- The Blueprint

- Posts

- Mortgage rates fell to their lowest level in years

Mortgage rates fell to their lowest level in years

Plus, how new agents can hit the ground running in ‘26

Something extraordinary

Over the weekend, something extraordinary happened. For the first time in 3 years, the 30-year mortgage rate fell below 6%. Even though most everyone was expecting mortgage rates to average in the low sixes in ‘26, nobody saw this happening this early in the year.

In our Triad today, we explain what happened and explore its deeper implications.

Then, in Foundation Plans, we give some advice to new agents on how to hit the ground running when starting out in the new year.

With that, let’s get into it today!

- David

Mortgage rates fell below 6%

On Friday of this past weekend, the 30-year mortgage fell below 6% for the first time in three years. It dropped 22 basis points to 5.99%, matching the low from Feb. 2, 2023, according to CNBC. Here's why it happened and what to know going forward.

Why did rates fall?: Mortgage rates fell so sharply because President Trump instructed Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds, prompting an immediate market reaction.

What’s the immediate impact of the rate drop?: Buyers saw small but meaningful affordability gains. Monthly payments fell by about $118 on a median-priced home, and purchasing power has increased by more than $30,000 since last summer, per Redfin.

Will rates fall much further?: Possibly, but not by much. The $200 billion bond purchase is modest compared to the Fed’s Covid-era programs, and rates have already ticked back up to about 6.07% as of today.

What are the deeper implications?: Sub-6% rates may pull some marginal buyers back into the market and further boost refinancing activity. For builders, the bigger win is psychological: improving buyer sentiment and potentially reducing the need for incentives.

My take

This dip below 6% matters less because it changes the rate landscape and more because of what it signals. Even without direct Fed action, policy moves can still push rates quickly, but the affordability math hasn’t fundamentally reset. For agents, the opportunity is really for those on the edge: fencesitting buyers, homeowners considering a refi, and sellers who may catch a short window of stronger demand before spring inventory builds. It’s more of a sentiment boost and a timing play than a fundamental change in the housing market, but it should still help lift transaction activity.

Metros where for-sale inventory is piling up

Source: Unsplash

48 of the 50 largest metros in the country posted year-over-year inventory growth. In fact, according to realtor.com, all four major U.S. regions saw increases, with the West and South still leading the way. Here are the key trends to know:

In the last 12 months, inventory rose across all regions:

West: +14.4%

South: +12.3%

Midwest: +11.1%

Northeast: +7.5%

On a metro level, these 5 markets saw the sharpest increases in inventory:

Washington, DC: +32.8%

Charlotte, NC: +30.8%

Las Vegas, NV: +29.2%

Seattle: +28.8%

Raleigh, NC: +26.7%

My take

What’s driving this jump in inventory really depends on the particular market. In some metros, homes are just taking longer to sell, so listings are starting to stack up. In others, especially fast-growing markets like Raleigh and Charlotte, inventory is rising because new construction and long-delayed resale listings are hitting the market at the same time. The key thing for agents to keep in mind is that this isn’t a wave of distress. It’s the market slowly normalizing: more sellers are willing to list, buyers are getting used to rates in the 6s, and leverage is starting to shift back toward buyers through more choice, sharper pricing, and the return of contingencies.

Counties seeing the biggest bump in home prices

Source: Unsplash

Over the past five years, the median home sales price has increased 54%, reaching $365,185 in the fourth quarter. According to ATTOM’s latest housing report, while homes remained less affordable than historical norms in the vast majority of markets, affordability improved in the fourth quarter of 2025 in 86% (511 of 594) of the counties they analyzed.

Here are the top 10 U.S. counties with the largest year-over-year increases in median home price in Q4 2025:

My take

What’s eye-catching about this update is where the strongest price gains are occurring. The largest year-over-year increases are concentrated in smaller, more affordable counties across the Midwest and South rather than high-cost coastal markets, suggesting demand continues to push into secondary and tertiary markets. It lines up with what we’re seeing on the ground: when buyers prioritize affordability the most, they’re moving more to the Midwest than the coasts – or even Texas and Florida.

Schematics

The news that just missed the cut

What Polymarket’s new betting market for housing prices means for buyers and sellers

Fed unlikely to cut rates again after lackluster jobs report

The mistake most agents make after mortgage rates drop

Pulte is pulling back from the 50-year mortgage idea

Ellen DeGeneres buys a $27.4 Montecito mansion as rumors swirl of a return to the U.S.

