- The Blueprint

- Posts

- New study shows cost of listing off-MLS

New study shows cost of listing off-MLS

Plus, where investors are spending BIG

Seeing both sides

Our goal with this newsletter has always been to report on different approaches to the market, even if we don’t wholly agree with them!

We think that’s what’s fair to all our readers. We give you a broad look at every side of our business, and then we give you our take on whether we agree or disagree.

In our second story, we do just that. We highlight a recent study about the cost of sellers listing off-MLS. While we believe sellers should have the freedom to list off-MLS, we still wanted to bring this report to your attention.

With that, let’s get into all the stories we’ve collected for this Friday edition of The Blueprint!

- James and David

Pending home sales have barely moved

Pending home sales ticked up 0.7% year-over-year during the four weeks ending November 2nd, marking the smallest increase in four months. Even though mortgage rates have dipped to their lowest level in a year, many house hunters remain cautious amid economic uncertainty and rising prices. The result is a sluggish market reminiscent of pre-pandemic conditions, with homes taking longer to sell and sellers adjusting expectations. Here’s what to know.

Buyers are hesitant despite affordability improvements – The median monthly payment fell 2.1% from a year ago to $2,508, yet buyers aren’t rushing in. Economic uncertainty and fears over job stability have kept many on the sidelines, extending search times and stalling offers.

Home prices and supply show gradual growth – The median sale price climbed 2% to $392,375, its largest increase in six months, while new listings rose 4% YoY. With 4.7 months of supply, the market is nearing balance, suggesting modest but steady inventory recovery.

Regional performance remains uneven – Detroit (+11.6%) and Newark (+9.8%) led price gains, while Dallas (-3.3%) and Jacksonville (-3.5%) saw declines. Florida metros such as West Palm Beach and Tampa outpaced others in pending sales, underscoring how local dynamics still drive national averages.

Our take

Buyers aren’t disappearing, they’re just being very cautious. Lower mortgage rates and softer payments haven’t been enough to offset worries about prices, jobs, and the broader economy. The market’s inching toward balance, but confidence hasn’t caught up yet. Until it does, this type of stagnation will remain common.

Off-MLS transactions cost sellers thousands of dollars

Source: Unsplash

A new study from the San Francisco Association of Realtors and RealReports finds that homes listed on the MLS sell for nearly 19% more than those sold privately. The report, which covers data from 2022 through 2024, provides a rigorous, numbers-driven comparison of MLS versus off-market performance. Here are its key findings:

Public listings command higher prices – The study found that MLS-listed homes sold for about $302,000 more on average than off-market sales, representing an 18.6% advantage. With San Francisco’s median home price around $1.4 million, this gap equates to hundreds of thousands of dollars in potential lost value for sellers who choose private deals.

MLS participation is rising despite private-listing pushes – Even as overall listings declined, the share of homes marketed through the MLS climbed from 79.8% in 2022 to 83.2% in 2024. This shift suggests that agents are regaining confidence in the open market and seeing it as the most effective way to achieve full value and fair competition.

Transparency strengthens market integrity – Researchers and industry leaders argue that off-MLS transactions undermine appraisals, distort housing data, and reduce public trust. By contrast, MLS participation ensures consistent data standards and repeatable outcomes, reinforcing confidence across the entire housing ecosystem.

Exposure is emerging as a survival strategy – With lawsuits, commission uncertainty, and ongoing consolidation reshaping the brokerage industry, broad market exposure is increasingly seen as leverage. In San Francisco’s high-stakes market, the evidence is clear: transparency and open marketing don’t just protect the system, they maximize returns for sellers.

Our take

As we said up top, our goal with this newsletter is to show all approaches to the business, not just the ones we prefer! While we are proponents of sellers having the freedom to list off-MLS, we still thought this story was worth your attention. It is the most comprehensive report we have seen on the subject. Its key finding is clear: sellers who transact off-MLS are consistently leaving money on the table. Transparency, it seems, isn’t just ethical, it’s also profitable and powerful.

Where investors are paying top dollar

Source: Unsplash

In Q2 2025, investors continued to outspend typical buyers in several states, especially across the West and along the coasts. According to Realtor.com’s latest update, investors paid up to 35% more than the median sale price.

Despite a national slowdown, investor activity held firm, giving them a stronger position in tighter markets. While total home sales fell 4.2% year over year, investor purchases declined only 2.7%, underscoring their resilience in a cooling market.

Investors are shaping prices from both ends of the spectrum – paying premiums in high-demand metros while scooping up discounted homes in more affordable regions. In the top-tier markets, many are targeting luxury listings, short-term rentals, and high-end renovations, often driving closing prices well above the local median.

Here are the top 5 states and large metros where investors paid above the median price:

States | Large Metros |

Our take

This has been a recurring theme this year – investor activity continuing on a different track than the broader market. By outbidding traditional buyers and paying premiums in already expensive metros, investors are signaling confidence in both rent growth and long-term appreciation. These purchases, despite steep entry costs, underscore a belief that strong urban economies and persistent affordability barriers will sustain demand. In effect, investors are betting that scarcity itself will continue to drive value.

