- The Blueprint

- Posts

- The House passes major bipartisan housing bill

The House passes major bipartisan housing bill

Plus, metros where homes are taking the longest to sell

A ray of light

Since we started this newsletter, we’ve been hammering one simple point: if you want to fix housing affordability, you have to build more homes. For the first time in a long time, it looks like lawmakers are finally getting that message.

As we’ll break down in today’s edition, House lawmakers passed a bill that cuts through red tape, lowers construction costs, and meaningfully incentivizes new housing supply – all on a massive bipartisan basis.

We didn’t expect this, and frankly, we weren’t sure we’d ever see it. But this bill signals a real shift toward faster building, smarter regulation, and policies that actually move the needle.

So, without any further ado, let’s jump into today’s Blueprint.

- David

The House passes a major bill to boost home construction

Source: Unsplash

The U.S. House of Representatives on Monday passed a major bill aimed at increasing housing affordability by giving builders and local governments incentives to boost construction by reducing regulations around home construction. Here are the key takeaways to know:

Rare bipartisan agreement

The bill passed the U.S. House of Representatives by a 390–9 vote, with a separate Senate housing package already approved, increasing the odds of a final bill reaching the White House this year.

Supply is the central problem

Lawmakers agree that high prices stem from chronic underbuilding.

The U.S. faces a 4 million–home shortage, and closing the gap could take nearly a decade, even with reform.

Cutting costs by reducing regulation

State and local rules can account for up to 25% of construction costs.

The bill promotes faster permitting, streamlined zoning, pre-approved designs, and clearer federal best practices.

Manufactured housing and local lending

Updates to manufactured and modular housing rules aim to speed delivery and lower costs.

Community banks get regulatory relief to expand mortgage lending, reflecting their key role in financing new homes.

Broad industry backing, but limits remain

About 70 housing and real estate organizations support the bill.

Lawmakers caution that regulatory reform alone won’t be enough without sustained funding, and the bill does not address proposals to restrict large investors from buying homes.

My take

This is a huge step in the right direction. For the first time that we’ve seen, lawmakers are acknowledging that addressing supply is the primary way we’re going to tackle our housing affordability crisis. This bill is genuinely supply-focused and, shockingly, built on a rare foundation of bipartisan agreement. It won’t solve affordability overnight, but it signals a clear shift toward faster building, faster permitting, streamlined zoning, pre-approved designs, and clearer federal best practices. With roughly 70 housing and real estate organizations supporting it, this is the most credible federal push we’ve seen in years to work our way out of the current housing shortage.

Markets seeing the sharpest home price declines

Source: Unsplash

In December 2025, home prices rose just 0.9% year over year, one of the softest growth rates since the post–Great Recession recovery, according to new research from Cotality.

While prices are still rising nationally, many local markets are already in decline, with the South and West bearing the brunt of the correction.

These regions account for the largest drops in Cotality’s Home Price Index (HPI), which flags markets at higher risk of downturns by analyzing 45 years of home price trends using proprietary statistical models.

Here are the top 5 metros and states seeing the steepest declines in home prices:

Metros | States |

My take

Price growth hasn’t collapsed nationally, but the cracks are clearly forming at the local level. Markets that saw the fastest pandemic-era run-ups – especially across the South and West – are now correcting as inventory rises and demand cools. This isn’t a crash; it’s leverage shifting back toward buyers and discipline being forced back into pricing

Metros where homes are taking the longest to sell

Source: Redfin

In December, the typical U.S. home went under contract in 60 days, up from 54 days a year earlier. In Austin, that figure stretched to 106 days. According to Redfin, that’s the slowest December on record going back to 2012, and the slowest pace among the 50 largest U.S. metros.

Here are the top 5 markets where homes are lingering the most and least number of days on market before going under contract:

The Most | The Least |

My take

Think of this data as a playbook, and part of your job as an agent now is to teach clients how to read it. In markets like Austin, time isn’t working against buyers anymore; it’s working for them. Buyers can slow down, look at multiple homes, and negotiate with confidence, and agents should be coaching them to do exactly that. On the listing side, these numbers are your proof point. Longer days on market don’t mean something’s wrong with the house—they’re just how this market works. Use the data to reset expectations early, price realistically, leave room for concessions, and explain why a price adjustment can be a smart move, not a panic move. The agents who stand out right now are the ones who help clients understand what’s changed and how to navigate it calmly.

