, according to Redfin. That’s equal to 15.1% of homes that went under contract that month, and marks the highest percentage of cancellations on record in any August dating back to 2017.

These are the top three factors causing home-purchase cancellations:

Home inspection or repair issues – 70%

Buyer financing falling through – 27.8%

Buyer inability to sell their current home – 21%

Here are the top 5 markets with the highest and lowest percentage of cancellations in August:

Highest | Lowest |

Our take

This report is eye-opening. Deals are falling apart at a record pace, with more than 70% collapsing over inspection or repair issues. As an agent, you can’t control every variable, but you can stack the odds in your favor. Get pre-inspections done, price with flexibility, and make sure your buyers are solidly pre-approved. Sellers should anticipate repair requests and line up back-up offers, while buyers need to review HOA rules and prepare financially. In today’s market, preparation and transparency aren’t optional; they’re how you keep deals alive and get to the closing table.

Bank-owned properties surged 41% from last year

Source: Unsplash

Nationwide, there were 4,077 bank-owned properties or REOs recorded in August, up 5.46% month over month and a striking 41.12% from a year ago. According to ATTOM via Biggerpockets, this signals that more homes are completing the foreclosure process and returning to bank ownership, expanding the supply of distressed inventory. Here are the main trends to note:

Texas leads the nation in growth – Texas logged 476 REOs, representing a 186.75% year-over-year spike, the largest in the country. Major metros such as Dallas, Houston, and San Antonio are seeing increased bank-owned listings, positioning the state as a key market for investors looking for entry points.

Notable gains across North Carolina and California – North Carolina’s 112.68% surge and California’s 49.78% jump show that foreclosure pressures are spreading beyond traditional hotspots. Even high-demand or high-priced areas like Raleigh, Charlotte, and Los Angeles are showing signs of distress-driven opportunity.

Why REOs matter for investors – Unlike auctions, REO properties are owned by banks, which are often motivated to sell quickly. This structure allows investors to negotiate directly with lenders, conduct inspections and title checks, and often finance purchases through conventional or non-recourse loans.

Caution and strategy still required – While REOs can offer discounts and less competition, they also carry risks ranging from repair needs to title issues. Investors who track REO trends at the ZIP code level can spot emerging markets early and approach banks or MLS listings with data-driven precision.

Our take

The jump in REO activity signals a subtle but important shift in the housing market. With more foreclosures working their way to completion, banks are emerging as major sources of discounted and distressed inventory. For investors, this opens a window of opportunity for those who are selective and do their due diligence. Be the agent who tracks REO trends and shares that insight with investor clients. Even in a tough market, that will result in more closed deals. As we said earlier, it’s investors, not homebuyers, who are keeping the housing market afloat.

Schematics

The news that just missed the cut

Use these strategies to engage unresponsive leads and close more deals

Do sellers owe their agent a commission if the agent didn’t find the buyer?

Why agents should strive toward “integration”, not “work-life-balance”

Off-MLS sellers left more than $1B on the table the past two years

What the government shutdown means for commercial real estate

Foundation Plans

Advice from James and David to win the day

In our first installment of our “Prep for 2026” series, the very first piece of advice we gave was that you need to have specific, measurable goals. Today, we’d like to unpack what we mean by “measurable”.

It’s not only important to track your stats, but to know how to track them. That helps you interpret that data and use it to act strategically. Today, we’re going over some key metrics you need to watch like a hawk.

Year-over-year production – Compare your current performance to the previous year. This metric provides invaluable insights into whether your performance is aligned with your goals. It’s concrete data that enables you to make strategic adjustments to ensure continuous growth and success.

Active and future listings – Listings are king in real estate. Understanding current active listings provides insights into market trends, pricing strategies, and property availability. Future listings help in planning and preparing for upcoming opportunities. Being aware of active and future listings allows you to better match client needs with available properties, offer more tailored and timely options, and enhance customer satisfaction.

Conversion rate – It’s vital to know how effective you are in turning inquiries or leads into actual business. Monitoring this conversion rate helps in evaluating the efficiency of sales strategies, identifying areas for improvement in communication or sales techniques, and ultimately optimizing efforts to increase successful deals. This helps maximize your productivity and revenue potential.

Lead flow – We will say this till we’re blue in the face. Never let your pipeline go dry. It’s critical to continuously generate leads, but you also need to know how effectively your marketing tactics are working. To do that, you need to track the number and quality of potential clients, as well as identify which lead sources are most successful. Tracking lead flow helps optimize your time and resources to maximize your chances of securing more deals.

This is just the tip of the iceberg. To learn what other metrics to track, start here.

Just in Case

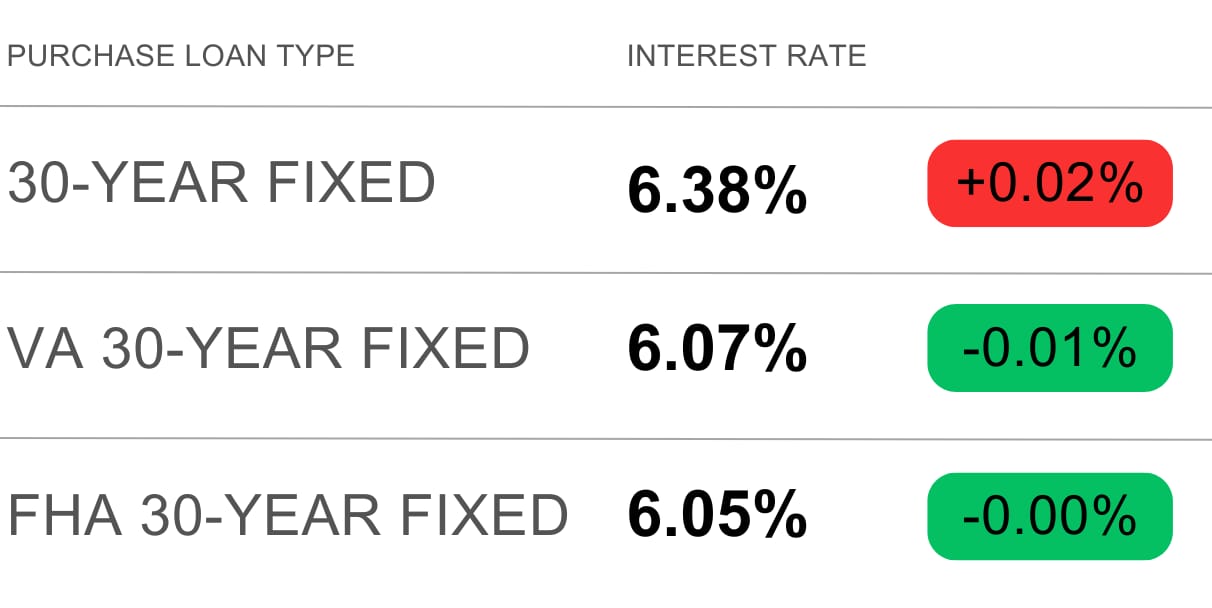

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

Success starts with taking ownership of your life, your choices, and your habits. Nobody else can do it for you. It’s not enough to want change; you have to take consistent, proactive steps to make it happen. There’s no shortcut. It takes work — but the payoff is worth it.

Have a great weekend, friends! Thank you for reading. We’ll see you on Tuesday!

- James and David