- The Blueprint

- Posts

- What real estate investors are saying about 2026

What real estate investors are saying about 2026

Plus, metros with the most million-dollar listings

Investor outlook

We’ve been talking a lot about how typical buyers and sellers are approaching the new year.

Today, we have a report on how investors are planning for 2026.

ResiClub and LendingOne have just published a survey that tells us a lot about the current mindset among single-family rental investors.

We believe that agents should always consider investors as potential clients, and these survey results tell us why that makes a lot of sense.

And while we’re talking about 2026 – if you’re planning to make some changes to your real estate business, or simply get into the business – we have our advice for choosing the right brokerage for you. Scroll down to today’s Foundation Plans for more.

With that, let’s get into today’s Blueprint!

- James and David

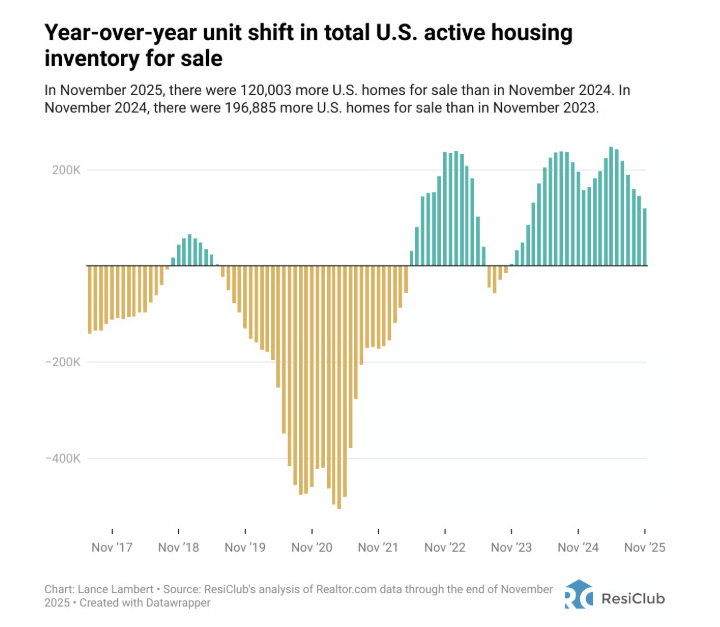

Housing inventory is growing, but at a slower pace

Source: ResiClub

National inventory of for-sale listings is rising year-over-year, but the pace of growth has slowed in recent months. According to ResiClub, inventory rose 12.6% between November 2024 and November 2025, down sharply from the 26.1% growth over the same period in the prior year.

The slowdown is visible in raw unit terms as well. Net inventory increased by 196,885 homes in November 2024 versus 120,003 homes in November 2025, confirming the deceleration is not just a percentage “denominator effect.”

Here are other key takeaways from the report:

Days on market are stabilizing: Homes are no longer lingering at the same pace as earlier in the cycle, reducing upward pressure on active listings.

More sellers are pulling listings: Some sellers, particularly in weaker regions, are pulling listings rather than cutting prices.

Absorption has modestly improved: Existing-home sales have edged up from multiyear lows, slightly offsetting slower inventory growth.

Market softening has slowed, not reversed: National home price growth is hovering around ~1% YoY, below income growth and consistent with market stabilization.

Regional differences remain stark: Midwest and Northeast markets continue to see modest gains, while parts of the Southwest and Southeast remain under mild price pressure.

Our take

The housing market is stabilizing. We’re seeing slower inventory growth, not because of a surge in demand, but because homes are selling at a more predictable pace, hesitant sellers are pulling their homes off the market, and buyer activity is showing modest improvements. But as the data keeps telling us, there are big differences between regional markets. That’s shaping up to be the story of 2026. Pricing power will depend less on national trends and more on local supply discipline and buyer depth. We’ll be keeping a watchful eye on softer markets, like Southwest Florida, to see if sellers put homes back on the market after delisting them. That will be a telling sign as the spring season rolls around, as it will help us determine the next phase of inventory trends.

