- The Blueprint

- Posts

- Home prices mark weakest rate in two years

Home prices mark weakest rate in two years

Plus, another big spike in all-cash deals

Adjusting expectations

In this business, there is always a gap between what’s happening in the market and what many clients think is happening.

Right now, we’re seeing one of the largest gaps on record. Many sellers think they can get more for their home than they actually can. And what’s happening? As we discussed last week, delistings are up a troubling amount.

Well, as you’ll see today in our first story, the situation isn’t improving for sellers. Prices are continuing to fall in many metros, and price growth has slowed to the weakest rate in two years.

In today’s Foundation Plans, we discuss what agents can do to help clients properly set expectations, so we can start to close the gap between perception and reality… and hopefully, close some deals.

On that note, let’s get into today’s Blueprint!

- James and David

33% of major U.S. housing markets see falling home prices

Source: Unsplash

Nearly one-third of the largest 100 housing markets are showing annual price declines of at least one full percentage point, according to mortgage technology firm ICE via CNBC. In June, annual price growth slowed to just 1.3%, down from 1.6% in May, marking the weakest rate in two years. Here are the other key takeaways from June:

Inventory is up 29% year-over-year

Single-family home prices rose 1.6% YOY, while condo prices fell 1.4% YOY

Prices remain strong in the Northeast and Midwest, but are softening in the South and West. Cape Coral, Austin, and Tampa lead the declines, along with seven of California’s 10 largest markets.

Our take

Several factors are combining to cool the housing market: overinflated prices, elevated mortgage rates, rising inventory, and softer demand. While increasing supply may improve affordability in many metros, it’s also contributing to slower sales and falling prices, making would-be sellers more hesitant to list. As we noted last week, many sellers are responding by delisting altogether. For a deeper dive on this trend, scroll down to today’s Foundation Plans.

New homes see spike in all-cash sales

Source: Unsplash

All-cash deals aren’t just heating up the resale market, the share of all-cash deals surged in new construction home sales too. According to ResiClub, major builders like D.R. Horton and Lennar have seen the share of all-cash buyers double or even triple since 2019. For example, D.R. Horton rose from 9% to 26%, and PulteGroup from 17% to 33%. Even value-focused builders like Meritage and KB Home saw gains of 6 to 11 percentage points.

Here are the homebuilders with the largest percentage point increases in all-cash sales from 2019 to 2024:

Clayton Properties Group: +24 pts

NVR: +23 pts

D.R. Horton: +17 pts

Century Communities: +17 pts

PulteGroup: +16 pts

Lennar: +12 pts

Meritage Homes: +11 pts

Toll Brothers: +9 pts

Taylor Morrison: +7 pts

KB Home: +6 pts

Our take

A lot of people might be led to believe institutional investors are behind this trend, but their buying has slowed since mid-2022. What’s really happening? Equity-rich repeat buyers, particularly Baby Boomers and Gen Xers, are skipping financing entirely and buying homes outright with cash. Agents, take note: profile clients who’ve built up equity and position new construction as a smart, rate-proof option. These buyers don’t need rates to fall for them to make a move.

States with the most fixer-uppers

Source: Unsplash

West Virginia leads the nation in fixer-upper inventory with 9.3% of listed single-family homes in need of repairs, while Nevada has the lowest share at 1.8%. As home prices remain high and affordability stays near four-decade lows, first-time home buyers are turning to fixer-uppers as a more accessible path to homeownership. This is according to realtor.com’s latest report.

However, fixer-uppers aren’t distributed uniformly across the country. States with older housing stock and less new construction – primarily in the Midwest and Appalachia – offer the most fixer-upper inventory.

Here are the top 10 states with the highest rate of fixer-uppers, and the top 10 states for the least-expensive fixer-uppers:

States with the highest rate of fixer-uppers | States with the least expensive fixer-uppers |

Our take

Fixer-uppers can not only be a creative workaround for buyers priced out of move-in-ready homes, but they’re also a valuable opportunity stream for real estate investors. In states with older housing stock and limited new construction, like West Virginia, Michigan, and Illinois, there’s a higher concentration of underpriced homes with renovation potential. That creates opportunities for investors looking to buy below market value, renovate, and flip for a profit. For agents working with fix-and-flip clients, this data highlights where to focus prospecting efforts, and where project homes are simply too scarce to build a reliable pipeline.

Schematics

The news that just missed the cut

Homes are flooding the Vegas market as retirees leave and investors cash out

Do this to make sure you’re showing up in local searches

What agents need to know about SEO

Zenlist just got bought by Realtor.com

Activities top-producing agents do daily

Foundation Plans

Advice from James and David to win the day

We planned to continue our mid-year review series, but we’ve decided to pause in order to address an urgent trend: the surge in delistings. The latest data shows that delistings are up 47% nationally year-over-year. That’s a red flag. It signals a growing disconnect between what sellers want and what the market will bear.

Instead of adjusting their expectations, more sellers are simply pulling their listings and waiting it out. If you're not prepared, this can waste both your time and theirs. Here are three practical strategies to help you stay ahead of the curve:

1. Set realistic expectations early – Many sellers are anchored to peak-pandemic pricing or what a neighbor "supposedly got last year” mindset. It’s your job to reorient them toward today’s market realities. Here’s how to do it:

Bring clear data: Use up-to-date comps, average days on market, and list-to-sale price ratios to show how similar homes are selling only after price cuts or extended time on the market.