Foundation Plans

Advice from David to win the day

Every new year gives you the chance to reset and start fresh. If you’re new to the business or just want a few simple refreshers to get you going on the right foot, here’s a list of quick tips to help you hit the ground running this year:

Don’t overthink it, take action – Don’t get us wrong. We’re huge believers in intentional planning and goal setting. But sometimes agents spend too much time at their desks instead of out in the field. Are you having a minimum of five real estate conversations per day? Are you making connections through open houses, circle dialing, or FSBOs? Are you increasing your circle of influence by getting to know both potential sellers and buyers? That’s what grows your business the fastest.

Don’t let FOMO lead you astray – Don’t compare your success to someone else’s, especially if you’re a new agent. It’s easy to fall prey to this mentality in our social media age, but it doesn’t make any sense. If you’re just starting out, you can’t compare yourself to a 20-year veteran. Instead of focusing on others, focus on yourself and your business. Are you better than yesterday? Are you hitting your goals? If so, that’s what counts.

Don’t ever let your pipeline go dry – Our loyal readers know we say this a lot. We recommend dedicating at least two hours each day to prospecting. It will turbo-boost your pipeline and ensure a steady flow of new opportunities. The more people you contact, the more opportunities you’re going to generate. As an agent, this is going to be your number-one job. Get to know as many potential sellers and buyers as possible and then connect them. This is what’s key to building momentum and succeeding in this business.

Don’t leave your commission unprotected – All agents need to learn how to protect their commission. It’s imperative that agents know how to set clear expectations from the start and how to explain alternatives to commission discounts.

Just in Case

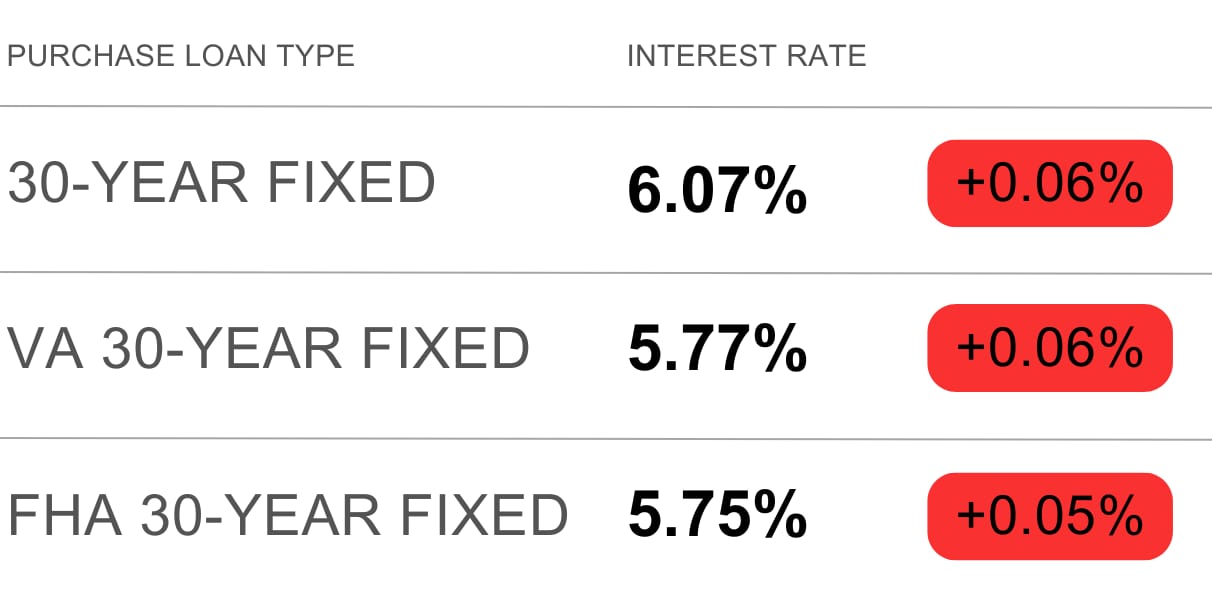

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“You’ve gotta keep control of your time, and you can’t unless you say no. You can’t let people set your agenda in life.” — Warren Buffett

Don’t let events or other people set your agenda. Stay ruthlessly focused on your goals — your time is limited, and you only get one life. Make the most of it. Have a wonderful week. We’ll see you back here on Friday!

- David