Two-thirds of real estate investors are looking to buy

Source: Unsplash

68% of single-family rental investors say they’re very likely (51%) or somewhat likely (17%) to buy another investment property in the next 12 months. That’s according to the latest survey of single-family rental investors conducted by ResiClub and LendingOne. These are their key findings.

Investor activity remains resilient: 38% of single-family rental investors expect to increase investment activity in 2026, while a majority (52%) plan to maintain current levels; just 9% expect to pull back.

Portfolio churn is increasing: 43% expect to sell at least one existing property over the next year, signaling more active portfolio management rather than broad exits.

Costs are squeezing cash flow: 88% report that rising home insurance premiums negatively impacted cash flow in 2025.

Rent growth is modest but widespread: 74% plan to raise rents in 2026, with most increases expected in the +1% to +3% range.

Rate expectations are improving: Only 11% expect mortgage rates above 6.5% in the next 12 months, down sharply from 57% in mid-2025.

Our take

This tells us that single-family rental investors aren’t pulling back; they’re recalibrating and becoming more selective. Overall, their interest in buying remains strong, even as more investors plan to sell underperforming assets and manage rising costs, particularly insurance costs. Agents, take note! Investors are likely to be a major source of transactions next year. Those who can bring well-priced opportunities, credible underwriting, and clear cash-flow narratives will be best positioned to broker deals.

Markets with the most million-dollar listings

Source: Unsplash

There are over 1 million homes for sale in the country, and at least 10% of those listings are selling for $1 million or more. Demand for high-end homes remains strong despite higher inventory. Luxury properties are selling faster year over year, narrowing the gap with typical listings.

According to Realtor.com, markets such as New York, LA, and Miami now treat seven-figure prices as the norm. This is due to sustained demand, limited land, strong amenities, and proximity to economic hubs.

Here are the top 10 metros with the most million-dollar listings:

Our take

In major metros, million-dollar homes are the new baseline. In markets like New York, Los Angeles, and Miami, seven-figure prices are “entry-level” territory. With luxury homes selling faster even as inventory rises, this shows us that this is simply the new normal for these markets. In 2025, the luxury sector was doing its part to buoy housing sales, and we expect the same in 2026.

Schematics

The news that just missed the cut

Source: Unsplash

Google enters the portal wars with MLS listings in select cities

How agents are using webinars to generate large commissions

How to get Google to recommend you as the top agent in your city

LA’s megamansion returns to the market with a $42 million price cut

Foundation Plans

Advice from James and David to win the day

At the start of every year, many new agents join the ranks of our profession. If you’re one of them, the next big decision is determining what brokerage to join. Today, we’d like to go over some key questions you need to answer before choosing a firm.

Does the brokerage provide buyer or seller leads? – This one is huge because it's how you get clients and close deals. Brokerages that provide leads are a major asset to new agents, so take the time to learn more about how each brokerage provides leads for you.

What is the company culture? – Whether you're working out of the brokerage's office or working remotely, you definitely want a good fit. You’re going to be spending countless hours each day with these people. Make sure the company fits your values and their expectations match yours, especially when it comes to the day-to-day and week-to-week workload.

What are the financial details? – Make sure you know EXACTLY how you get paid and how the split structure works. Also know EXACTLY what your financial obligations are to the firm. Don’t get caught off-guard. You’ve got to negotiate for yourself just like you would for a client. Each brokerage will have different policies on commissions, referral fees, and covered expenses, so ask about these. Write down the specifics for each brokerage so you can compare notes later and choose the best one for your goals.

What we have given you is just a start. Here are two excellent, comprehensive guides to use when making your decision. Drop us a line if you have more questions. Not only do we want to hear from you, but we also want to be a resource you can trust.

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“You are what your deepest desire is. As is your desire, so is your intention. As is your intention, so is your will. As is your will, so is your deed. As is your deed, so is your destiny.” — Upanishads

Mind your intentions, friends. What you focus on determines how you act, and how you act determines where you end up. Be deliberate with your goals, disciplined in your execution, and patient with the results. Over time, intention compounds into opportunity – and ultimately, your life.

- James and David