- The Blueprint

- Posts

- New data shows NAR rules impact on commissions

New data shows NAR rules impact on commissions

Plus, Zillow makes its forecast for 2026

Panic vs Patience

When big changes happen in our business, there is always panic about what could go wrong. We understand why. Our industry is always evolving, and new rules or policies can have a huge impact on our day-to-day.

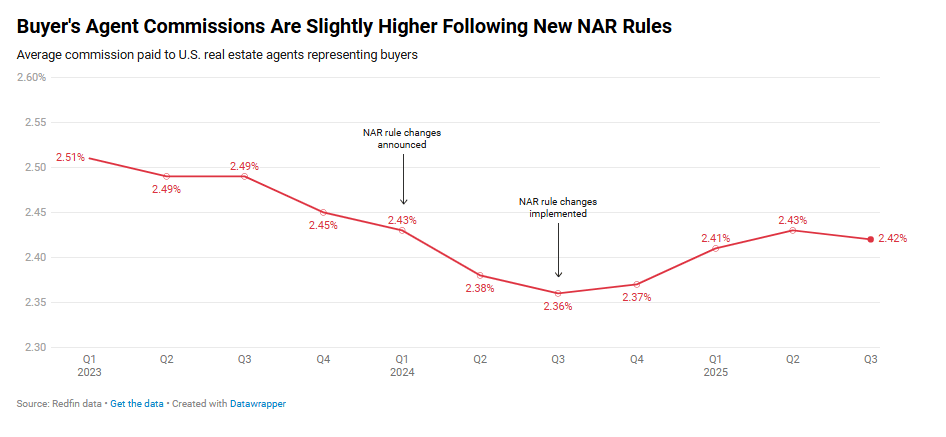

In August of last year, we saw this happen when the NAR put its new rules into effect. Many agents and experts worried that this would have a huge impact on our business, especially in terms of buyer agent commissions.

At the time, we said not to panic, and that agents would not be forced to reduce their compensation.

Well, we’re now a year into these changes and – we don’t want to toot our own horn – but we were right. The latest data shows that these commissions haven’t gone down. In fact, they’ve gone up!

That’s why we started this newsletter. We wanted to help agents separate between panic mode and patience mode. We think, in this business, it’s usually best to take a wait-and-see approach.

On that note, the wait is over. Here’s what we have for you to see in today’s edition of The Blueprint!

- James and David

Zillow’s forecast for next year

Source: Unsplash

Zillow expects home values to increase 1.2% in 2026, with the number of major markets posting annual price drops falling to 12, down from 24 this past October. The shift signals growing price stability, giving homeowners more confidence in building equity. Here’s what else Zillow forecasts for next year:

Affordability will improve despite mortgage rate firmness – Zillow predicts mortgage rates won’t dip below 6%, but purchasing power will improve due to easing inflation and aligning wages. Even without big rate cuts, more buyers should be able to qualify and move forward.

Existing home sales will increase – Zillow projects that existing home sales will reach 4.26 million in 2026, a 4.3% increase YOY and still above historical norms. Expect a more active spring season as more homeowners make moves they’ve delayed for years.

Homebuilding will slow down – Single-family housing starts are on track for their slowest year since 2019 as builders work through existing inventory. Incentives like rate buydowns are likely to remain, keeping new construction competitive with resale options.

Renting will become a stronger lifestyle choice – Apartment rents are expected to rise only 0.3%, pushing rent burdens to their lowest point since 2021. With nearly 3 in 5 renters – many of them being families – choosing to keep renting, the rental market will shift from a “temporary stopgap” to a long-term housing strategy.

Our take

If Zillow is right, then the 2026 market won’t deliver fireworks, but it will deliver momentum. Buyers and sellers can finally act, instead of waiting. We can expect stable prices, modestly improving affordability, and rising sales. For agents, this is a year of growing opportunities. They won’t come all at once, but will steadily grow throughout the next year. Be ready for the spring season, which should be more active and lively than last year’s.

Buyer agent commissions have increased

Source: Unsplash

The average U.S. buyer’s agent commission was 2.42% for homes sold in the third quarter, up from 2.36% when the new NAR rules went into effect in August 2024. That’s according to Redfin’s latest report. Here are other key takeaways from the update:

Commissions have stabilized since the new rule rollout – Rates today match levels seen when the NAR announced its settlement in early 2024, showing that the rule changes have not meaningfully reduced buyer-agent compensation. In a slower market, sellers still offer competitive commissions to attract demand buyers.

A cooler market has boosted buyers’ negotiating power – Longer listing times and fewer competing offers give buyers more leverage to request higher representation, and sellers are often willing to accommodate since they may have only one serious buyer.

