- The Blueprint

- Posts

- New data shows jump in mortgage applications

New data shows jump in mortgage applications

Plus, FSBO home sales hit record low

Navigating a complicated market

If you’re feeling like the current market is difficult to navigate, you’re not the only one.

In today’s edition, we discuss why the market is full of contradictions. Buyers sending mixed signals. Data pointing in different directions. Areas where activity is rising, and areas where it hasn’t budged one bit.

We’ll give you our take on how to strategically approach your day-to-day business in these rather complicated times.

But while it’s always crucial to focus on your business, we feel we could always use a little perspective to keep us grounded. In today’s Foundation Plans, we discuss the importance of staying balanced, as we think that is truly the key for success in our industry.

With that, let’s dig into today’s Blueprint!

- James and David

Mortgage applications surge unexpectedly

Mortgage purchase applications rose 6% last week – putting them up 31% year-over-year – a surprising boost given the seasonal slowdown and slight rate increase. Buyers are responding to improved inventory and slower price growth in many markets, prompting more active searching even as costs remain high. That’s according to the latest update from the Mortgage Bankers Association. Here are the trends they report:

Rates still remain lower than last year – Despite the recent uptick from 6.31% to 6.34%, mortgage rates are still 52 basis points lower than a year ago. The small increase didn’t deter buyers, suggesting that marginal rate movements matter less than broader affordability pressures like inventory and pricing trends.

Refinance activity dips, but remains much higher than last year – Refi applications fell 3% week over week as higher rates discouraged some borrowers, particularly in conventional and VA loan categories. Even so, overall refi volume is still up 147% from the same week last year, supported by rates that remain significantly below 2024 levels.

Economic developments could shift rate expectations – With little rate movement early this week, and the closure of the bond market for Veterans Day, investors are watching the possible end of the government shutdown for clues. Any resolution—or further instability—could influence interest rates and shape buyer behavior heading into the year’s end.

Our take

The jump in mortgage applications is a genuinely positive signal. But it doesn’t tell the whole story. Data still shows buyers are hesitant, pending sales are slipping, and homes are taking longer to go under contract. That is the market right now–defined by contradictions. There are pockets of renewed activity, but overall, a general sense of caution. For agents, the message isn’t that demand is roaring back; it’s that those active buyers are serious, selective, and responding to very specific conditions.

