- The Blueprint

- Posts

- Where the U.S. luxury market stands, and why it’s splitting

Where the U.S. luxury market stands, and why it’s splitting

Plus, how to turn real estate investors into repeat clients

Level setting on luxury

In today’s edition, we’re taking a clear-eyed look at the luxury market. The goal is simple: to level set where things stand now and establish a baseline for tracking how the market evolves over the rest of the year.

Many of you write in asking how to break into this segment. This edition is designed to help – packed with context, data, and practical talking points you can use with clients and prospects.

Plus, in today’s Foundation Plans, we share our best tips for targeting a client group no agent should ever forget: real estate investors. Unlike other types of buyers, they move faster, buy multiple properties, and often return for repeat transactions.

With that, let’s dig into today’s Blueprint!

Let’s go!

- James

Luxury real estate is stabilizing, but the market is splintering

Source: Realtor.com

Luxury homes are taking longer to sell, but demand hasn’t disappeared. The median days on market for the top 10% of listings rose to 88 days, while homes in the top 5% and top 1% are still selling faster than a year ago, according to Realtor.com’s latest luxury market update. Here are the key takeaways:

12% of U.S. listings priced $1M+ – The share of million-dollar homes has edged lower but remains historically elevated – pointing to adjustment, not a retreat, at the high end.

Entry-level luxury is stabilizing; higher tiers are still resetting – The 90th-percentile price slipped just 0.6% YoY to $1.19M, hinting at a near-term floor. By contrast, the 95th percentile is down 3.0% YoY, and ultra-luxury remains volatile, off 4.1% YoY.

Miami has overtaken New York in million-dollar listings – Miami now holds the largest $1M+ inventory in the country, reflecting cash-heavy buyers, international demand, and less seasonal listing behavior than New York’s.

Luxury price gaps show how fragmented markets have become – Nationally, luxury runs about 3× the median, but in places like Stamford, CT, and Naples, FL, it’s 5× or more—a sign of sharp neighborhood-level stratification, not broad market stress.

My take

This doesn’t look like a luxury slowdown so much as a luxury reality check. Buyers are still there, especially at the very top and in structurally strong markets, but they’re choosier and far less forgiving on price. The key shift is that luxury is no longer one market: the top 10% is slowing, while the top 5% and top 1% continue to find demand, often from cash-heavy buyers. Where you’re selling, who your buyer is, and how precisely you price now matter more than the label “high-end.”

What it takes to crack the top 10% of luxury homes

Source: Unsplash

Breaking into the top 10% of the luxury housing market still requires eyebrow-raising prices, but the market is clearly resetting.

Heber, UT, is the most expensive luxury market in the U.S., with the top 10% of listings starting around $6.9 million. As a legacy mountain market with limited supply and few substitutes, Heber remains insulated from broader luxury price declines — and is one of the few top markets still posting annual gains.

Elsewhere, prices are softening. Across California, markets like Los Angeles, San Jose, Santa Rosa, and Oxnard are seeing mid- to high-single-digit declines. This reflects recalibration, not distress.

Bottom line: the luxury market is cooling, not breaking. Homes are taking longer to sell, pricing power varies sharply by region, and the gap between resilient niche markets and resetting metros is widening as 2026 begins.

Here are the top 10 markets in the country by 90th percentile listing price:

My take

Luxury housing isn’t moving in one direction anymore. Markets with real scarcity and lifestyle appeal are holding up just fine, while bigger, more flexible metros are still working through price adjustments. This isn’t a luxury crash; it’s a sorting process. Where you buy, and what makes that market unique, matters more than ever in 2026.

Portugal’s Economic Momentum

Markets rarely move in isolation. Real estate performance tends to reflect broader economic health, confidence, and capital flows over time. In that context, Portugal’s recent trajectory stands out.

According to The Economist, Portugal was named the best-performing economy of 2025, outperforming larger European peers in employment growth, inflation moderation, and GDP expansion. Foreign investment continues to rise, tourism revenue is hitting record levels, and infrastructure spending is accelerating.

That macro momentum increasingly shows up in established destinations like Vilamoura and Palmares, where international demand is supported by affordability, accessibility, and long-term planning. These are markets benefiting not from hype, but from alignment between economic strength and lifestyle appeal.

For those considering relocation or second-home ownership, Portugal’s Golden Visa program continues to be a key pathway, offering residency options tied to investment while maintaining access to Europe and long-term lifestyle flexibility.

On a personal level, Portugal has always mattered to me. I spent a significant part of my childhood there, and it’s a place my family and I still feel deeply connected to today. Watching the country strengthen economically while preserving what makes it livable only reinforces why so many people are looking at Portugal with fresh interest.

Sales in the ultra-luxury market are skyrocketing

Source: Unsplash

The nation’s top 10 luxury markets – those with the highest concentration of home sales priced at $10 million or more – recorded over 1,600 such transactions in 2025, up 32% year over year, with total dollar volume rising nearly 24% to $28.6 billion, according to the WSJ and Compass.

Importantly, the surge in $10M-plus sales is no longer confined to traditional luxury strongholds like Los Angeles, New York City, and Palm Beach. It now includes emerging ultraluxury markets such as Phoenix, San Diego, and Dallas, where eight-figure sales are no longer anomalies but part of a growing trend.