Use visuals: Charts that display price trends, absorption rates, and show activity over time can make the message hit harder than just words.

Preempt unrealistic hopes: Ask upfront, “If we don’t get strong interest in 2 weeks, are you willing to adjust the price?” This frames price drops as a strategy, not a failure. This is very important! Framing is key.

2. Reframe the conversation around timing – Many sellers delist reactively after sitting on the market too long. You can avoid this by helping them make intentional decisions about timing from the start. Do this:

Offer a trial window: Say, “Let’s give it 21 days. If we don’t get X showings or Y offers, we reassess.” This allows them to feel in control while avoiding stagnation.

Plan around seasonality: If the market is soft now, you might say, “Let’s consider re-listing in the fall or spring if activity remains low, but let’s go in with a clear plan.”

Keep them active, even when off-market: If they do delist, encourage prepping for a stronger re-launch later with upgrades, staging, fresh marketing strategy, etc.

3. Clarify and prioritize seller motivation – Delistings often signal low motivation. Your role is to clarify what the seller really wants and help them see whether the market can realistically support that goal.

Ask deeper questions: “What happens if it doesn’t sell in the next 90 days?” or “Is your next move contingent on this sale?” Motivated sellers will have clearer, time-bound goals.

Differentiate needs from wants: If they “want” a certain price but don’t need to sell, say, “We can wait for better timing. But if you're serious about selling now, we need to price accordingly.”

Gauge readiness to adjust: Sellers unwilling to negotiate or respond to market feedback may not be ready to list. It’s okay to walk away or recommend holding off.

We know we’ve said a lot, but we wanted to address this issue thoroughly. If you're seeing something different in your market or have your own tips, let us know. We’re always learning, just like you. Drop us a line!

You don’t need another “motivational moment.” You need a framework that works.

The Estate Elite 90-Day Multi-Million Dollar Listing Challenge gives you a structure to upgrade your business and land your first/next $1M+ listing.

Join now for free and get:

A polished luxury brand and online presence

Weekly post prompts, reels scripts & video walkthroughs

Outreach scripts for agents, buyers & referral partners

Ad templates to attract high-end leads

Live feedback and accountability from our coaching team

You’ll learn directly from us, along with Josh Flagg, Tracy Tutor, Glenda Baker, and Dawn McKenna—the best in the business.

Start with a 30-day free trial. But don’t wait too long—slots are going quickly.

Just in Case

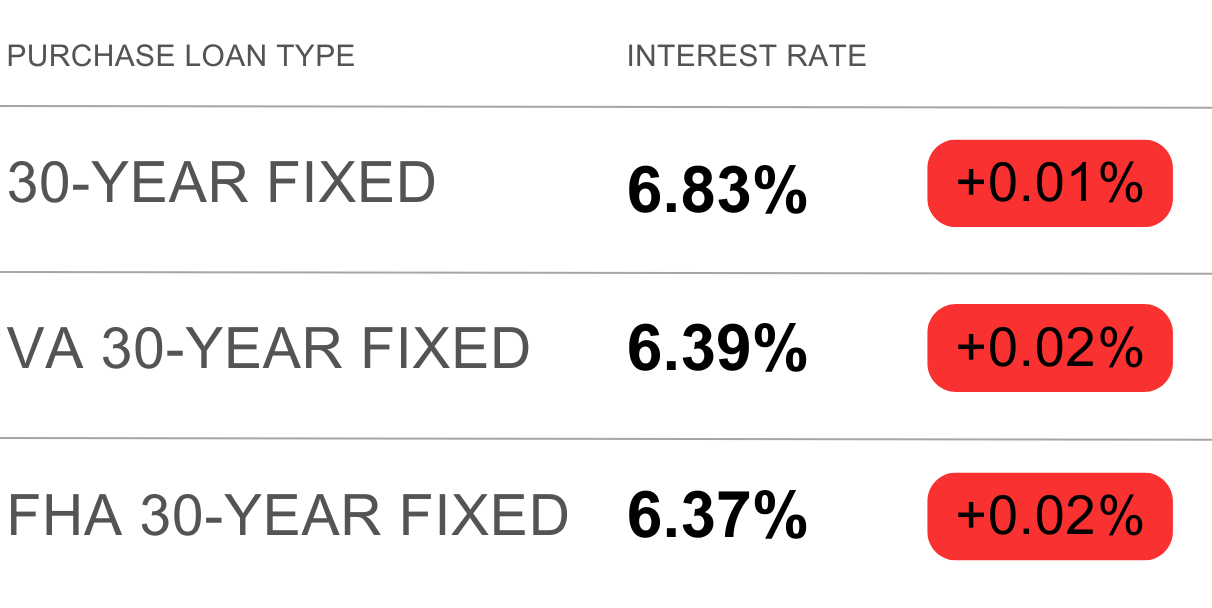

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

“Your time is limited, so don’t waste it living someone else’s life.”— Steve Jobs

Each day is a gift – a chance to live the life that you want. Ruthlessly focus on your goals. Don’t let your past or the fear of being judged distract or paralyze you. Choose to live your life with an integrity that you can be proud of.

- James and David