FSBO home sales fall to record low

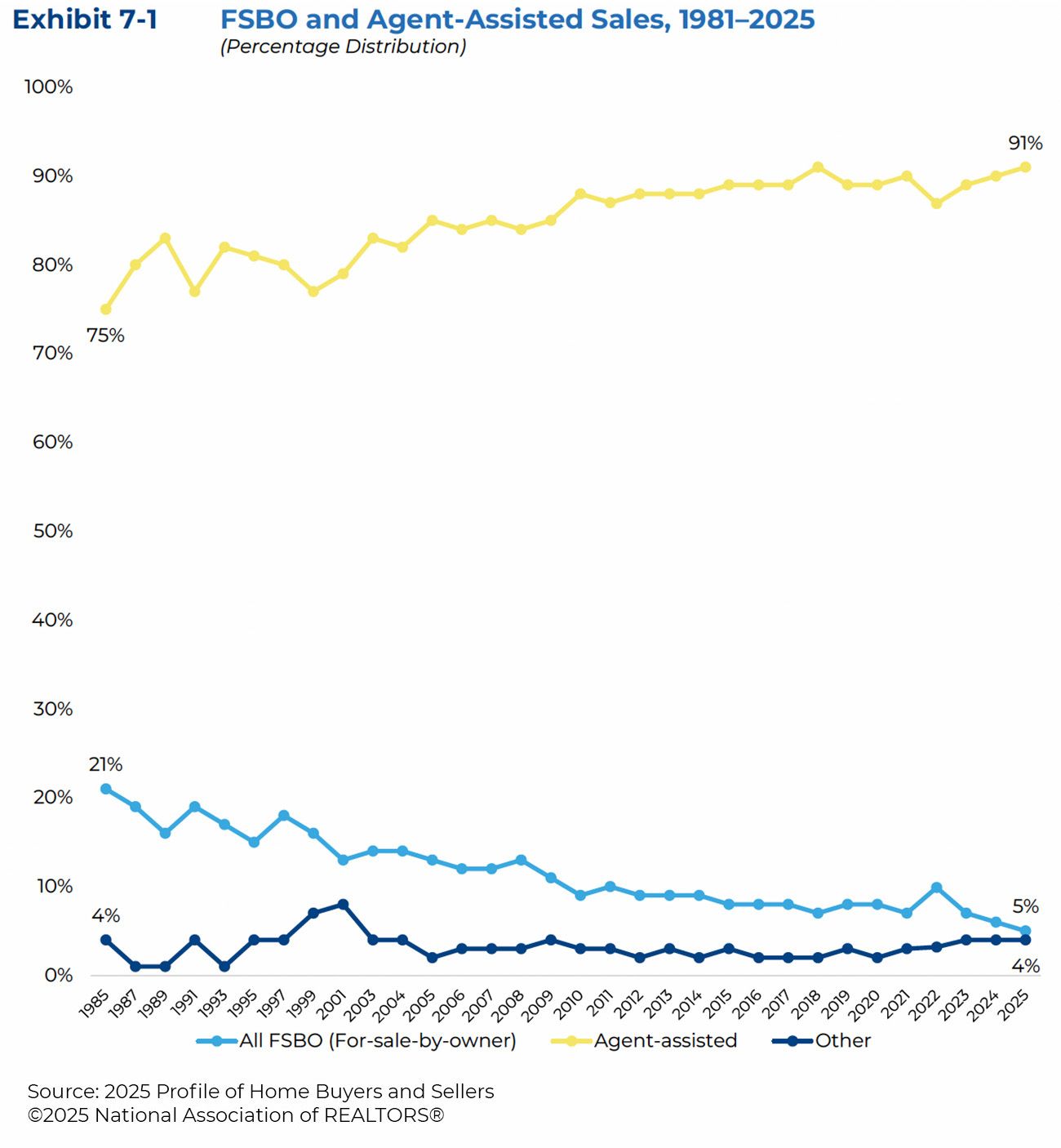

The latest NAR data shows FSBO (for sale by owner) home sales have fallen to an all-time low, making up just 5% of all transactions, which is a dramatic decline from the 21% share in the early 1980s. Nearly all sellers now prefer working with agents, reflecting a clear shift toward valuing expertise, efficiency, and risk reduction. Here are the forces causing the FSBO market to shrink:

FSBO activity is concentrated in rural and niche markets – Rural and resort areas remain the only pockets where FSBO is still somewhat common, while suburban markets overwhelmingly rely on agents. At this point, FSBO sellers are clear outliers in an agent-dominated landscape.

FSBO properties consistently sell for less – FSBO homes sold for a median of $360,000 in 2024, far below both the overall median and the median for agent-represented sales. Manufactured and mobile homes make up a large share of FSBO listings, whereas nearly all single-family, condo, and townhouse sales are agent-assisted. The persistent gap shows that agent guidance typically leads to stronger pricing and better final outcomes.

FSBO sellers rely on informal pricing methods, leading to weaker results – Most FSBO sellers base prices on nearby sales, appraisals, or online estimates, but lack the professional insight needed to price with precision. Their marketing is limited as well, with 40% doing little to actively promote the home and 90% offering no buyer incentives. Low visibility naturally results in fewer buyers and less competitive offers.

FSBO sellers typically don’t repeat the experience – Sellers often go FSBO to avoid fees or because they already know the buyer, yet many report difficulty pricing, preparing, or selling within their desired timeline. Satisfaction is highest for those selling to someone they know. Even then, most don’t choose FSBO again. The pattern reinforces a broader trend: selling a home is complex, and consumers increasingly prefer expert representation.

Our take

FSBO dropping to just 5% isn’t a random blip; it’s a reminder of how complicated selling a home really is. Even with all the online tools out there, most sellers realize pretty quickly that pricing, marketing, and negotiating aren’t DIY tasks. If you’re an agent, this report is something you should use. It lays out, in plain numbers, the value you bring to the table — better pricing, better exposure, and better results — and helps you show clients exactly why going it alone rarely pays off.

Pending home sales slip

Source: Unsplash

Pending home sales dipped 0.3% year over year as buyers continue to sit on the sidelines, discouraged by high housing costs and economic uncertainty. Homes are taking 49 days on average to go under contract, the slowest pace for this time of year since 2019, as mortgage rates hover above 6% and prices notch their biggest jump in six months.

According to Redfin, many Americans are simply waiting for mortgage rates to fall below 6% before reentering the market.

Here are the metros with the biggest year-over-year increases and decreases in pending sales:

Increases | Decreases |

Our take

As we said in our first story, the market is currently full of contradictions. Right now, buyers are sending mixed signals–pending sales are slipping and homes are sitting longer, yet purchase applications just hit their strongest pace since September. High prices and economic uncertainty are keeping many on the sidelines, but rising inventory and slower price growth are pulling others back. For buyers who can afford to act now, today’s low competition and motivated sellers may offer a rare opening before future rate dips bring other buyers back into the market. Overall though, this is a tough and uneven market for agents to navigate.

When we decided to join Million Dollar Listing, it was all about reach. We knew the kind of clients TV exposure could bring. Today, social media has that same power. That’s why our partners at Estate Media created the Agent Growth Program specifically for agents and brokerages who want to elevate their social presence to the next level. You film in short sessions, and their team handles everything else: scripting, editing, posting, and performance tracking. The Blueprint readers get a free social media audit.