When we decided to join Million Dollar Listing, it was all about reach. We knew the kind of clients TV exposure could bring. Today, social media has that same power. That’s why our partners at Estate Media created the Agent Growth Program specifically for agents and brokerages who want to elevate their social presence to the next level. You film in short sessions, and their team handles everything else: scripting, editing, posting, and performance tracking. The Blueprint readers get a free social media audit.

Schematics

The news that just missed the cuts

Source: Unsplash

88% of buyers rely on agents, not AI

Use this to close more deals without being pushy

A potential teardown in Palm Beach hits the market for $185M

How the Utah governor’s zoning idea could impact housing

Business planning masterclass w/Sharran Srivatsaa, former Real Brokerage President

Foundation Plans

Advice from James and David to win the day

In real estate, it’s easy to be a “one-hit wonder” – a one-deal-and-done kind of agent – especially when you’re starting out. But a real estate career isn’t built on one big sale. It’s built on consistency–daily effort, follow-up, and building genuine relationships.

We discussed this in an episode of Rise Above the Ranks, if you’d like to hear more.

If you’d prefer a quick run-thru, here’s a breakdown of our key pillars to building consistent success:

1. Consistency builds the pipeline – Success in real estate comes down to showing up – every day. Whether it’s cold calling, hosting open houses, or networking, consistency compounds. Agents who treat every effort as part of a long-term system, rather than a one-off task, end up with a steady stream of clients instead of just one lucky deal.

2. Relationships over transactions – The best prospecting doesn’t feel like selling; it feels like helping. Checking in with past clients, friends, and contacts builds trust and keeps you top of mind when opportunity strikes. People work with those they like and remember, and genuine outreach always outperforms scripted pitches.

3. Mindset is everything – Too many agents approach prospecting with anxiety or avoidance. Shift your focus from “I have to sell” to “I get to help.” That single change in mindset turns calls into conversations and builds confidence over time—because service, not desperation, is what clients respond to.

4. Combine preparation with authenticity – Every great call starts with preparation and ends with authenticity. Know your market stats, recent sales, and neighborhood trends so you can offer real value—but deliver it in your own voice, not a script. Clients don’t want rehearsed lines; they want confidence, enthusiasm, and honesty—and when you pair knowledge with genuine energy, people can feel it.

Remember: the agents who win aren’t the loudest – they’re the ones who keep calling, caring, and showing up long after everyone else stops!

Just in Case

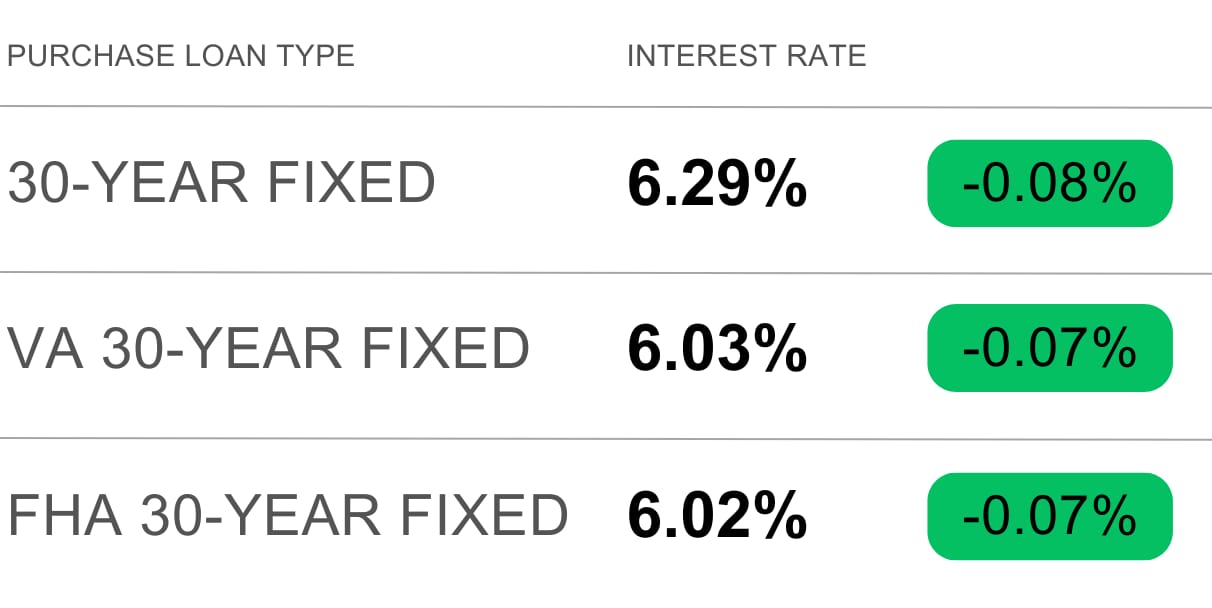

Keep the latest industry data in your back pocket with today’s mortgage rates:

When it comes to closing deals, finding clients, negotiating sales, and marketing yourself, what are your biggest hangups and holdups? We want to know! Drop us a line anytime. We want to hear from you.

Have a wonderful weekend, friends. Thanks for reading, and we’ll see you back here on Tuesday!

- James and David