Homes under $500,000 carry the highest commissions at 2.52% – This price tier continues to post the strongest rates since late 2023, driven by first-time buyers who rely more heavily on agent guidance, keeping commissions firm.

Commission rates were mostly flat across price tiers – Mid-priced homes dipped slightly to 2.32%, while $1M+ homes nudged up to 2.22%. Year over year, shifts were minimal, reinforcing a stable commission landscape despite the rule changes.

Our take

As we said up top, we don’t want to toot our horn, but we saw this coming! Even before the NAR rules kicked in, we said that the NAR settlement neither forces agents to reduce their compensation nor precludes the cooperation compensation model from being effective. And now, look at what’s happening. Contrary to all the hubbub on social media last year, commissions haven’t collapsed or meaningfully shifted downward since the new rules went into effect. Market conditions – not regulations – remain the biggest driver of compensation trends. In a slower housing cycle, buyer’s agents continue to maintain modest pricing power. This just goes to show that, usually, the best way to handle panic is with a little patience.

Real estate investment barely moved in Q3

Source: Unsplash

Investor activity remained muted in Q3 2025, with purchases rising just 1% year over year and investors maintaining a steady 17% share of all home sales. This comes as profits tightened and more offloaded homes sold at a loss.

According to Redfin, returns were soft due to high prices, elevated rates, slowing rent growth, and rising vacancies. This pushed condo purchases to near decade lows, holding overall activity flat even as long-term buyers stepped in for discounted deals.

Investors shifted toward high-priced homes (+3%) while pulling back from mid-priced ones, and condo buying dipped 1% amid surging HOA fees, climate-risk concerns, and stricter rental rules.

Here are the top 5 markets where investor purchases increased and decreased the most in Q3:

Increased | Decreased |

Our take

Yes, investor activity isn’t exactly on fire, but it’s not ice cold either. Investors are simply being more selective as a result of thinner profits, higher costs. Also, if we look at the overall picture, there’s not a lot of movement, but there are sharp differences at the regional level. In some areas, capital is still moving. It just depends on whether the numbers work in that region. Basically, investors are shifting strategies, not stepping away.

Schematics

The news that just missed the cut

How much of America’s housing is owned by corporations

In a surprise move, real estate billionaire Donald Bren is leaving San Diego

Serhant’s advice on what agents should do to guide their clients

Foundation Plans

Advice from James and David to win the day

We agree with the forecasts we’re seeing: next year is shaping up to be better for sellers, agents, and especially, buyers. More deals will get done in 2026. To hit the ground running next year, it’s important to fully understand the expectations of your buyer clients.

Today, we’re going to focus on four important expectations from your buyer clients. This will help you come prepared to handle (almost) any question they throw your way.

Know every listing in your market cold – Clients expect you to be well-versed in the local market, beyond just new listings. Familiarize yourself with square footage, room counts, and property details for every home in the area. Your clients are likely looking at listings daily. Don’t let them know more than you. Analyze the MLS hot sheet daily to stay current on new listings, properties sold, price points, and reductions. Just 10-15 minutes a day will make sure you’re on point for the whole year.

Make sure your buyers know what they can afford – Even if they don’t go into detail about their finances, buyers will expect you to know exactly what’s in their price range. Make sure they are working with a reputable lender and that they understand how changing mortgage rates affects their monthly payments. Above all, keep them realistic! Make sure they understand every single cost that comes with homeownership so it’s not an unwelcome surprise later.

Separate between what your clients want and need – Buyers have must-haves, needs, and wants, but they usually can live without a few of them. Ask specific questions to understand their preferences and motivations, and see where they can bend a little. For instance, if they need four bedrooms for a home office, would a three-bedroom option work? Would another type of room work for an office? Do they really need to work at home? Addressing their 'whys' narrows down their options and helps you focus on finding the exact right home.

Be an expert on negotiating – While your clients might not be aware of all the behind-the-scenes work, they know negotiating is a crucial part of your role. Whether it's the sale price or home inspection, ensure you have the skills to benefit your client. Stay connected with fellow agents to learn effective strategies in the current market. Continuously educate yourself, practice negotiation skills, and watch your business thrive. We strongly recommend that you role-play with your mentors and trusted agent-confidantes.

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Unsplash

“The distance between dreams and reality is called discipline.” — Paulo Coelho

Strive to make your dreams come true, friends. Your dreams become a reality not when you ruminate or talk about them but when you take consistent action. Plan with intention, choose with clarity, but don’t let analysis turn into paralysis. Have a bias towards action.

Have a great week! We’ll see you back here on Friday.

- James and David