- The Blueprint

- Posts

- Housing market predictions we love to see

Housing market predictions we love to see

Plus, October’s hottest markets

Let’s end the year strong!

There are fewer than 30 working days left in the year, which is absolutely bonkers! It’s been a wild year to say the least, and it’s not over yet. In fact, it’s still picking up.

It’s crunch time for us. We’re working tirelessly to hit both our Q4 goals and our annual goal for 2022. We always strive to be better, no matter how successful we may be. There’s always room to grow!

Now we all know the holiday season can be crazy, so we suggest finding some time now to follow up with potential clients. We got some great news last week about inflation and mortgage rates dropping, so be sure to pass that along. Start preparing gifts to send to your clients, and get in front of as many people as you can as we head into the homestretch!

- James and David

Market rebound forecasted for 2024

Source: Unsplash

NAR Chief Economist Lawrence Yun released his predictions for the housing market in 2023 and 2024.

Here are key takeaways from Yun's report:

He does not expect a significant decline in home prices for most of 2023, due to elevated interest rates, limited housing inventory and slowed sales

He said today’s market looks nothing like the market that preceded the Great Recession

October's CPI showed slower inflation, which means that mortgage rates have likely peaked

Short sales and distressed property sales are "virtually nonexistent"

He predicts a strong market rebound in 2024

Our take

We’ve been saying this all along, so we’ll just pat ourselves on the back real quick for predicting it! But in all seriousness, the data didn’t show that a “crash” was going to come. Considering what we read in last week's inflation report and what we are seeing in our day-to-day, we think the future won’t be so full of doom and gloom as some naysayers predicted. We hope this energizes consumers to reverse their negative sentiment. We’re looking forward to what next year has in store!

October's hottest markets

Source: Unsplash

Realtor.com revealed their October Market Hotness rankings. Using data from their website, they took into account two aspects of the housing market: 1) market demand, as measured by unique views per property and 2) the pace of the market as measured by the number of days a listing remains active.

For the first time since September 2020, no Southern markets made the list. There were also no Western region markets on this month’s list for the fifth month in a row. 7 of the 10 hottest markets were also some of the most affordable, with prices below the national median listing price.

Here are the 10 hottest markets from October:

Manchester-Nashua, NH

Rochester, NY

Burlington-South Burlington, VT

La Crosse-Onalaska, WI-MN

Columbus, OH

Hartford-West Hartford-East Hartford, CT

Fort Wayne, IN

Topeka, KS

Worcester, MA-CT

Dayton, OH

Our take

There’s no denying that the market is in a unique position. Some markets aren’t doing well, and others are on fire. If you are a realtor working in these hot markets, use this data to share with your clientele. Go door-knocking, and let potential sellers know that they can get top dollar for their property. What an amazing opportunity for agents in these markets!

JPMorgan banks on build-to-rent market

Source: Unsplash

JPMorgan and Haven Realty Capital formed a $1 billion joint venture to build single-family rental homes. Their collaboration comes at a time when new for-sale housing starts declined to a two-year low as consumers have become reluctant to buy or have been priced out of the market. This deal targets these would-be home buyers, and demonstrates the intense interest investors have in the single-family market.

The joint venture will either acquire or develop communities with 50 to 200 homes ranging from 1,500 to 2,500 square feet, primarily with 3 to 4 bedroom and 2 to 3 bathroom floor plans.

Our take

We love seeing this. When Wall Street invests in the housing market, we don’t see it as them making our jobs harder. We think it's quite the opposite! Their confidence in our industry is just another reason we believe we are in the best job around. The market for single-family homes is still one of the best purchases someone can make, and we remind ourselves of that every time we close a deal.

Schematics

The news that just missed the cut

Source: mansionglobal.com

Look inside this record-breaking $85 million Miami condo

Why Keller Williams Realty's former CEO is suing them

What's behind the mass exodus of real estate agents

This is why builder confidence has fallen

10 cities where buyers can still negotiate a great deal

Want to save on a new-construction home? Here's how

Foundation Plans

Advice from James and David to win the day

How are your people skills? Be honest with yourself! (Truthfully, I think we all have room to improve!) If you know your ability to relate, connect, and communicate with your clients could use a little work, keep these tips in mind the next time you meet up with them:

Listen first, talk second. Before you start talking numbers, take time to really understand your client’s wants and needs. Ask what they’re looking for and why. Give them the space to share their story before you jump into the details.

Be boldly confident. You’re the expert, so sound the part! Let your clients know you’ll do everything possible to get them the best deal with the best terms. After all, no one knows your local market like you, right?!

Know when to reassure and when to walk away. Sometimes our clients need a bit of reassurance that they’re making the right choice. Don’t be afraid to remind them why they decided to buy or sell in the first place. But if they’ve changed their mind, be ready to let it go.

Want more deal-closing tips? Check out Entrepreneur’s in-depth article here.

Just in Case

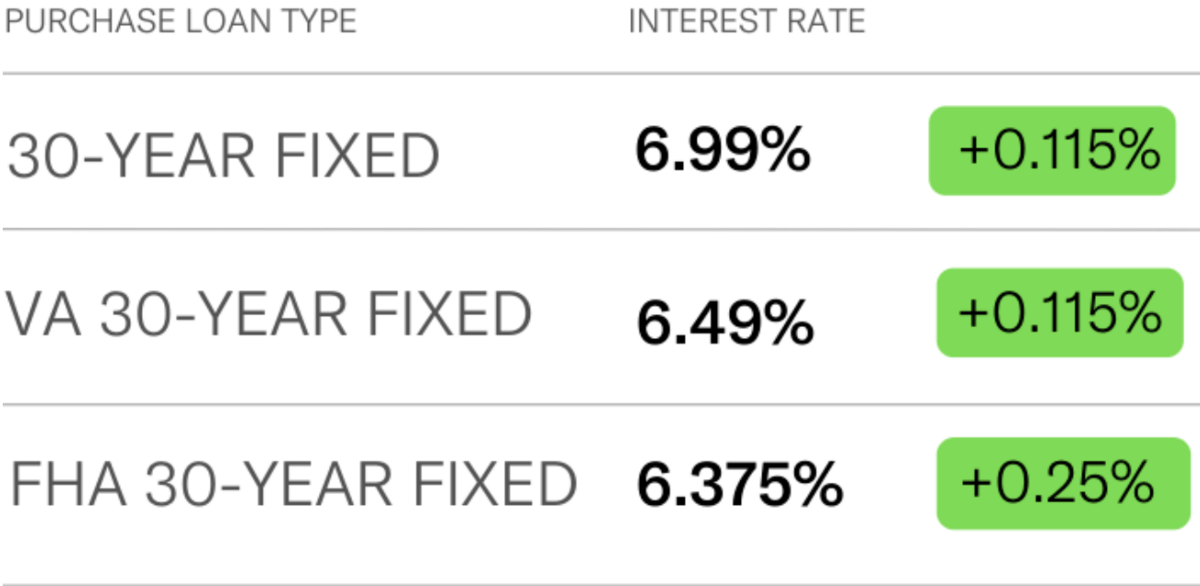

Keep the latest industry data in your back pocket with today’s mortgage rates:

Rocket Mortgage

That’s all for this edition of The Blueprint! Remember to track your progress toward your Q4 goals so you can finish strong in 2022. Get out there, door-knock this weekend, and reach out to potential clients before the holidays get here. We know you’ll be glad you did!

Have a fantastic weekend, and we’ll see you on Tuesday!

-James and David

Was this forwarded to you? Sign up here.

Want to advertise in The Blueprint? Go here.

Want to submit a question to us? Submit here.