- The Blueprint

- Posts

- New-home sales beat expectations

New-home sales beat expectations

Plus, metros with biggest shifts in buying power

Raising your game

Our goal with this newsletter has always been to help agents be the best versions of themselves.

We believe we now have the best solution out there: our Agent Growth Program, which we developed with our partners at Estate Media.

This is our signature content and strategy service designed to turn top agents into standout personal brands. We help you build your entire digital portfolio, showing up consistently with short-form video content that not only looks good, but drives engagement and grows your business.

We guide you in building your brand, helping you discover your unique voice and then creating content that feels authentic to you. It’s that touch of personalization that will help you stand out in the market.

If you want to elevate your entire brand and business, explore more about this terrific program here!

With that, let’s take a look at today’s Blueprint!

- James and David

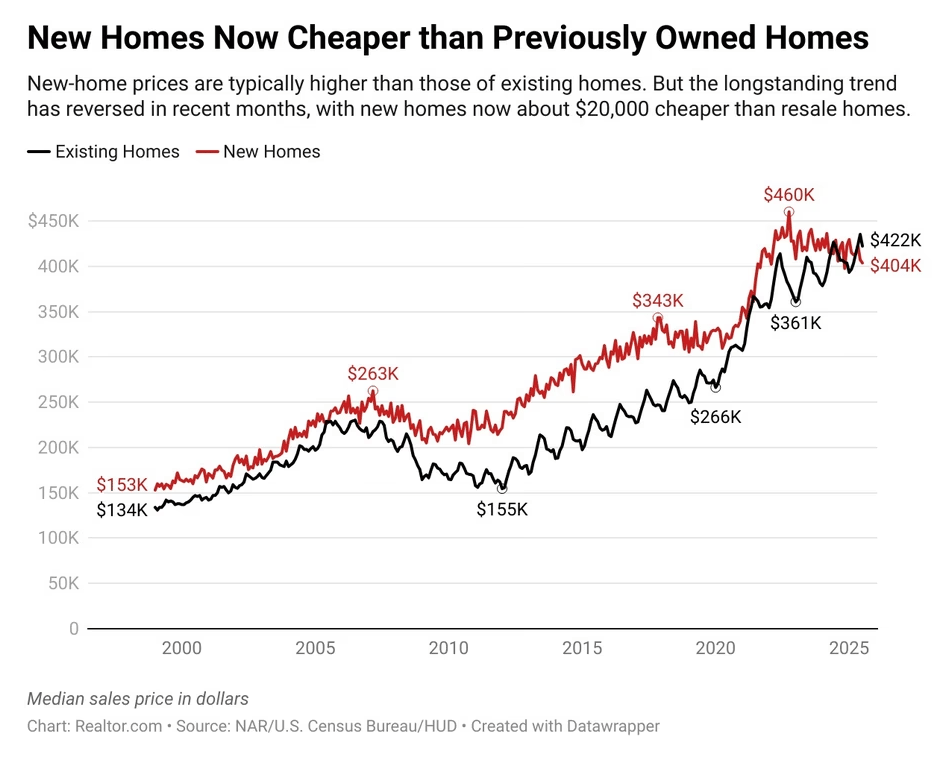

New-home sales slip, but beat forecasts

Source: Realtor.com

In July, signed contracts for new single-family homes came in at a seasonally-adjusted annual rate of 652,000. While that’s down 8.2% from a year ago, it’s ahead of economists’ projections of 630,000, according to the Census Bureau. Here are the other key takeaways:

Prices: In July, the median sales price of a new home fell nearly 6% year-over-year to $403,800, the lowest July figure since 2021.

Price gap: For the fourth month in a row, new homes sold for less than existing homes in July. The gap is about $20,000.

Incentives: 66% of builders used sales incentives, the highest share since the pandemic. Price cuts remain common, with 37% of builders reducing prices in August (average discount: 5%)

Inventory: New-home supply for July stood at 499,000 units, up 7.3% YoY

Regional shifts: Sales rose 11.7% in the West, but fell in the South and Midwest.

Our take

Even with a slew of discounts and incentives, new-home sales remain sluggish. While builders are more flexible on price than individual sellers, the real constraint is demand. Affordability pressures, high mortgage costs, and growing resale inventory are pulling buyers toward existing homes. That rare dynamic of existing homes selling above new homes underscores how much leverage buyers now have. However, so far, they’re not rushing to take advantage.

