- The Blueprint

- Posts

- Mortgage rates drop to lowest level since 2022

Mortgage rates drop to lowest level since 2022

Plus, the most expensive sales in January

Positioning buyers

Buyers have leverage right now — even if they don’t feel like it.

Listings outnumber buyers by a record margin. Mortgage rates are at their lowest levels since 2022. Sellers are cutting prices, and concessions are back on the table.

And yet, many buyers are still sitting on the sidelines.

The opportunity is there — but buyers need to be shown how to use it.

After the top stories, today’s Foundation Plans shows you how to help buyers capitalize — using one of the most effective negotiation levers in this market.

Let’s jump in!

- James

Pending sales post strongest January gain since 2024

Source: Unsplash

Pending sales rose 1.2% year-over-year in January. That’s the strongest annual gain in pending sales since late 2024, according to realtor.com’s latest housing market update. Here are the key takeaways from the report.

Inventory is still rising, but momentum is fading – Active listings climbed 10% YoY (27th straight monthly gain), yet growth has slowed for nine consecutive months. Inventory now sits 17.2% below pre-pandemic norms, the widest gap since spring 2025.

The national inventory recovery has reversed in most regions – Since May 2025, inventory relative to pre-pandemic levels has regressed in the South, West, and Northeast. Only the Midwest has made modest improvement.

New listings barely budged – Newly listed homes rose just 0.7% YoY and remain 15.4% below pre-pandemic levels — signaling supply is still structurally tight.

Market pace is normalizing – Homes spent 78 days on market (+5 days YoY), marking 22 straight months of slower sales. Still, homes are selling five days faster than pre-pandemic norms.

Prices are flat nationally, but diverging locally – Median list price was essentially unchanged at $399,900 (–0.1% YoY). Price per square foot fell 1.6% nationally, with sharper declines in the South and West, while the Northeast posted a 4.3% gain per square foot amid tighter supply.

My take

January’s 1.2% bump in pending sales is an encouraging sign. It suggests buyers may finally be stepping back in as rates ease. But let’s keep it in perspective. Sellers still outnumber buyers by a wide margin, which means buyers continue to hold the leverage, not the other way around. Even though inventory growth is slowing relative to pre-pandemic norms, there are still more homes for sale than qualified buyers are willing to get off the sidelines. That imbalance is keeping price growth muted and giving buyers room to negotiate. So this isn’t a surge — it’s stabilization within a market that still tilts in the buyer’s favor.

Mortgage rates just hit a 3.5-year low — and demand is starting to respond

Source: realtor.com

The 30-year fixed mortgage rate fell to 6.01%, the lowest level since September 2022, following a drop in the 10-year Treasury yield after inflation data came in softer than expected. And early indicators from realtor.com and the MBA show that buyers and refinancers are already responding. Here are the key trends to know:

30-year fixed: 6.01% (down from 6.09% last week; 6.87% this time last year)

Rates were 6.6% six months ago

The 10-year Treasury fell to its lowest level since late November

Fed held overnight rate at 3.5%–3.75%, but minutes show a renewed hawkish tone

Demand is stabilizing — with early, promising signs

Pending home sales up 1.2% YoY in January (strongest since late 2024)

Mortgage applications rose 2.8% WoW after three weekly declines

Unadjusted purchase apps up 8% YoY

Refinancing is surging

Refi index up 7% WoW and 132% YoY

Refi share now 57.4% of total applications

Many recent buyers are reducing annual payments by thousands

Rates declined across all major loan types

Conforming 30-year: 6.17%

Jumbo 30-year: 6.21%

FHA 30-year: 5.99%

15-year fixed: 5.50%

5/1 ARM: 5.29%

My take

This is a meaningful shift, but it’s not a structural reset. Moving from roughly 6.9% last spring to about 6.0% today makes a real difference in purchasing power. That kind of drop is enough to revive refinance activity and bring some marginal buyers back into the market. The bigger question is durability. Treasury yields fell on softer inflation, but Fed minutes show policymakers remain willing to tighten if progress stalls, which means this window could close as quickly as it opened. Whether this turns into sustained momentum will come down to how demand and pricing respond as we move through the spring season.

The biggest home sales in January

Source: Unsplash

January’s top home sales highlight the continued strength of the ultra-luxury market. Every property on the list sold for more than $29 million, with Coastal Florida accounting for six of the 10 most expensive transactions nationwide.

The priciest sale was a $55 million waterfront estate in Naples, followed by a $42 million ranch in Aspen and a $38.3 million beachfront property on Hawaii’s Big Island. Two additional coastal Florida compounds each traded above $36 million.