Here are the top 10 markets of $10M+ homes by sales number and volume:

My take

The broader housing market had a tough year in 2025. The ultra-luxury market didn’t; it was white-hot. While higher rates continue to weigh on most buyers, ultra-wealthy, largely rate-insensitive buyers are putting capital to work in high-end real estate, treating it less like housing and more like a durable place to park money. What stands out is how far this trend has spread beyond traditional luxury hubs: when $10M-plus sales become routine in markets like San Diego, Phoenix, and Dallas, it’s a sign that scarcity, tax considerations, and lifestyle flexibility, not mortgage costs, are driving demand at the top of the market. This trend isn’t changing anytime soon.

Schematics

The news that just missed the cuts

Source: Unsplash

Foundation Plans

Advice from James to win the day

Many agents hear “lead generation” and think about individual buyers and sellers, but investors represent one of the most consistent, scalable sources of business. As we said up top, they buy multiple properties, move faster than traditional buyers, and often come back for repeat transactions.

As of June of last year, 29% of all single-family home purchases in the country were made by investors. Today, in our ongoing series on lead generation, we’ll give you some tips on how to target investors.

Tap into investor networks – Investors gather in predictable places: local real estate meetups, BiggerPockets forums, and even casual landlord associations. Show up where they are and bring value, whether it’s market data, deal comps, or insights into zoning changes. By being a trusted resource in their circles, you’ll naturally position yourself as their go-to agent when opportunities arise. Investors want to see how you can add value, so make that clear from the get-go

Market yourself with investor-specific content – Investors care less about granite countertops and more about cash flow, cap rates, and long-term appreciation. Create newsletters, short videos, or social posts that translate market trends into investment opportunities. When you consistently speak their language, you’ll stand out from agents who only market to traditional buyers.

Offer deal analysis as a service – Many investors—especially those just starting out—struggle to evaluate whether a property will actually perform. If you can break down rent rolls, operating expenses, and financing options in a clear way, you’ll become invaluable. Even experienced investors appreciate an agent who can run quick pro formas and validate whether a deal pencils out.

Leverage repeat business and referrals – The real upside with investors is volume. One investor could represent ten transactions over the next few years—and they often refer their colleagues once you prove your value. Focus on building systems for follow-up, portfolio check-ins, and deal sourcing so you stay at the center of their investment journey.

To help you get going, here are some top forums real estate investors and landlords use. Drop us a line if you have specific questions on how to market to real estate investors.

Just in Case

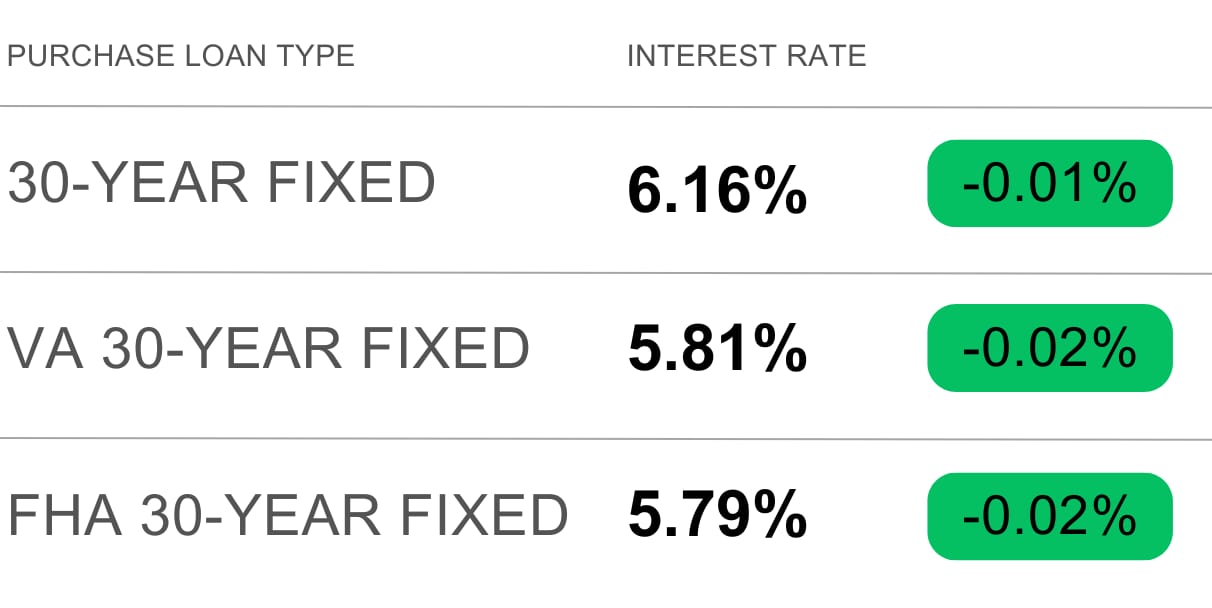

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“Whatever you are not changing, you are choosing.” – Laurie Buchanan

Every day is a fresh chance to build the life you want. Perfection isn’t required — choosing to improve is.

Have a wonderful weekend, friends, and I’ll see you back here next Friday!

- James