Metros with biggest shifts in buying power

Source: Unsplash

A new Realtor.com report finds that while wages are up 15.7% since 2019, the maximum affordable home price for a median-income household has dropped to $298,000, nearly $30,000 less than five years ago. At the same time, the median home price has climbed to $439,450.

That combination of shrinking buying power and higher prices meant that just 28% of homes for sale were affordable for the typical U.S. household in July. Nonetheless, some markets have actually seen improvements in buying power.

Here are the markets where buying power has fallen or risen the most, based on percentage changes in max affordability:

Risen | Fallen |

Our take

Affordability is getting hit from both sides: prices keep rising while borrowing power lags wage growth. For agents, this explains why clients feel squeezed. Use this data to reset expectations, highlight which markets are gaining or losing ground, and explain why buyers may need to make some trade-offs. Until rates drop or supply increases, many will either have to stretch their budgets or wait on the sidelines.

Markets where home prices are falling

Source: Unsplash

Between July 2024 and July 2025, home prices fell year-over-year in 35% (105 of 300) of the nation’s largest housing market. That’s the highest percentage of markets with falling home prices to date, according to the Zillow Home Value Index reading published this week via ResiClub.

The divide is regional. Prices are still appreciating in Northeast and Midwest markets with tight inventory, while prices are declining in Sun Belt states where listings now exceed pre-pandemic 2019 levels (Arizona, Texas, Florida, Colorado, and Louisiana).

Here are the top 10 major metros where home prices have fallen the most year-over-year:

Our take

Don’t let the stats fool you. While more markets are posting price declines, the majority — 195 of 300 — still show year-over-year gains. As shown up top, the key dynamic is inventory. This is why we encourage you to keep a close eye on inventory levels in your local markets. That’s the best indicator of where prices are headed.

Schematics

The news that just missed the cut

Source: Unsplash

The listing tool that turns features into offers

Share this with clients who are giving real estate to their kids

New trend: More homebuyers are pushing for sleepovers before buying a property

How to generate, nurture, and convert leads in real estate

Meet the ‘elite’ buyers who can buy a house today

Foundation Plans

Advice from James and David to win the day

While it’s important to generate leads from expired listings, withdrawn listings can be just as promising, and there are lots of them in our current market.

A withdrawn listing usually signals a motivated seller who still wants to sell, but pulled back due to timing, pricing, or frustration with their prior agent. These homeowners may be more open to a fresh strategy and a proactive agent who can show them a better path forward.

Here are steps you can take to turn withdrawn listings into valuable new leads.

1. Research the “why” behind the withdrawal – Before reaching out, dig into why the home was pulled off the market. Was it overpriced, poorly marketed, or simply a case of seller fatigue? Knowing the cause helps you tailor your approach and demonstrate empathy. When you contact the seller, acknowledge their situation and show that you understand why things didn’t work the first time.

2. Reframe the opportunity for the seller – Most withdrawn sellers are discouraged, not uninterested. Your job is to show them how market conditions, pricing adjustments, or improved marketing could lead to a different outcome. Reframe their perspective. Show them that the first listing attempt was a learning process, not a failure. This positive, solutions-focused approach might help them forget about that last attempt and try again.

3. Offer a concrete, customized plan – Don’t just promise “better marketing.” Spell out what you’ll do differently. Share a quick snapshot of how you’d reposition their home, from staging tweaks to digital advertising to pricing strategy. Provide examples of homes you’ve successfully sold after a failed first listing. Those specifics give the seller tangible reasons to meet with you.

4. Time your outreach strategically – Withdrawn sellers often need a cooling-off period before they’re ready to re-engage. Track these leads and follow up at smart intervals, such as after 30–60 days, or when market activity picks up in their area. Consistent, thoughtful touches — a market update, a handwritten note, or a quick call — keep you top of mind. When they’re ready to try again, you’ll be the agent they think of first.

Bottom Line: Withdrawn listings aren’t dead ends; they’re opportunities waiting for the right approach. By showing empathy, offering a fresh strategy, and following up consistently, you can turn discouraged sellers into your most loyal clients.

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.” — Charlie Munger

Heed Charlie Munger’s words, friends. You don’t need to be perfect—just a little better than yesterday. If you stumble, get back up and keep going. Learn from your mistakes, but don’t let them define you.

Have a great week, friends. We’ll see you on Friday!

- James and David