These were the 10 most expensive sales in January, according to Redfin:

1650 McLain Flats Rd., Aspen, CO 81611: Sold for $42 million

72-3207 Maninioawli Dr., Kailua-Kona, HI 96740: Sold for $38.3 million

1083 Hillsboro Mile, Hillsboro Beach, FL 33062: Sold for $36.5 million

1160 N. Ocean Blvd., Palm Beach, FL 33480: Sold for $36.3 million

9001 Collins Ave. Unit S-1011, Surfside, FL 33154: Sold for $33 million

1839 + 1833 W. 24th St., Miami Beach, FL 33140: Sold for $32 million

631 Island Dr., Palm Beach, FL 33480: Sold for $31.8 million

26 Deep Sea, Newport Coast, CA 92657: Sold for $31.5 million

53 W. 53rd St. Unit 65, New York City, NY 10019: Sold for $29.5 million

My take

January’s luxe home sales make the K-shaped housing market obvious: while 2025 was difficult for most buyers, the ultra-luxury tier stayed hot. Six of the ten priciest deals were in Florida, and every property cleared $29M — driven largely by cash-heavy, rate-insensitive buyers. While the broader top 10% of the luxury market has slowed, the top 5% and 1% continue to transact. For these buyers, scarcity, tax considerations, and lifestyle flexibility — not mortgage costs — drive demand, and that dynamic isn’t changing anytime soon.

Schematics

The news that just missed the cuts

Source: Unsplash

What Bravo star Talia McKinney did to close a $31 million deal

Use this follow-up framework to end the feast or famine cycle

These 5 luxury real estate enclaves are booming because of ultra-luxe buyers

Supreme Court strikes down Trump’s tariffs in key ruling for homebuilders

Foundation Plans

Advice from James to win the day

With listings outnumbering buyers by a record margin and many listings growing stale, sellers are more willing to accept offers below ask. Many of them are willing to throw in some concessions, too. We believe that one of the best ways agents can help buyers in our current market is to persuade sellers to pay all, or some portion, of the closing costs. Today, we’d like to offer you some tips for helping your buyers make a great deal:

Craft a strong offer – Coming in at, or near, the asking price shows good faith and strengthens your request for closing cost assistance. In the offer, clearly state the amount of closing cost contribution you're seeking from the seller. Be very clear on both the comps and the days on the market in your local area. Right now, we believe it’s possible to come in below the asking price and still get some concessions in certain markets.

Package your offer in an appealing way – Explain why you think the seller should contribute to the closing costs, and why your offer makes sense. For example, present your offer as an alternative to a lower sales price. The seller might see it as a wash financially, but it keeps the appraised value higher. Alternatively, show them how your offer will lead to a fast closing. As we said up top, a lot of listings are going stale. The share of listings staying on the market for more than 60 days is growing. Use that to your leverage. Also, while closing costs are your goal, be open to other concessions. Maybe it's a lower earnest money deposit or a faster closing date that will do the trick.

Work with a lender who offers lower closing costs – This strengthens your case for the seller covering the remaining amount. Sellers are often more open to granting seller concessions if the buyer’s demands aren’t exorbitant

Just in Case

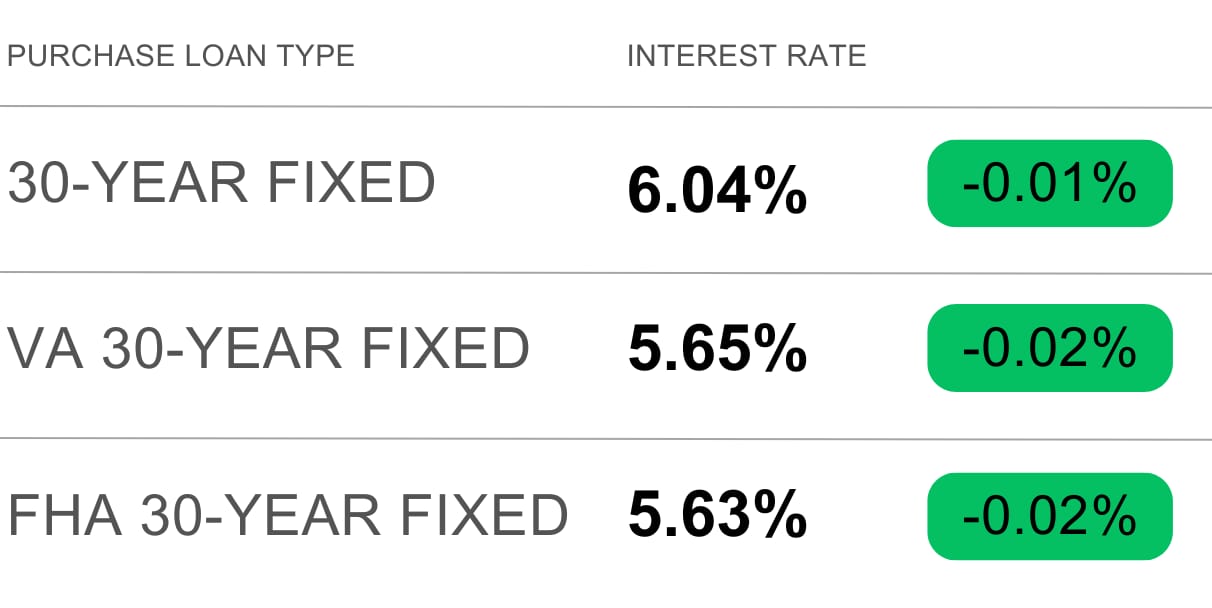

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

"Excellence is never an accident. It is always the result of high intention, sincere effort, and intelligent execution." – Attributed to Aristotle

Thanks for reading, friends. Excellence and success don’t happen by chance — they’re built through intention, focus, and consistent effort.

Have a wonderful weekend, and I’ll see you back here next Friday!

- James