Schematics

The news that just missed the cuts

Source: Unsplash

NAR’s plan to show its worth to its members

6 marketing trends agents know right now

Here’s what to know about “portable mortgages”

This is the most expensive home for sale in Atlanta

WalletHub ranks the healthiest real estate markets right now

Foundation Plans

Advice from James and David to win the day

Work-life balance is especially tough in real estate, where our work doesn’t follow a typical clock-in-clock-out approach. This can be especially tough if you’re building a family or have other responsibilities outside work.

On our latest "Rise Above the Ranks" episode, we tackle this subject and discuss why we think balance is key to success in real estate. Here are the points we cover:

1. Protect small windows of your personal life – Even at the peak of a busy real estate career, you can create protected blocks—often 90 minutes to two hours—where your personal life gets your full attention. This means carving out time for children, friends, relatives, or yourself. During these windows, the phone stays close, but the priority is being mentally present, not just physically in the room. This “quality micro-time” compounds massively over the years.

2. Be present when you’re off the clock – High-producing agents can’t turn their phones off at 6:00 p.m., but they can control how they show up. That means responding when necessary, but resisting the urge to scroll, multitask, or drift mentally away. The goal isn’t perfection—it’s demonstrating to those around you that they matter as much as your business.

3. Use weekends strategically – Weekends aren’t days off in this business—they’re flexible days. You can blend family and personal time with focused work blocks, like showings, calls, or two-hour recap sessions where you update all your sellers. This structure keeps clients informed, maintains trust, and still leaves the majority of the weekend for rest, family, and other personal obligations.

4. Personal communication builds trust and wins repeat business– While many agents delegate client updates, taking time to write personalized weekend recap emails sets you apart. Sellers want to know what’s happening with their listing, and they want to hear it from you—not from a template or assistant. This habit strengthens relationships, increases referrals, and helps you retain listings long-term.

Just in Case

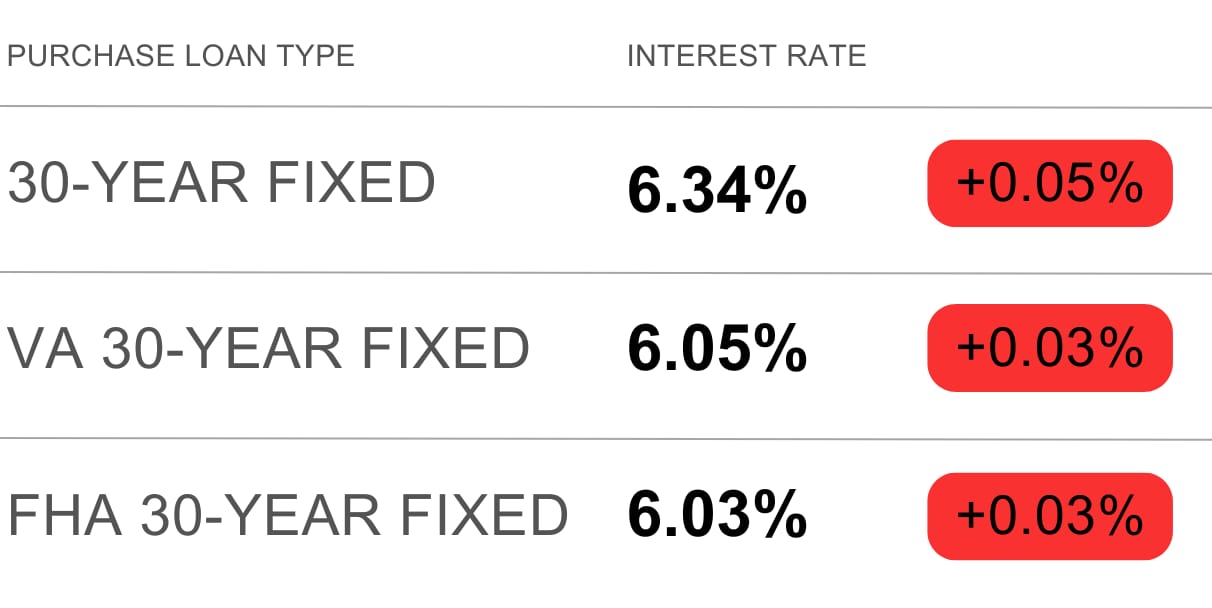

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

Success starts with taking ownership, friends — of your choices, your habits, and your vision. No one else can build the life you want; that work belongs to you. Take action, focus, and keep moving toward the person you want to be. To live is to choose.

Have a wonderful weekend. Thanks for reading, and we’ll see you back here on Tuesday!

- James and David