Schematics

The news that just missed the cut

Source: Unsplash

Foundation Plans

Advice from David to win the day

As part of our ongoing series on lead generation, we want to focus on webinars in today’s edition. They can do a lot to help agents build trust and authority with their clients by showcasing their knowledge and expertise. Today, we explain the benefits of using webinars as part of your marketing strategy.

1. Establish Authority Through Education – Webinars allow agents to share insights on home buying, selling, financing, or market trends in a professional format. Attendees are more likely to reach out for personal advice when they see the agent as a reliable expert. Over time, this creates a reputation that extends beyond the single event and strengthens long-term brand recognition.

2. Engage a Wider Audience – Unlike in-person events, webinars remove geographic and scheduling barriers, enabling agents to reach clients across the city or even the country. A recorded session can be repurposed for future marketing campaigns, posted on social media, or emailed to prospects. This multiplies the agent’s exposure far beyond the live event itself. A single well-executed webinar can deliver ongoing value through replays and follow-up communications.

3. Generate and Nurture Leads – Hosting a webinar naturally requires registration, which provides agents with valuable contact information. This creates a warm lead pool of individuals who have already signaled interest in real estate topics. Follow-up emails, personalized outreach, and additional resources can nurture these leads into clients. Because the initial interaction was educational, prospects are more likely to respond positively and view the agent as a trusted guide.

4. Differentiate from the Competition – Many agents rely heavily on open houses, postcards, or cold calls—strategies that often blend together in the eyes of consumers. Webinars provide a fresh, modern way to stand out by showing initiative and digital savvy. Agents who regularly host high-quality webinars demonstrate adaptability in a changing market, which appeals to younger, tech-friendly buyers and sellers. This differentiation helps agents remain top of mind when clients are ready to act.

One of the best agents who uses webinars to generate over a million in CGI every year is Bradley Pounds. We encourage you to take a look at how he integrates webinars into his overall marketing strategy.

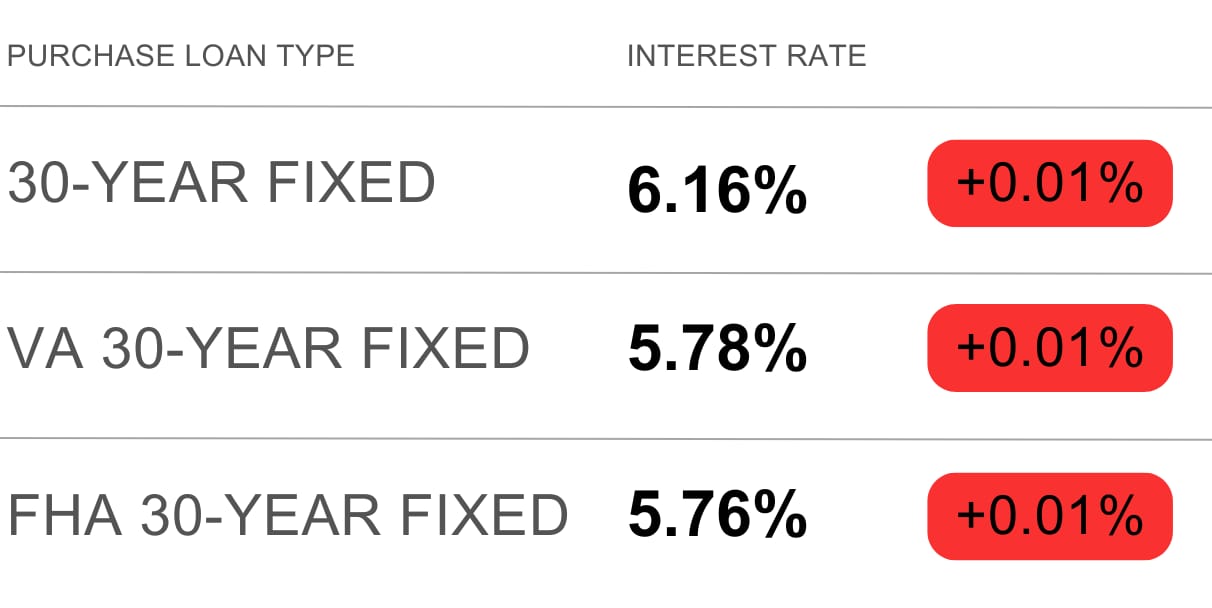

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

Success in life comes from first taking ownership of your life and choices. Take action to become who you want to be. Nobody else can do it for you.

Have a great week, friends, and we’ll see you here on Friday!

- David